ETH/BTC Ratio Tanks 5%—Is This the Calm Before a Massive Surge or the Start of a Steep Crash?

Ever felt like Ethereum and Bitcoin are locked in the ultimate dance-off—one moment Ethereum takes the spotlight, and the next, Bitcoin sways to center stage, hoarding all the liquidity? Well, the ETH/BTC ratio just took a nosedive of 5.8% in a mere 60 hours, signaling that Bitcoin might be stealing the show again. But hold on a sec—before you write off Ethereum, consider this: history’s shown us a curious pattern where sudden drops like this aren’t the end, but rather a prelude to a comeback fueled by a frenzy of trading volume and that classic retail impatience. It’s almost like watching a roller coaster that’s plunging only to prepare for its thrilling climb back up. So, is Ethereum gearing up for another breakout, or is this just a temporary stumble? Let’s dig into what’s setting the charts on fire and what to watch next. LEARN MORE

Key Takeaways

The ETH/BTC ratio fell by 5.8% in just 60 hours, signaling a sharp rotation out of ETH. However, trading volume and retail impatience may be setting the stage for another leg higher on the charts

The ETH/BTC ratio just took a sharp dive — Down by 5.8% over the last 60 hours according to a recent Santiment tweet. And, that is not something that can be ignored.

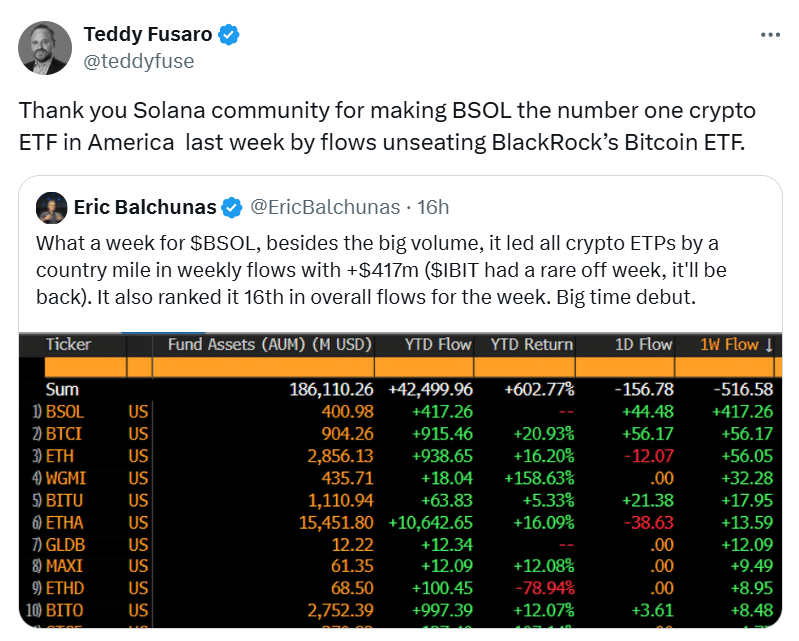

This kind of drop usually tells us one thing – Bitcoin is sucking up most of the liquidity, leaving ETH behind. That is exactly what is happening right now.

In fact, such a shift reflects a temporary breakdown in Ethereum’s relative strength. Worth noting, however, that does not guarantee a long-term rejection just yet. In fact, the same exact setup already played out earlier this year.

Could May-style FOMO spike again?

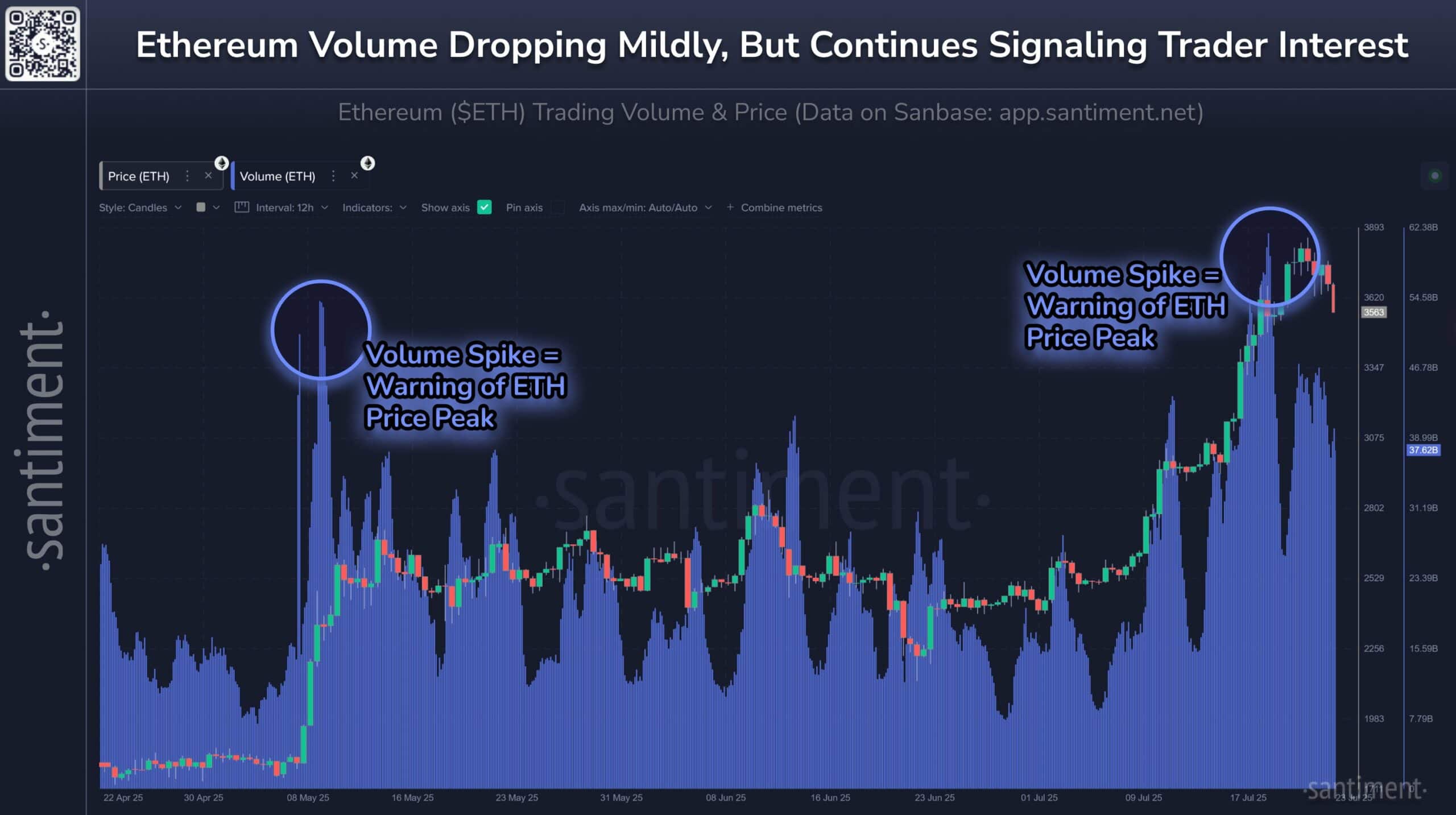

Back in early May, ETH saw a sudden volume surge in spot, derivatives and social mentions — All spiking at once. Most traders saw it as a breakout confirmation. On the contrary, however, it marked a local top.

At the time of writing, something similar seemed to be coming into play. ETH’s recent trading volume spiked aggressively — again driven by FOMO — and it soon preceded a ratio dump. Here is where it gets interesting though as when those metrics started to cool off, the market reset.

What followed was not another crash, but a second rally. This was triggered mostly by retail chasing the dip out of impatience.

Trading volume, social mentions hint at a potential rally

The next few days matter more than most think.

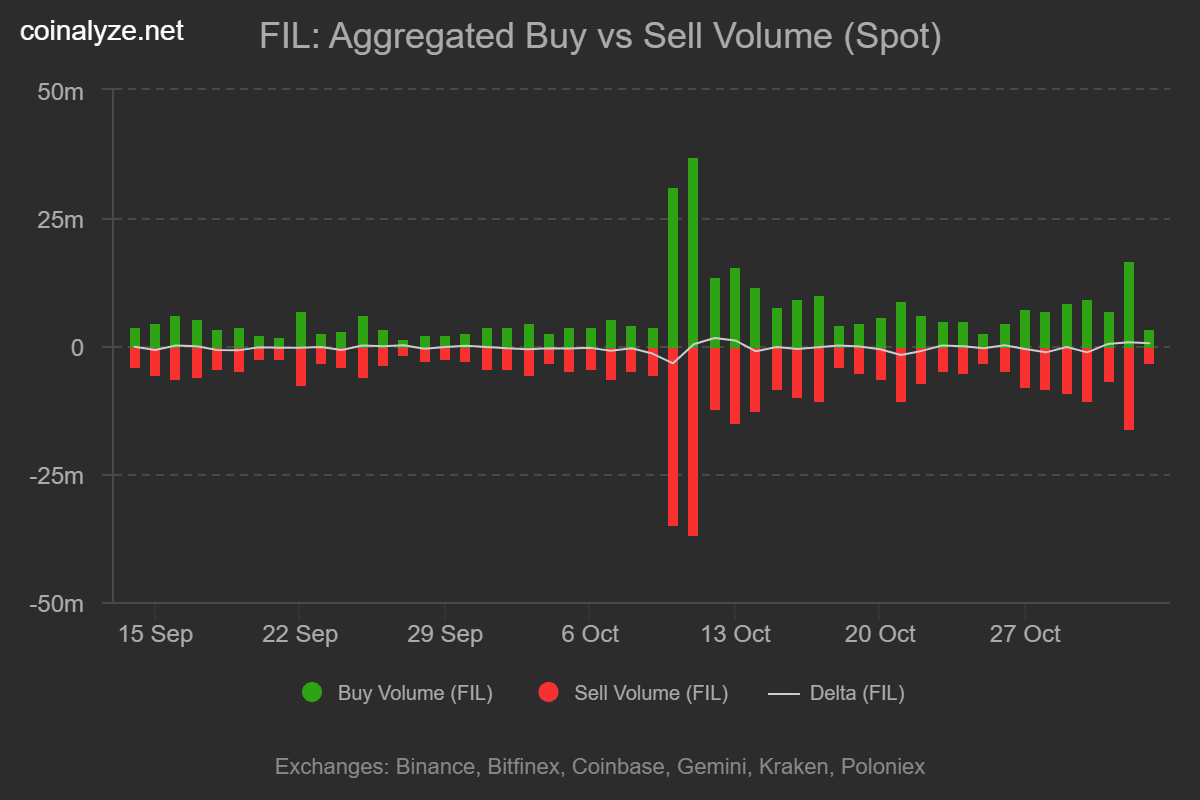

If ETH’s trading volume and social sentiment continue to surge, the altcoin rally can’t be ruled out. This would also allude to Futures traders in short liquidations and a profit-taking phase.

Whenever that happens, the next wave tends to fuel more organic demand. On the back of such volume, ETH’s price may be primed to shoot up the charts again.

This scenario will become even more likely if retail starts taking profits or exits early, expecting a breakdown that now might be unlikely.

What next for ETH?

In the short run, ETH might be looking weak versus BTC. Structurally though, it may be entering a zone where market psychology begins to shift. Traders get impatient as the number of positions get lighter, especially as the smart money starts building again.

With the press time support zone at around $3685 holding strong and bullish momentum accumulating, the $4K target milestone price level may still be within reach.

Ergo, while the ratio is dropping, the setup may be quietly turning.

A second bullish wave is not guaranteed. However, based on its recent patterns, that is definitely on the table.

Post Comment