Ethereum ETFs Surge with $1 Billion Inflow—Is This the Tipping Point That Will Ignite the Next Crypto Boom?

Ever wonder what’s driving the latest surge in Ethereum ETFs that just pulled in a jaw-dropping $1 billion in a single day? It’s not just a fluke — institutional investors have turned up the heat, piling into Ethereum as ETH flirts with the $4,300 mark, inching closer to its all-time high. This robust influx signals a growing confidence in Ethereum’s future, led by heavy hitters like BlackRock and Fidelity, who posted their largest single-day inflows yet. With Ethereum riding a five-day winning streak, and major players like Fundamental Global stepping up their accumulation game, could this be the moment where Ethereum cements its place as a powerhouse asset? Let’s unpack what’s fueling this frenzy and why it might just change the game for crypto investors everywhere. LEARN MORE.

Institutional demand and aggressive accumulation are fueling record inflows, signaling growing confidence in Ethereum’s long-term outlook.

Key Takeaways

- Spot Ethereum ETFs recorded over $1 billion in daily net inflows, their highest since last July.

- Investor interest in Ethereum exposure through ETFs is rising as ETH trades around $4,300.

Share this article

US-listed spot Ethereum ETFs listed in the US pulled in more than $1 billion in net inflows on Monday, their highest daily total since debut, according to data tracked by Farside Investors.

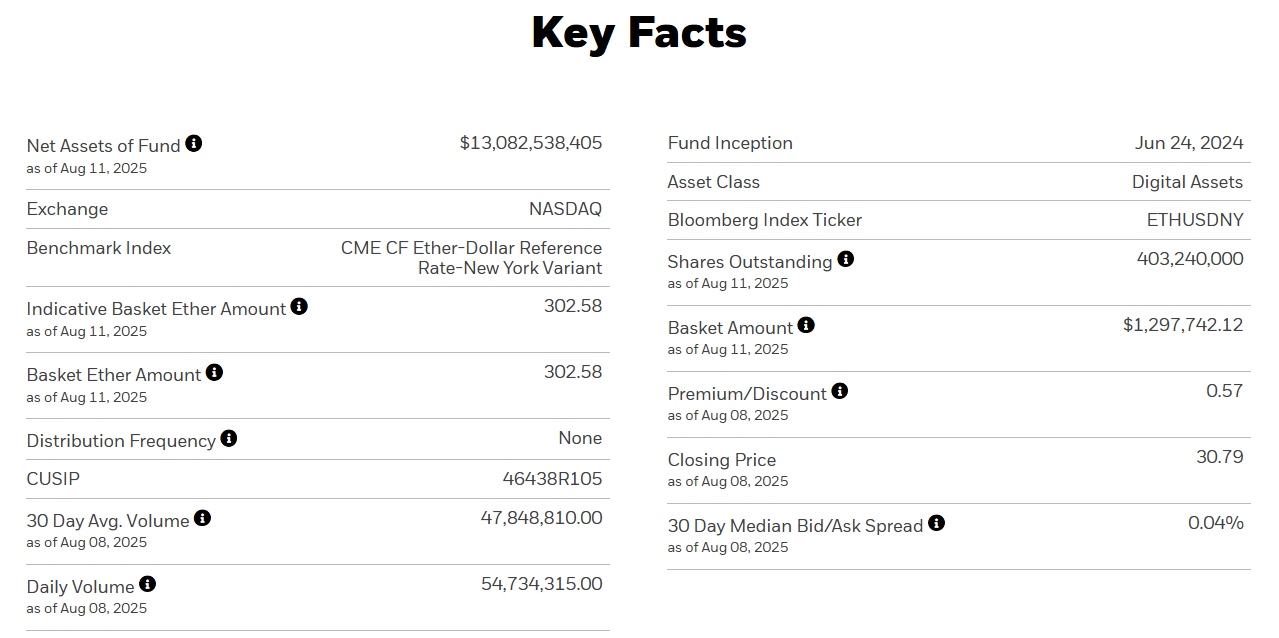

BlackRock’s iShares Ethereum Trust (ETHA) and Fidelity Ethereum Fund (FETH) also posted their largest single-day inflows, drawing about $640 million and $277 million, respectively. Except for Invesco’s fund, all other Ether ETFs posted positive results.

BlackRock has maintained its top position, with assets under management exceeding $13 billion as of August 11.

Monday’s gains pushed Ethereum funds into a five-day winning streak. Their longest winning streak on record took place between July 3 and July 31.

The strong performance came as ETH hovered around $4,300, its highest level since December 2021. The digital asset is now around 12% away from its all-time high of $4,868 set in November 2021 during the bull run market, TradingView data shows.

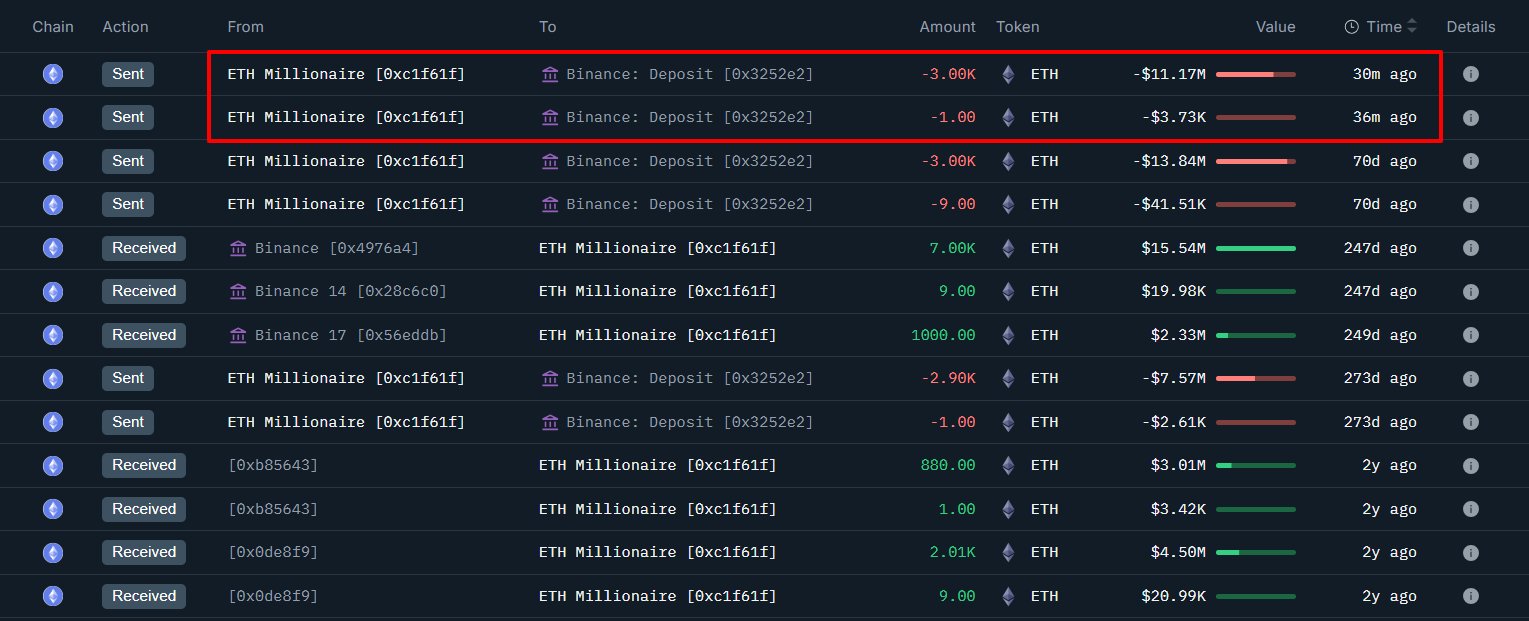

Ethereum’s price surge comes amid aggressive accumulations from publicly traded companies, such as Tom Lee’s BitMine and SharpLink Gaming.

Furthermore, on Monday, Fundamental Global, soon to be renamed FG Nexus, which recently filed a $5 billion shelf registration with the SEC to expand its Ethereum accumulation strategy, announced it had acquired 47,331 ETH as part of its ambition to take a 10% stake in the network.

Share this article

Post Comment