Ethereum’s $10B Crash and ETF Exodus: Is ETH’s Next Move a Game-Changer or a Total Disaster?

Ethereum’s been playing a high-stakes game of tug-of-war lately, and if you ask me, the rope’s starting to fray. After dancing near $3,900, ETH’s stumbled below $3,600, and with the biggest ETF outflows ever recorded flashing like a red warning light, the question isn’t just “What’s next?” — it’s “How deep might this slide go?” It’s like watching someone clear the table of the weak hands and nervous traders, but here’s the kicker: smart money, like BlackRock, is swooping in to scoop up ETH, signaling some serious belief amidst the chaos. So, is Ethereum gearing up for a comeback, or are we on the edge of a steeper downfall? The battleground is set, with $10 billion in Open Interest wiped out, whale numbers dipping, and spot demand the key to breaking the stalemate. Buckle up — Ethereum’s ride is anything but dull right now. LEARN MORE

Key Takeaways

Ethereum is starting to show signs of distribution. Its ETFs saw the biggest outflow ever. That lines up with the drop below $3.6k. Is more downside coming?

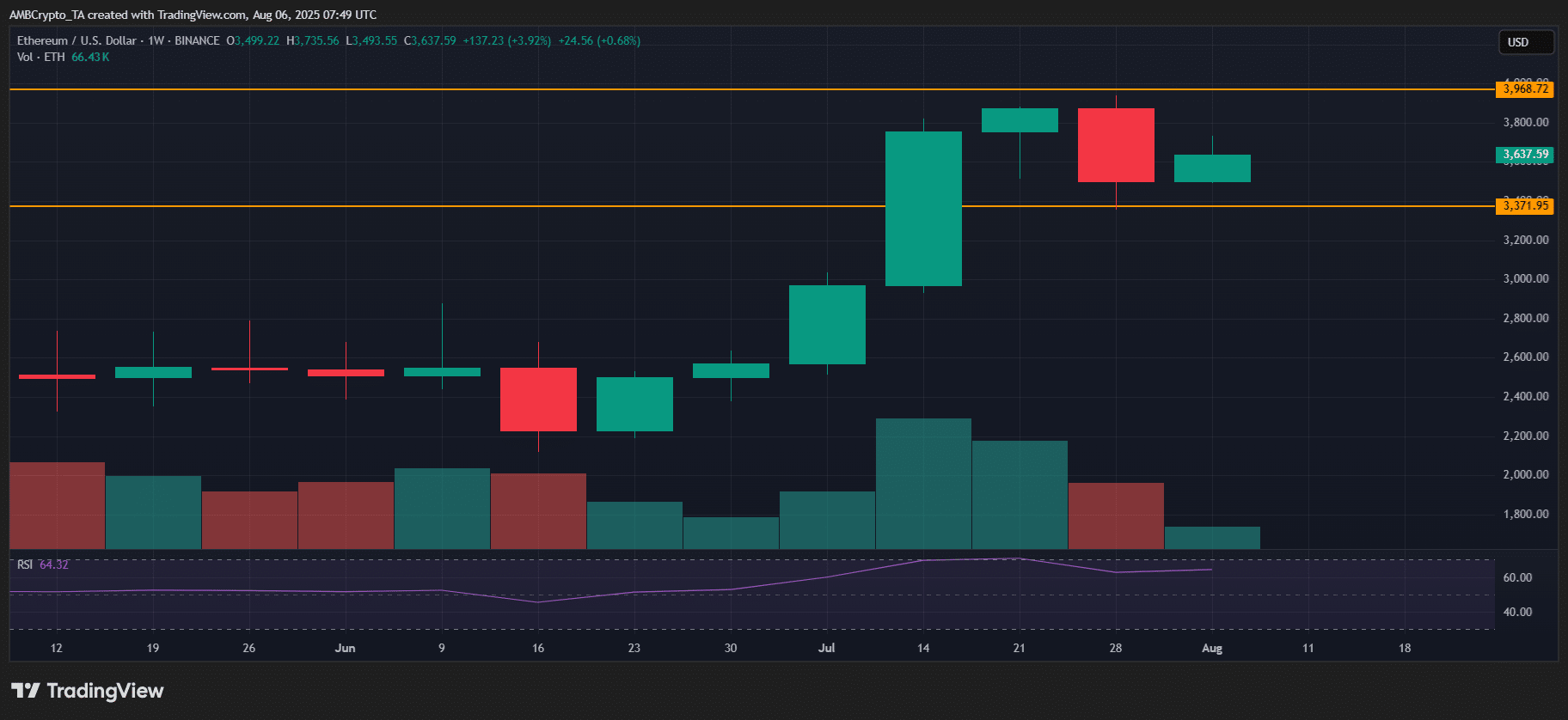

Ethereum’s [ETH] has been range-bound since tagging $3,900, and the price is now sitting at a key pivot.

The 10% pullback off the highs looks like a textbook flush, clearing out weak longs and cooling overheated funding.

Open Interest takes a $10B hit

Backing that up, over $10 billion in Open Interest got wiped out in just ten days. That’s a major de-risk across the board.

Plus, we saw back-to-back $1 billion+ in Realized Profits, pointing to profit, not panic, as the main driver.

Structurally, last week gave us Ethereum’s first proper weekly red candle in a while. It was a clean 9.67% pullback off the top. But this week’s already bounced back nearly 4%, so bulls aren’t out of the fight yet.

That kind of resilience in a choppy market signals strong bid interest.

Case in point: BlackRock scooped up 23k ETH ($88 million). It is a big tell that smart money’s still buying the dip.

But is that enough to offset a $10 billion OI flush, especially with whale addresses down 164 in 30 days?

According to AMBCrypto, that’s the real equation. How it resolves could dictate Ethereum’s next leg, especially with ETH/USDT longs now over 60% on Binance, showing a clear bullish crowd skew.

Early distribution signals flash as Ethereum slides

Calling ETH’s 10% pullback a “healthy reset” might be jumping the gun.

Early distribution signals are in play, and $3.9k is starting to look like a local top, or at least a level that’s going to need serious spot demand to break through again.

Per SoSoValue, ETH ETF outflows just hit record levels, with over $500 million yanked in a single day. It’s a clear shift in institutional flows, flipping from steady July inflows to full-blown cooldown mode.

Meanwhile, Fidelity moved 14,978 ETH ($53.6 million) to Coinbase Prime, likely gearing up to sell into strength. That’s a textbook profit-taking play from smart money as the market turns risk-off.

All eyes are now on ETH’s 4% bounce off the lows.

If these outflows keep coming and whales keep trimming, we could see a liquidation cascade with $60 million in liquidity stacked around the $3,500 level. In short, Ethereum’s bounce has legs. But it’s walking a tightrope.

Post Comment