Ethereum’s Record-Breaking Surge: Why Soaring Activity with Low Fees Could Explode Your Next Investment Move

Ever wondered what it takes for a titan like Ethereum to flex its muscles in the crowded blockchain arena without burning through wallets in gas fees? Well, buckle up—because Ethereum’s recent network activity didn’t just break records, it practically rewrote the playbook. Picture daily transactions zooming past 2.4 million and active addresses topping 1.2 million, setting fresh all-time highs—all while gas fees kept chilling near historic lows. It’s like throwing a massive party and having everyone pay just pennies at the door. But here’s the kicker: while long-term holders are starting to ease off their bets, short-term holders are scooping up ETH with a confidence that’s often a harbinger of major rallies. Could this be the early drumroll for Ethereum seizing a bigger slice of Bitcoin’s crown in the coming months? If you’re eyeing the next cycle, this dynamic might just be the pulse you don’t want to miss. LEARN MORE

Network strength follows resilience

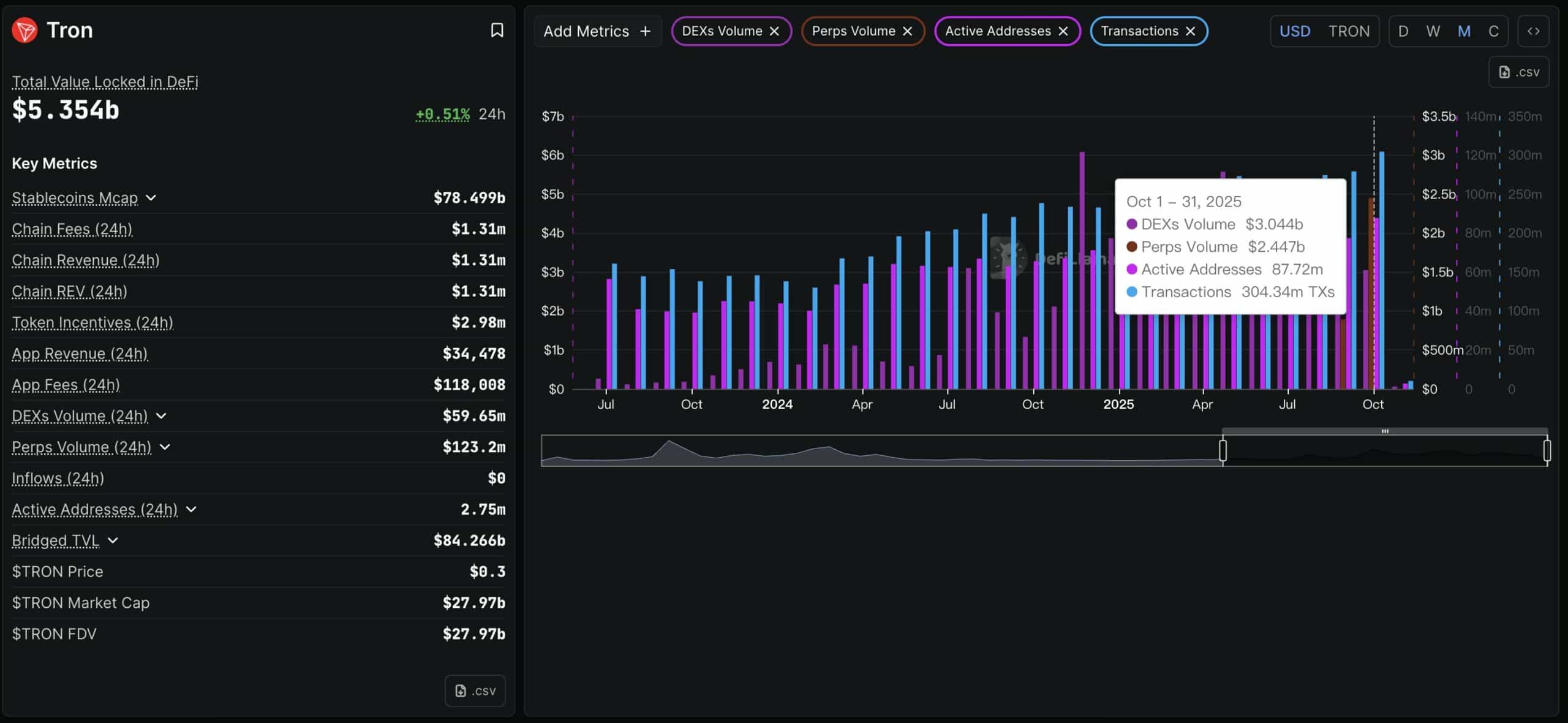

Building on its market resilience, Ethereum’s network activity broke records. Daily transactions surged past 2.4 million, while Active Addresses held above 1.2 million — in fact, both at all-time highs.

Yet, despite this unprecedented demand, Gas Fees stayed close to historic lows, hovering near $80 million per day compared with peaks well above $300 million in earlier cycles.

Short-term holders bring about the next wave

This strength on the network side was mirrored in Ethereum’s holder dynamics.

Data showed LTHs controlling 81 million ETH were starting to offload, while STHs held 39.4 million ETH and were actively accumulating instead of selling.

In fact, when STHs resisted profit-taking, Ethereum historically entered powerful rallies.

The current setup signaled confidence among newer buyers, which often precedes price breakouts.

If this trend continues, Ethereum (and the wider altcoin market) could absorb more of Bitcoin’s dominance over the next three months, putting ETH at the center of the next cycle.

Post Comment