ETH’s Spot Volume Surges Past Bitcoin—Is the ‘Flippening’ Finally Within Reach?

Ever wonder why suddenly everyone’s buzzing about Ethereum over Bitcoin? It’s not just hype—there’s a serious shift in where the big bucks are flowing. Institutional players like BitMine Immersion and SharpLink Gaming have quietly dropped billions into ETH, flipping the script on the age-old BTC dominance story. And it’s not just them; ETF inflows paint a crystal clear picture—while Bitcoin’s showing inconsistent interest, Ethereum-linked funds are sprinting ahead with steady, green weeks and fresh capital rolling in continuously. Makes you ask: could Ethereum be the dark horse racing ahead as September rolls in, poised to triple Bitcoin’s performance? Let’s dive deeper and unpack why this might just be the market’s hottest ticket right now. LEARN MORE

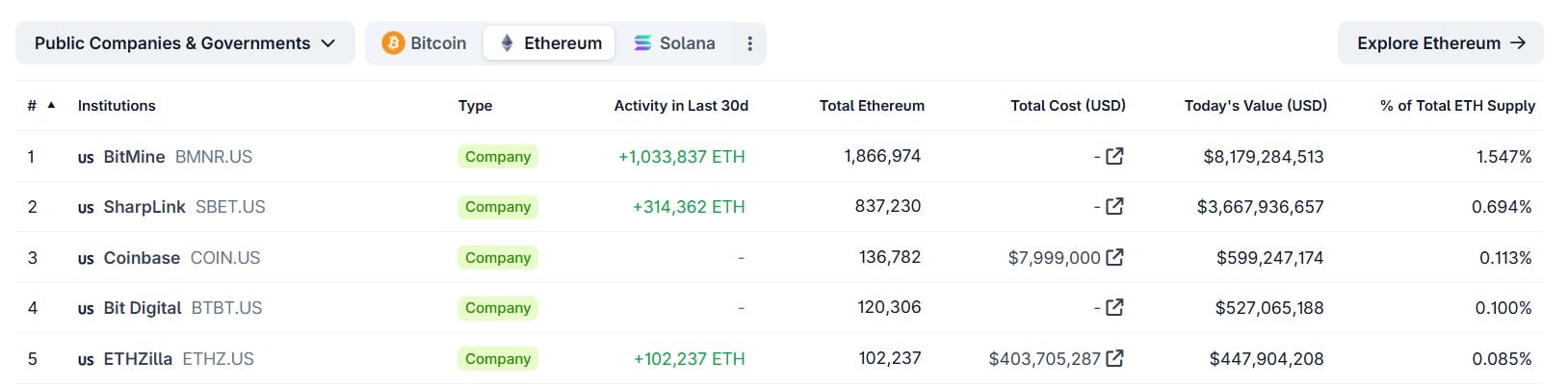

Part of Ethereum’s latest edge over Bitcoin comes down to where institutional money is moving. Corporate treasuries, including firms like BitMine Immersion and SharpLink Gaming, have recently disclosed billions in ETH purchases.

ETF flow data reinforced the trend too. While Bitcoin products saw uneven inflows throughout August, Ethereum-linked funds enjoyed consistent green weeks before closing the month with higher aggregate inflows.

- Source: SoSoValue

- Source: SoSoValue

ETH funds continued to attract fresh capital too, even as BTC products posted outflows.

Hence, by the looks of it, Ethereum may be the market’s hot property heading into September.

Post Comment