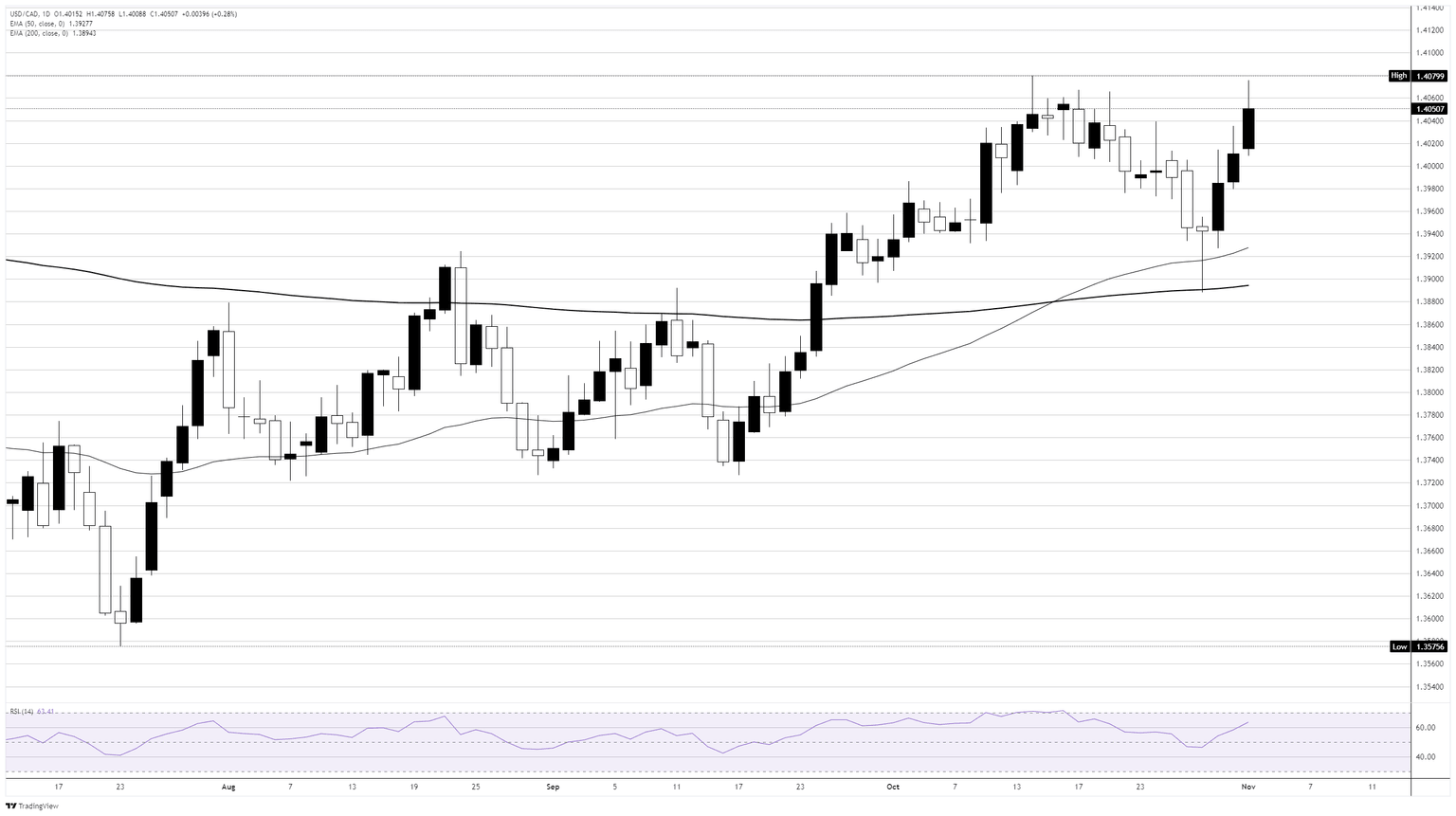

EUR/USD Stuck in a Tight Range: What Smart Traders Need to Know Before the Next Big Move Between 1.1665 and 1.1745

Ever notice how the Euro can be a bit like that friend who’s always teetering on the edge of making a bold move but then just hangs back, playing it safe? Well, that’s exactly the game the EUR/USD pair seems to be playing right now—consolidating between 1.1665 and 1.1745, hesitant to commit to a full sprint upward. As UOB’s FX gurus Quek Ser Leang and Peter Chia point out, the current burst of upward momentum? Not enough to light a fire under it just yet. It’s got to break and close *above* 1.1745 before we can start dreaming about a sustained rally. And honestly, isn’t that the kind of challenge that keeps traders glued to their screens? The sharp rally we saw recently felt like watching a rollercoaster’s first big climb—exciting but maybe a bit overstretched, setting the stage for a consolidation pause. The question hanging over the market: Will the Euro find the strength to break out, or will it just keep playing babysitter to its own potential? Stick around, because this dance between resistance and support levels could be the headline story of the coming weeks. LEARN MORE

Euro (EUR) is likely to consolidate between 1.1665 and 1.1745. In the longer run, increase in upward momentum is not enough to indicate a sustained rise; EUR must first close above 1.1745, UOB Group’s FX analysts Quek Ser Leang and Peter Chia note.

Upward momentum is not enough to indicate a sustained ris

24-HOUR VIEW: “After EUR dropped to a low of 1.1598 last Thursday, we highlighted on Friday, when it was at 1.1615, that it ‘could drop below the 1.1595 support level, potentially testing 1.1575.’ EUR subsequently dropped to a low of 1.1581. During the NY session, EUR took off and rallied to a high of 1.1742, closing at 1.1715, up sharply by 0.95%. The sharp rally appears to be overstretched, and instead of continuing to rise, EUR is more likely to consolidate between 1.1665 and 1.1745.”

1-3 WEEKS VIEW: “We turned negative on EUR last Wednesday (20 Aug, spot at 1.1645), indicating that it ‘could edge lower and test 1.1595.’ After EUR fell to a low of 1.1598, we highlighted on Friday (22 August, spot at 1.1615) that ‘for a continued decline, EUR must first close below 1.1595.’ We added, ‘the likelihood of EUR closing below 1.1595 will remain intact as long as 1.1675 (‘strong resistance’) is not breached.’ We did not expect EUR to drop to 1.1581 and then surge to a high of 1.1742. This time around, the increase in upward momentum is not enough to indicate a sustained rise. For EUR to continue to rise, it must first close above 1.1745. The odds of EUR closing above 1.1745 will increase over the next few days, as long as the ‘strong support’ level, now at 1.1630, remains intact. Looking ahead, should EUR close above 1.1745, it would increase the probability of an advance above 1.1790.”

Post Comment