EUR/USD Surges Nearly 1% This Week—Could Trade Optimism Outsmart Weak US Data and Rewrite Market Rules?

You ever wonder how a currency pair like the EUR/USD can dance in tandem with the whispers of trade deals and central bank moves? Well, buckle up, because this week’s action has been nothing short of a financial thriller. The EUR/USD got a nice little lift on the back of hopeful signs that the US and the EU might just ink a deal before that looming August 1 deadline – talk about timing! Meanwhile, US Durable Goods Orders showed a bit of weakness, but strong jobless claims threw a curveball, keeping everyone on their toes about whether the Fed will hold steady in their upcoming policy meeting on July 30. And let’s not forget the ECB—playing its cards close to the chest, holding rates steady and shifting focus to what next week’s Fed decision might have in store. It’s a high-stakes balancing act, and the EUR/USD is right there navigating the waves. Ready to dive deeper into the twists and turns behind these moves? LEARN MORE

- EUR/USD boosted by signs of imminent US–EU deal ahead of August 1 deadline.

- US Durable Goods Orders miss, but jobless claims stay strong, supporting Fed hold expectations.

- ECB holds rates steady; next week’s focus shifts to key Fed policy decision on July 30.

The EUR/USD finished the week up by nearly 1% on Friday, yet ended the daily session flat, following economic data from the United States (US) that was worse than expected, but offset by positive trade news. With the Greenback cutting losses, the pair trades at 1.1741 virtually unchanged.

Sentiment remains upbeat as the latest trade news suggests that the US and the European Union (EU) may be close to a deal. The economic docket in the US revealed that Durable Goods Orders disappointed investors, after posting stellar double-digit figures in May, as indicated by the US Department of Commerce. Nevertheless, strong jobless claims figures, despite weaker manufacturing activity as shown by the S&P Global Manufacturing PMI, sparked investors’ reaction to discount a less dovish Federal Reserve at next week’s meeting.

In the EU, the European Central Bank kept rates unchanged, with the Governing Council adopting a meeting-by-meeting approach amid a split division between doves and hawks in the Governing Council. Friday’s schedule was empty, though following week calendar will be packed.

EU – US Trade news

US President Donald Trump said that they’re near a deal with China. Regarding the EU, he said there’s a chance, but stated that they may have to lower their tariffs.

Earlier news during the week that the US struck a deal with Japan boosted the EUR/USD. Another leg-up was gained after the Financial Times (FT) reported that the EU and the US are set to sign a deal before the August 1 deadline, as mentioned by sources familiar with the matter.

Next week, the FOMC is in the spotlight

The US economic schedule will feature the Federal Open Market Committee (FOMC) meeting on July 29 – 30. The Fed is expected to hold rates unchanged, with a 98% chance of maintaining rates at around the 4.25%-4.50% range.

Daily digest market movers: EUR/USD consolidates after ECB’s decision, bad US data

- US Durable Goods Orders for June dropped 9.6% MoM, reversing sharply from May’s 16.5% surge, as demand for aircraft plummeted. Despite the decline, the figures came in better than the -10.8% contraction forecast by analysts, with the downturn led by transportation equipment, which fell 22.4% during the month. Core Durable Goods Orders—excluding the volatile transportation category—rose by 0.2%, signaling modest but continued strength in underlying business investment.

- On Thursday, better-than-expected Initial Jobless Claims pointed to continued labor market strength, even as S&P Global reported a contraction in manufacturing activity.

- In US trade developments, President Donald Trump announced that most trade deals are now finalized. He added that forthcoming letters are expected to outline tariff rates ranging from 10% to 15% and stated that the likelihood of an agreement with the EU is at a “50-50” chance.

- Despite this, EU member states are set to vote on EUR 93 billion of counter-tariffs on US goods on Thursday, and a broad majority of EU members would support using the anti-coercion instrument in the event of no US trade deal and US tariffs of 30%.

- The ECB kept rates unchanged at 2% as foreseen, with the statement highlighting that data have come broadly in line with the previous assessment, while adding that due to uncertainty, their approach would be meeting by meeting.

- Next week, the US economic docket will feature the Fed’s decision, Gross Domestic Product (GDP) preliminary figures for Q2, the release of Core PCE figures, and Nonfarm Payroll figures.

- In the EU, the schedule will feature Retail Sales in Germany and Spain, as well as inflation figures for Spain, Germany, and the EU. Traders are also eyeing the release of the GDP prints for the EU and Germany.

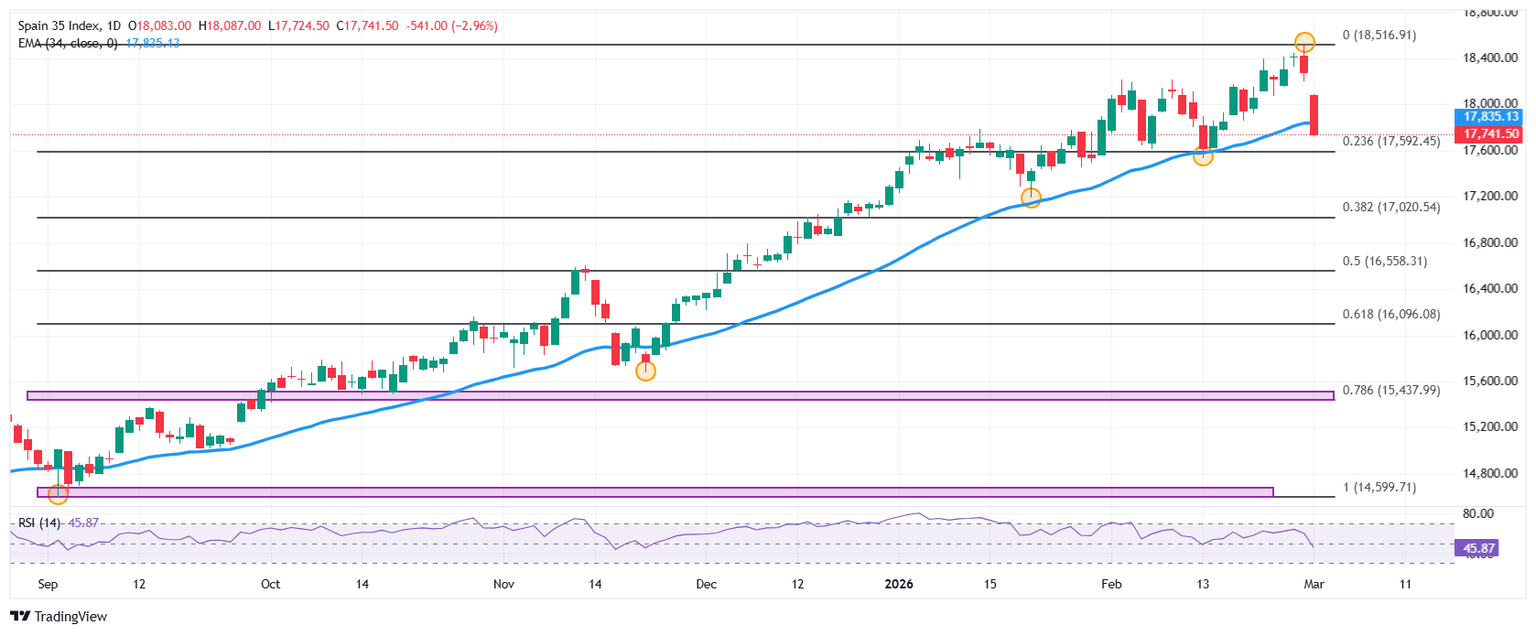

Technical outlook: EUR/USD consolidates at around 1.1750

EUR/USD is consolidating after hitting a weekly high of 1.1788, just shy of the key 1.1800 level. While the Relative Strength Index (RSI) remains in bullish territory, momentum is waning as the indicator nears its neutral zone.

A break below the 20-day Simple Moving Average (SMA) at 1.1714 could open the door for a retest of the 1.1700 support. Further downside would expose the 50-day SMA at 1.1556. On the upside, a sustained move above 1.1800 would bring the year-to-date high at 1.1829 into focus, with the next resistance seen at 1.1850.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Post Comment