FLOKI Faces a Critical Crossroad: This Unexpected Bearish Signal Could Flip the Script Overnight—Are You Ready to Act?

Floki Inu just pulled a classic move — getting listed on Robinhood and climbing the ranks to become the eighth-largest memecoin by market cap. Sounds like a smooth sail, right? But don’t be fooled by the headline-grabbing 6% gain or the buzz of 25+ million new potential users. Behind the scenes, there’s a tug-of-war brewing between bullish enthusiasm and some pretty ominous bearish chart signals. Over a million dollars in memecoin shifting back onto exchanges and tens of thousands lost in liquidations hint at choppy waters ahead. So, is Floki gearing up for a breakout or bracing for a tumble? Buckle up—this ride’s got a few twists yet. LEARN MORE

Key Takeaways

FLOKI gained after its Robinhood listing, ranking eighth among memecoins. Despite bullish sentiment, bearish chart patterns, $1.16 million exchange inflows, and $68K in liquidations suggest potential volatility ahead.

The popular memecoin Floki [FLOKI] logged a 6% gain on the 13th of August, at press time.

FLOKI ranked as the eighth-largest memecoin with a market capitalization of $1.12 billion, trailing Official Trump [TRUMP] and SPX6900 [SPX].

The recent boost came as FLOKI debuted on the U.S.-based trading platform Robinhood.

In an X post, the team called it a “huge step forward,” noting it opens access to 25+ million users on one of the world’s most influential retail platforms.

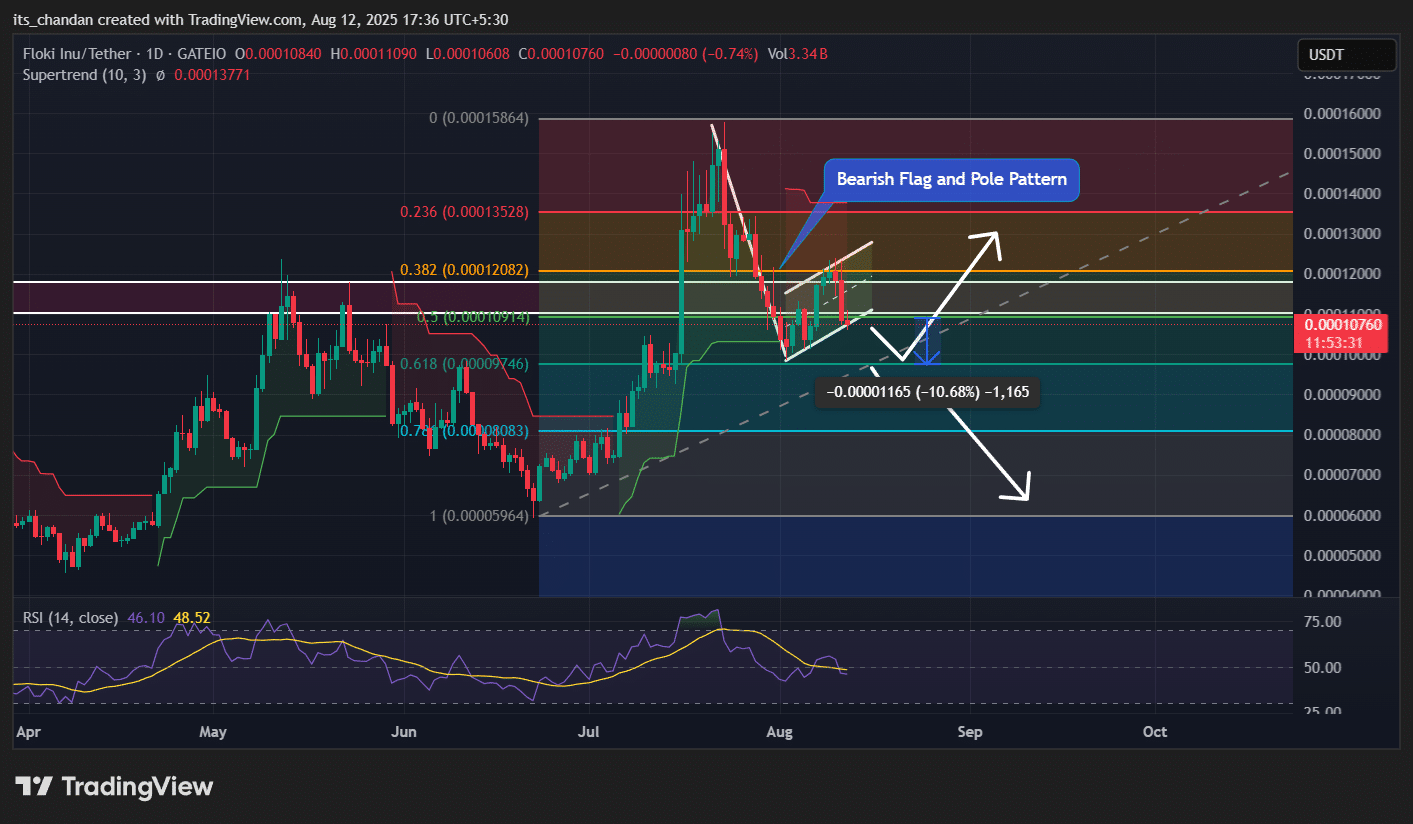

Price action and Fibonacci levels

Notably, on the 12th of August, FLOKI dropped 9% in value, settling at $0.00001069. Despite the decline, investor and trader participation surged.

According to CoinMarketCap, FLOKI’s 24-hour trading volume jumped 51% in the same period, signaling heightened market activity.

In fact, during this downside momentum, FLOKI failed to sustain the 50% Fibonacci level and is headed toward the key 61.8% Fibonacci level on the daily chart.

Also, it appeared that the memecoin also formed a bearish inverted flag and pole pattern and is breaking out of it.

AMBCrypto’s price action analysis suggests that if FLOKI breaks out of the pattern and closes a daily candle below the $0.00001055 level, it could trigger another 10% price drop and may reach $0.000009746, which is the key support level.

So far, the technical indicator Supertrend has remained red, reinforcing the bearish bias.

Meanwhile, at press time, the Relative Strength Index (RSI) hovered around 46, placing the asset in neutral territory without overbought or oversold signals.

On-chain flows signal potential selling pressure

Given the current market sentiment and FLOKI’s long-term potential, investors appeared to be offloading their holdings, as per CoinGlass.

Data showed that over $1.16 million worth of FLOKI memecoins moved into exchanges in the past 24 hours.

This inflow of tokens into exchanges hinted at potential dumping, increasing selling pressure and further downside momentum.

At the time of writing, FLOKI’s $68.09K in total liquidations leaned heavily toward long positions, with $47.46K wiped out compared to $20.63K in shorts.

CoinGlass data also highlighted liquidation clusters at $0.0001051 (lower) and $0.0001143 (upper). Over-leveraged positions at both levels leave the door open for sharp price swings if either band is breached.

Post Comment