From Cubicle to Cash Flow: How 3 Rental Properties Became My Escape Plan to Financial Freedom

Ever wonder if diving headfirst into the deep end of pricey real estate markets is sheer madness or the secret sauce to fast-tracking your financial freedom? Most rookies are nudged toward affordable areas, but what if the goldmine was right in your own backyard—albeit one that costs a pretty penny? Meet James Kitt, a guy who flipped conventional wisdom on its head. Instead of running to the cheaper side of the country, he doubled down near New York City, snagging three duplexes that churn out a whopping $9,000 in monthly cash flow. What’s even more jaw-dropping? He pulled this off with barely any savings and just $1,000 down on his first property.

James’s journey is a vivid reminder that with a smart use of debt, some scrappy do-it-yourself skills, and a killer house hacking strategy, you don’t have to wait decades to ditch the corporate grind. Whether you’re in a high-cost city or somewhere a bit more forgiving, the lessons from James’s story might just reshape how you think about real estate investing—and your own path to freedom. Whatever your market, his playbook offers a fresh, gutsy perspective on turning dreams into dollars. Curious to know how he did it? Let’s break it down.

New investors are often told to avoid pricey markets and buy rental properties in more affordable areas, but today’s guest did the exact opposite. Now, he owns three duplexes that bring in $9,000 in monthly cash flow and was able to quit his corporate job much sooner than would have been possible otherwise. With his investing roadmap, you could, too!

Welcome back to the Real Estate Rookie podcast! James Kitt couldn’t see himself spending the next 40 years of his life working in a cubicle, so when the world suddenly shut down, he decided to take a stab at real estate investing. But rather than chasing below-median home prices in other areas of the country, James leaned into his own market just outside New York City. Despite having very little money saved, he found a way to buy his first rental property with just $1,000 down!

No matter your market, James will show you how to use debt to fast-track financial freedom and potentially leave your W2 job with only a few properties. You’ll also learn how to “live for free” through the power of house hacking, save a fortune with do-it-yourself (DIY) home renovations, and more!

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

Ashley:

Our guest today is charging 5,000 to 6,000 per unit just from duplexes in one of the most expensive markets in the country.

Tony:

James Kit used three low money down loans to build a $3 million plus luxury rental portfolio without ever needing a business partner. And in today’s episode, we’re going to break down. How are you doing?

Ashley:

This is the Real Estate Rookie podcast. I’m Ashley Kehr.

Tony:

And I’m Tony g Robinson. And with that, let’s give a big warm welcome to James. James, thank you for joining us today, brother.

James:

Guys, thank you for having me. I’ve been watching the show for a little while now, so it’s cool to kind of finally be a guest on it. So thanks.

Ashley:

So James, give us a quick overview of what your portfolio looks today and after that intro, I need to know what market you are in, how many doors and what does that cashflow actually add up to?

James:

Yeah, so I reside outside of New York City in southwestern Connecticut, so it’s a very wealthy suburb area. It’s about 45 minutes to New York City, so a lot of commuters in our area. I currently have six doors. I’m actually house hacking one of the properties now. And so from a cashflow perspective, if you were to take the market wrench for my current property that I live in, you’re looking at just about over $9,000 a month in cashflow.

Ashley:

That’s awesome. Congratulations. And what year did you start doing this?

James:

2021.

Ashley:

So that’s not that long of a timeframe to accumulate $9,000 in cashflow per month.

James:

Yeah, I like to think I was at the right place the right time and also a little bit of luck and a little hard work hopefully. So a few things came together for me. I think

Tony:

James, now you said you’re in New York City, right? Or just outside of New York City? I’m in Los Angeles. We’re talking about two of the most expensive metros that exist on the planet. I have not purchased in my own area just because when I got started I couldn’t afford to do it there. And I think that’s the mindset for a lot of people who live in high cost of living areas is that there’s no way to make this work. And maybe I fell victim to that same belief. So what were you seeing in your area that made you believe that real estate investing could actually work despite it being such a high cost of living area?

James:

I think it’s the squeeze to start. I was actually renting in 2020 and I was paying one bedroom around $2,000, and that’s in 2020 right before rents really started to go through the roof outside of New York City in particular with COVID going on. And so COVID in particular really brought a lot of commuters to the suburbs where we are do the hybrid and the remote work from home policies that they came into. And I just knew at the same time that working nine to five living in a cubicle, that just doesn’t work week. So I had to figure out a second angle. So that’s kind of where I figured something wrong. House hacking could work despite these prices. And luckily I had a couple people in my life who were in the real estate realm that helped tutor me a little bit and point me in the right direction I guess you could say.

Tony:

So it sounds like James U decided on house hacking as the primary strategy. Why did you go with that approach specifically?

James:

I can’t give you a great reason as to what other alternatives was other than the fact that paying $2,000 a month for rent didn’t sound appealing versus if you look at the numbers between what the difference would be on a mortgage and house hacking, it’s actually less and you save quite a little bit of money. So it just came down to simple finances and the idea of leveraging a large debt wasn’t as scary as the idea of throwing my money away in rent and especially when rents were jumping up at that time, like I said, $2,000 would be hard pressed to find a one bedroom Now for that cost, I mean most of ’em are like $3,700 in my area for a one bedroom now. It’s crazy. So it’s unjustifiable.

Ashley:

I’m renting one bedrooms at like $800 a month. So James, what is your actual buy box and the criteria you look for when you’re purchasing a property?

James:

I would honestly say the side-by-side profile for duplexes is a big thing for me. The up and down duplex, I’ve never been a big fan of that, and that’s mostly because I rented in a wood frame construction apartment building where you can smell the guys cooking above and below and you can hear their dogs walking around. And I’ve lived that life where you’re trying to go to bed at 9:00 PM and you hear somebody thumping around. It’s not fun to live above and below, especially when you’re paying a lot of money to live there. So being a side by side configurations have always been something that I was more interested in. And then there’s a few things that go into that that really make it more attractive to me.

Ashley:

I’ve had that horror story before of a tenant in the upstairs slamming her toilet seat too loud and that was what was just

James:

Give her one of the self-closing ones. Here’s your Christmas gift.

Ashley:

Yeah. Okay, so what were the actual numbers on the first deal that you did? How did you fund it? What did it cost? How did you find it? Everything like that.

James:

Yeah, so 2021 I came across a coworker of mine said his neighbor was trying to sell his house for like a million dollars. I did not have a million dollars by any means. Anyway, connected me with him. I went over there, saw the guy. I ended up offering him 800,000. He actually gave it to me for 7 85 because he said the roof was old. So that worked out well. I luckily had the eligibility for the VA loan and just out of good faith, I gave a thousand dollars deposit. So in reality, I purchased a $785,000 side-by-side duplex for just about a thousand dollars and that was luckily when rates were 2.7% interest when on top of that there’s no PMI. So my monthly PITI came out to like 4,700 a month. And then from there the front unit was actually renovated, but not anything premium or luxury I would say, but it was good enough and it was vacant, so I rented that out for $3,200 a month. So as you can imagine there I have a $1,500 deficit or delta between the two of them. And then I actually had two of my good friends move in and they each paid me $800 a month just to live in my house in the back unit. So with that, I wiped all of my living expenses for that property and I got to enjoy a relatively nice large townhouse with a three car garage actually too.

Tony:

James, kudos to you for getting so creative with this deal because not only were you house hacking one side, but then you took it to the next level and house hacked the unit that you were also living in. And if I’m doing that math correctly, you were netting a hundred bucks, give or take, living in property that

James:

Yeah, it worked out well.

Tony:

Just think about how insane that is. You were able to acquire a property $785,000 property for a thousand bucks out of pocket, and then you got paid $100 per month to live there. Right now, obviously the 2.7% interest rate helps a lot there and with today’s interest rates, that’ll be different, but even if you were able to cut your living expense in half, that’s still a major win in terms of why house hacking is attractive, said, man, you crushed it with that first deal. So you find this killer first duplex, it works out incredibly well for you. What do you do from there to help you scale? You said you’re at several properties now, 9,000 bucks a month in cashflow. If you include your single family home, what happens after that first deal?

James:

Yeah, I doubled down to say the least. So about a year later I got the itch, I guess you could say, of making a hundred dollars a month off of something I bought, Hey, this could work out for me. And I was working my W2 jobs still. So I found a property that was overpriced on the market. It was on the MLS, it was a side-by-side duplex. It had one photo, which was, I think the photo was taken with the equivalent of a potato. I mean it was grainy and awful. So I went to the Google Street view. I searched down looking around the block, it wasn’t very far away from the first property and I was like, this place is huge. It’s beautiful. There’s just awful marketing involved, and it was way overpriced. They wanted 1.4 million in 2023 market. It wasn’t realistic and it was awfully marketed, so it wasn’t going to go anywhere. Anyway, so I went to her, the property with the agent at the time, she just gave me the owner’s email and phone number. I was like, you just deal with them directly. Okay,

Tony:

That

James:

Is a one motivating. They knew they were Excel, they were, yeah, it worked out for me. I wouldn’t have hired her. But anyway, so I got their information directly inform, so I initially offered them half of what they wanted for the place because I ran very, very conservative numbers. There’s really no comps for a 3000 square foot, four bedroom, four bath townhouse, and especially when there’s two of them side by side, there’s no comps for that in our market. So I had to use single families as comparables and then kind of draw where the rents might fall once I’m done with the renovations from there. So anyway, I offered ’em, I lowballed them. They pretty much said, no, 900,000 is our number. And I was like, well, everyone says that. Put another offer in. Later, they just stopped replying. Then the listing expired on the MLS and I luckily had their direct information, so I sent him another offer, didn’t hear back, and eventually I talked to somebody and I was like, I really want this place, man.

Well, what do I have to do? He’s like, just put your pre-approval together, put a real offer on standard form contract together and do whatever the best you can to get to that 900 mark. I talked to my broker, we were able to just squeeze it, and this is just when rates started to climb back up. So every week it was ticking. My ability to afford this $900,000 loan was slowly diminishing. So I locked in. Luckily at a 4.3 rate, I was able to get them at 900,000. They responded an email saying, our attorney reviewed it, it’s legit. Let’s move forward. I was like, okay. And it turns out this was a 1995 build with brand new nine foot ceilings. It just needed, I’ll call light rehab on the property to me light I should say, but relatively cheap in the grand scheme of things. So it was a steal really.

Ashley:

I think that is such a great lesson right there, the motivation of an offer that’s put together and presented that the document is there, all you have to do is sign. I am actually going to do that on a property. I’ve been trying to get it for two months now. I started at 2 75 and then I went to 300 and it’s just kind of been like, oh, I don’t know. We’re going to see if we get other offers. It’s an off market deal, and I am to the point where I’m getting my pre-approval letter. I am getting the contract put together and I am going to send it to him and be like, here is my official offer. And I think that’s just a great tactic that you can use is actually put everything together so they can read it, they go through it and it makes it way more appealing as like, okay, well we have this all packaged together here for us. Maybe we should just do it.

Tony:

Let me ask, how much back and how much time did all that back and forth take? How long? Was it a weeks? Was it years?

James:

No, this is four or five months. I mean, honestly, none of these deals worked out immediately by any means. They all took a little bit of time to come together and a little bit of pressure.

Ashley:

So between these two properties that you have, how much debt did you accumulate at this time between those two, taking on the 900,000

James:

Good debt? A lot, to be honest, the second property was a three and a half percent down FHA loan. The first property, like I said, was a thousand dollars, so relatively zero. So you’re talking 1.6 something in debt at the time.

Ashley:

And how did you feel comfortable with that?

James:

Yeah, so I will say I was able to, I had a decent W2 job along with some military income. I was in the National Guard at the time, so I had some residual income from there, but mostly because the cash flows from the properties are the most important part. And what I would do is I would actually take a look at what the section eight was for the city, and I would actually use that as a backbone of like, okay, if everything goes wrong with this rental, and for some reason the local rental market crashes, there’s a really strong section eight demand in this area. And section eight in our area, a three bedroom will get you $3,300 a month. So if we talk about the first property, if I had a $4,700 a month, PITI, 3200, 3300, it’s covered by section eight, that’s my bottom threshold. So that kind of helped just reconfirm that taking on this debt wasn’t as crazy as it sounded. And then also just looking into the local market, but leveraging this debt is the only way you’re going to compete in a high cost market. At the end of the day, there are not $300,000 two families. The median price on a two family around here is 700 and something thousand.

Ashley:

So all said and done with that second property. What did the numbers look like after you got it rented?

James:

Yeah, so the PITI on that came out to like 6,800, the cash on cash was 89%. The cap rate is at 11.7% I think when I finished the rehab on the first unit, and then I lived in the other one, the first unit rented for 5,500 a month, so 68, 55. So do the math there. And then I eventually moved out of that unit and I just re-rented that. The unit I rehabbed there too for that one’s at 6,000, so that one’s making 5,000 or so a month in cashflow. So yeah, it worked out really well. And luckily, like I said, it was a 1990 build. So buying newer homes after 1965, it really eases up the renovation process and rehab process, and then you can kind of keep it mostly simple in the rehab scale.

Ashley:

Well, James, you built this high-end portfolio without doing complete renos or flips, but you did grow up with a contractor dad. So let’s talk about how that shaped your investing edge. We’ll be right back after word from our sponsors. Okay, we’re back with James now. Your dad was a contractor and you grew up swinging hammers before you could even drive. So let’s dive into how that actually shaped your approach to real estate. Are there any DIY jobs that you took on yourself with your projects?

James:

Yeah, definitely. I built a deck before I could drive, that’s for sure. So painting, flooring, tile work, I mean, honestly, you can name it. I actually ended up putting in a home feeder in the first property. The basement was unfinished with 10 foot ceilings, so I didn’t know what to do. And of course I was 23 at the time or something, and I liked football, so I was like, oh, I could have everybody over the Super Bowl when we put 140 inch feeder system in my basement was surround sound speakers and whatnot. That seemed like the appropriate thing to do. So luckily, my father had taught me a little bit of something and then honestly, with a combination of YouTube University and just reconfirming how to do some projects, I was able to definitely tackle a lot and it saved me thousands of dollars If I had to put a number on it, it’s in the ballpark of $70,000 in work I didn’t have to subcontract out because at the end of the day, there’s a lot of small things that can be done on your own that trades are expensive and rightfully, but there are things you can do as you’re doing your own, but you got to learn the limits of what you can and can’t do at the same time.

And that comes into how you build the relationships with those aspects that you can’t. So being close with an electrician and a plumber are the two biggest things that have saved me a lot of money and also finding a really quality kitchen supplier has been really great.

Tony:

So James, were there any jobs that you did where you were halfway through and you were telling yourself, oh man, this was not one that I should have tackled myself? I think about our friend Rob Ava, and he was on the podcast a while ago and he shared with us he was DIYing one of his first investment properties and it was like the tile in the bathroom floor and he said it took him three days to get 20% of the tile done and he’s like, man, I can’t do this anymore. He hired a guy who did the other 80% in one day. So were there any jobs like that for you or your end? You’re like, oh my God, this is not what I was supposed, I shouldn’t be doing this myself.

James:

So there’s two things. The first one I’ll say is with the kitchen supplier, I did first attempt to put Home Depot cabinets in the first property and quickly realized these are not quality, it’s not fun, it’s a pain and it’s just never going to look like the same quality as if you have a kitchen company coming into it. The second thing actually is painting. Now I don’t paint. Once you watch a professional painter and drywall work, I look like an idiot out there with my blue painters marking off all the bolt, the trim work and stuff.

Ashley:

Well, that’s the worst part of

James:

It. Yeah, you watch a professional painter cut the line in three seconds and you just feel foolish for trying and they’re worth their weight in gold in comparison to how quickly he can paint. And typically that’s towards the end of the project. I’m trying to button everything up and get pictures done and get it. So I just justify the cost. So painting I used to do, I actually, I am so bad at it in comparison, especially if you’re doing patchwork, you can see everything, especially if you have a really well lit property, you can see all the small mistakes you can do with compound work. So having a good painter makes a huge difference. And that’s something I’ve kind of just straight away from now,

Ashley:

We had a guy for a while that would do it as a side job. He was in a painter’s union or something and had a full-time job painting, and then he would do the apartments on the side, so on weekends or nights, but he could just get them done so fast, we’d be like, okay, next week we’re going to be ready for paint. And it’d be like, okay, I’ll be done on this day. And it was so efficient and so quick, and I used to have just the maintenance guy at the apartments come and he would do it and it would just take him forever because it wasn’t what he was actually skilled at. He’d have to go and buy new brushes. We hadn’t done a painting in a while and he didn’t save them and wash them or whatever. So it was so much more cost effective just in how quickly the painter could get it done and get in and out of there too.

Tony:

Ash, I just want to add onto that because I think that time is a cost that a lot of rookies overlook, whether we’re talking about turning a rental unit, flipping a home, doing a burr, all of those have costs associated with time. If you’re flipping a house and say you’ve got hard money, private money, even your own capital that’s just sitting there, there’s a cost to having that money in that deal. And if you hire someone who’s a little bit cheaper for the paint, you hire someone who’s a little bit cheaper for the cabinet, someone who’s a little bit cheaper for this, you think you’re saving money. But then when you add up how much additional time it costs, you could end up maybe breaking even or even losing money on some of those yields with maybe even work that’s less superior, right? Work that’s not as good. So I know it’s counterintuitive, especially for Ricky’s as you’re starting to maybe go with someone who’s a little bit more expensive, but you want to make sure that you’re taken into account all of those different elements and not just, Hey, who’s got the lowest cost? James, I’m curious, did you ever get, I don’t know, maybe bit by a contractor, you’ve maybe got a better eye because you grew up in it, but we’ve all had our fair share of contractor horror stories. I’m just curious if you’ve had any.

James:

Actually, I did get bit recently and I’m bummed out about it. I didn’t actually, I didn’t get finish it out just yet, but yeah, recently what happened was I had a contractor for a paving job out of New York and I gave the initial deposit, everything looked good. I had gotten actually a referral for them and it was only like $1,500 and then they’ve ghosted me since then. So now I’m going through the process, which is a huge pain for out-of-state small claims court against the business, and it’s not a fun process. Luckily it was a relatively small amount of money, watched the BiggerPockets podcast before in the real estate rookie and how you should many years ago talk about how you should divvy up the proportions of money that you give out to these guys. So I gave ’em a small piece of money in comparison to what the total job was, just to start just for materials. So luckily I avoided that. But yeah, I’ve been bit, and that was actually four months ago, and I’m still going through the process of reclaiming the money, but for the most part I’ve avoided it with a lot of the other subs I’ve worked with who I have good relationships with. I didn’t have a driveway guy, I got a referral. I didn’t work out for me. So it definitely still happens.

Ashley:

And where are you finding most of them, their referrals from other investors or?

James:

Honestly, I use a mix of a referral from other real estate investors. I also go online. I’ve used Facebook marketplace. Surprisingly, a good amount of these guys actually use that. They’re legitimate companies. I’ll go and get quotes from them and they’re typically cheaper from over the border outside of my county. Like I said, I live in one of the most expensive counties in the country, so labor, materials, anything, they have a shop here, they’re overhead is immediately higher, their costs are immediately higher. So I tend to hire out people from over an hour away minimum. A lot of that’s over either in New York or up towards Hartford, Connecticut outside of my area. Either way, using either referrals, Thumbtack or honestly, I take a few quotes from Facebook marketplace that have worked out great, my electricians from Facebook marketplace and he’s been stellar.

Tony:

We’ve had mixed results with Facebook marketplace and it kind of varies depending on the market. We found a great landscaper for our hotel in Utah off of Facebook marketplace. We found some terrible contractors in California using Facebook marketplace. So I think it really does vary on the market and kind of who’s out there. But as we talk more about the renovation and the rehab, you said James, that you quote design for premium. What does that actually mean inside of your rentals?

James:

I like to provide a high class experience, I guess we’ll call it. I definitely target the higher income earners in the area. And to be frank, a lot of the tenants in which I’m pursuing, these are people, the households that are making a quarter to half a million dollars a year, they’re typically in their family formation years, late twenties, early thirties, or they’re possibly empty nesters who are downsizing from their $3 million house to a million and half dollar house and they need somewhere to stay while their house is getting built for two years. These are the people that I’m really targeting, and surprisingly, there’s a decently strong market for, and a lot of these people don’t want the high upkeep of a single family with a lawn. They want something that’s spacious, but at the same time easy to upkeep on their own if they need to.

So that’s where it comes into the side by side characteristics, providing that single family feel that provides comfort at the end of the day. And then working to add some of these modern finishes that really kind of stand out. You can’t do like a landlord special. You paint everything white and you move on with your day. I mean, I try to provide higher class appliances and really just try to go after that highest tier rent. And one of the other big things that helps design for a premium honestly, is fencing in your yard and allowing pets because all these people are in their late twenties and thirties, they all have a golden retriever or they have cats and they might have young kids. And it really helps provide, I think every rental I have right now has some kind of pet in it, and it’s because that’s the caliber of people in what you’re looking for.

Tony:

James, I’m curious, how quickly typically are you able to fill vacancies since you’re going after such a niche renter? I’m curious if it’s so niche and maybe it takes longer or is there such high demand for that type of product?

James:

It is surprising how quickly, instantly per my leases, I have to get a 90 day headstart on notice if they’re going to move out, I start showing 60 days out. I’m looking at a week turnover. I haven’t had anything longer than maybe two weeks. And that was just because it was the end of the month versus middle of the month. Yeah, it’s two week turnover is for me to patch holes. I replaced a sliding glass door, something small like that and move on. It’s crazy. And I’m looking at four to five offers for each property. It’s lucrative, it works out well, and then I can kind of go through and pick the best of the batch.

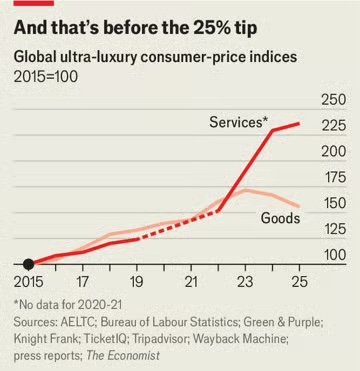

Tony:

It’s so interesting, right? Because we’re at this weird place in the economy where there’s all this talk about the economies. Is it slowing down? Is it heating up job numbers look weak one day and the inflation looks good, then it looks bad. And there’s all these different elements that are going on in the economy right now, but I think, at least from what I’ve read and what I’ve seen, that one part of the economy that’s remained a little bit more resilient are the folks who are in that higher income bracket, right? You said a quarter million to half million bucks a year is like your typical tenant, and those are the folks who are maybe less impacted by the fluctuations we’ve seen in the economy recently. It’s the people who are maybe in the middle of that bucket that are maybe a little bit more impact by what’s going on right now. And I think the reason I bring that up is because for all of us who live in high cost of living areas, we might actually be sitting on the type of tenant or in the type of market that would be able to sustain some of these ups and downs, and maybe the folks who are in less expensive markets might see more challenges. But to that point, Ashley, I guess I’m curious, you mentioned earlier 800 bucks and James is talking about 6,000. What are you seeing in your rentals right now?

Ashley:

This conversation is so timely for me because my live and flip, I am nine months into it, and I’ve actually started to consider moving out after a year and renting it. And when I bought this, I 100% thought there was no way to do that because it was too big. I would’ve had to charge too much. But right now, I think there actually is a need for a single family house with a garage that has more than three bedrooms, and someone who can’t afford to purchase a property or can’t find a property would actually pay the premium that I would have to charge on the property. So my mortgage payment is around $2,100 and they pay all their utilities, take care of everything. So that would pretty much be my cost. So I would want to rent it out for $3,000. I would want to have at least $900 in cashflow a month.

And I just think that is so ridiculous. Why would somebody pay that much more when they could buy the house and just pay a thousand dollars less for the mortgage? But right now, it’s not that easy for someone to go and purchase a property to buy a house, or they just don’t want to pay that interest rate and are still waiting for rates to come down. So I got to do a little more math on it and run the numbers, but I’m really interested because there is nothing available that is not a two bedroom or if it’s a three bedroom, it’s in an apartment complex. I don’t know where families are living that have to rent.

Tony:

So solving some that unmet need, it is just an interesting take James to say, Hey, we’re going after a very specific habit.

James:

I’m surprised every time, honestly, every time I get an application and the background checks and I see the kind of money these people have, it’s like, why are you renting from me to

Ashley:

It makes me want to do a test

James:

Listing.

Ashley:

Like, okay, let’s just put it up and see what passes. Make

James:

Sense? There’s a bunch of guys been like that.

Tony:

Yeah. But James, you talk about background checks and it brings me to my next question on tenant screening, because I know one of your units got raided by the FBI and this is probably one of the worst nightmares that a potential landlord can have. So talk through us about how you found yourself in that situation.

James:

So when I first moved out of the first property and moved into the second property, I had to rent out the unit that I was house hacking in. And so I rented it out. I found a potential tenant who he was making a lot of money. We’re talking three quarters of a million dollars a year, 800 credit score, squeakly, clean background check, no problem. A guy from the town I actually grew up in, and he had a younger son who was in his late teens who I didn’t think anything of. Apparently he was going away to school or something. So I approved him. He was ready to go, never missed a payment, no problems. And then six months into it, into the release, I get a call from a bunch of my neighbors, the A TF, the FBI, state police and local police were all at my house.

And funny enough, I was on my way there anyway because I was there to check on a hot water heater, I think, or a hot water tank. And anyway, I show up and they’re hauling everybody out of the house in handcuffs. Actually, like I had mentioned, there’s a three car garage there, and I have a storage unit above it where I keep my stuff and I have some equipment and stuff up there. And so they’re going through all my stuff. They’re asking me a bunch of questions. Well, it turns out this guy actually, his son had actually committed vehicular manslaughter as a kid, and he had gotten out of jail, was on probation, but he had violated in some sense or another, and it turns out he was actually seeing bomb parts suspiciously and some other stuff. So that’s why the alphabet agencies got involved. So ultimately it comes to the idea that you can’t just screen the people who are the moneymakers. You have to screen everybody. If they’re over 18, they have to get screened. It was definitely an interesting scenario. Didn’t miss a payment luckily, but definitely something I didn’t know how to deal with at the time. It was just kind of like, ah, okay, you guys do you? They wouldn’t let me in my own house. They’re like, you can’t go near.

Ashley:

So I guess in that circumstance, what does happen? So did the father stay living there? Was the father arrested and the house is vacant?

James:

No, the father was not involved in the crime. He just kind of got in the way when they were trying to take the son. So they just briefly put him in handcuffs to calm him down. They took the son away and then a week later, I got my next month’s check.

Ashley:

Yes. And the father kept living there? Yeah, yeah,

James:

He just stayed there and then he moved out west, I believe, actually nice enough. He actually gave me his security deposit as a gift for my wedding. I think it was like a, sorry about my son or I didn’t tell you about that, by the way. So nice enough for him, I guess. But

Tony:

Such a crazy story, and I think that’s the part of Landlording that we don’t talk about enough is that sometimes crazy things do happen. For those of you who have been around the podcast for a while, you may remember my story of Gina Katz, the drug using Airbnb guests I had who broke into not one, but two of my properties. But that’s story for a different day. James, you’re killing it right now. The deals are cash flowing, but I know you’re thinking creatively about how to grow your portfolio and I want to dig into that after a word from today’s show sponsors. Alright, so James, you’re sitting there with a few cash flowing properties. You’d actually put up a third as well that we didn’t touch on before. But I think at that point a lot of rookies would just kind of chill, but you’re looking to get even more creative in the next phase. So you mentioned a potential play to split a duplex into two condos, and I think we interviewed a Dave who also talked about condo or I can’t even remember what phrase you use, but something similar to that as well. What exactly is that play? What happens there?

James:

So I’m also doing a little research on this. I’ve gotten caught up in a few other things, so I haven’t gotten to divvy into it. I’ve been talking to my real estate attorney and I need to dive in a little bit more, but zoning does allow it. And essentially my second property is a prime example for this, where I purchased property for $900,000. It’s side by side townhouses that are huge, 3000 square feet each, four bedroom, four baths with two car garages below. They’re perfect for this. And luckily enough, recently a townhouse, an actual subdivided townhouse just sold for 1.1 that’s actually smaller and more outdated than mine in a similar area to mine. So the idea would be to legally go through the process to subdivide the units into two condos, to then sell one of the condos to wipe out the initial debt I have on the two family property, which would probably require some kind of bridge loan between the two of ’em.

And then ultimately what that would allow me to do is I would pretty much keep the same cashflow that I have from that property while completely wiping out the debt. So in theory, my debt to income comes shooting down, my cashflow stays the same, which gives me more flexibility to go out and find more deals and to invest further. It’s something that I’m toying with right now, as you can imagine, with the amount of, I got to call good debt that I’ve brought on. Obviously your debt to income creeps up on you. It’s okay. What do we do here to get around this?

Ashley:

Now you’ve only spent what around a hundred k to actually acquire over 3 million in assets. What are your plans going forward as far as tapping into the equity you have in the properties now?

James:

Yeah, so I’m currently going through the process of getting a HELOC application completed, cash out, refinanced, as much as it sounds nice. I have that 2.7 in that 4.3% interest rate, and it’s really hard to let go of that. Those are hard to give up. So honestly, I’m looking now at a HELOC options. At the end of the day, I’m not sitting on a bunch of cash and it’s not coming from daddy or somebody else, and that’s not coming from anywhere. So how do I tap into whatever equity I have now, which is near $800,000 equity between three properties? So I’m trying to look at it, how to pay for a down payment and renovations, honestly moving forward.

Tony:

And I think there’s so many investors who are not trapped, but yeah, maybe trapped is the right word, who are trapped into these low interest rates and they don’t want to touch it. And I couldn’t imagine that anyone who sub 3% refinancing anytime soon because we’ve got, I think my lowest interest rate right now on one of our rentals is 2.65%. It’s like, man, I’ll never get rid of the property free money. It’s free money.

Ashley:

Yeah, I actually saw someone post on Instagram today and I didn’t finish reading it, but they were writing about how it’s such a big dilemma for people as far as, okay, you want to sell your property or you want to move, but you have this really nice interest rate and you feel almost like stuck in that property. So I didn’t read the whole thing, but my solution is turn it into a rental and then you can still move.

Tony:

So as you think about scaling, we’re talking about tapping into some of the equity that you have, but I also know, James, that you’re maybe eyeing some different strategies. A lot of what you’ve done so far has been house hacking these different side-by-side duplexes, but you’re eyeing some short-term rentals in the Florida area. What’s the vision there and what’s the motivation behind that potential pivot?

James:

So I know with a good team, you can really do a short-term rental anywhere in the country once you set up that good base of local contractors and stuff. Honestly, for somebody like me, my old man, I moved him and his wife down to Florida outside the Tampa area, so I’m very familiar with the market now. As you probably are aware, Florida’s market is down making it a decent time to buy. So I’m looking at some family oriented beach style areas outside of Tampa, but in particular, having my father who’s a contractor be within 45 minutes of an Airbnb or something like that is huge in case of any service related maintenance issues that could pop up. And I really feel like that with the time that I have now, I can kind of provide a luxury rental experience in a short-term format like I do now for the long-term sense and I can provide a higher end customer service as a host moving forward. So I just want to diversify. I feel like once you get three properties all around the same area right outside New York City, it’s like, okay, what can I do to maybe get a nice small single family in Florida that will pay for itself in 25 years? And then I have a house in Florida that I could use and you can rinse and repeat a bunch of short-term renters have done it before. So it’s something I’m looking at.

Ashley:

So James, I’m curious, what was this conversation with your dad? I want to get you this house in Florida. You’re going to have a great time, it’s going to be amazing. Move down there and then you can be my maintenance guy.

James:

He’s bored. He’s like your classic blue collar guy who gets

Ashley:

Up. He’s probably expected

James:

To 4:00 AM for no reason.

He gets up and he just needs something to do. So they bought a house that was a move in new build and then you started remodeling it. He’s, lemme make this better. He’s that guy. He is just started working on it. Well, the fan could be over here, let me just climb up in the attic and move it. He’s that kind of guy. So he’s all for, and I think doing something with his son would make him happy, but ultimately he was on board. He’s got all the time in the world, he’d love to have something. Now he doesn’t want to retire, we’ll call it.

Ashley:

Well, what advice would you have for rookie investors who maybe live in an expensive market and don’t feel like they could actually do house hacking, that it’s not achievable for them?

James:

It’s definitely doable. So I would definitely try to start with the two or three family model. Anything you can get your hands into that makes sense. You can still use the creative loan programs that are low percent down like the FHA or 5% down Fannie Mae. You can still make aggressive offers maybe if you change up the terms in those offers itself. But the biggest thing is there’s still for sale by owners out there. They’re still talked to your manager like I did, and his neighbor wants to sell his house for a silly price, or if there’s a house that’s poorly marketed, the opportunities are still there. I just had one of my best friends just got a triplex in our area for 900,000. So now he lives rent free, I should say mortgage free between the other two properties paying out. So it’s totally possible that initial, when you look at the numbers on paper, it’s hard to swallow that, okay, I have a $7,000 mortgage. That’s tough to be comfortable with it first, but it all comes down to cash flow. If the numbers work and you can qualify for, I think it’s worth investigating deeper.

Tony:

And James, you have an incredible story and my hope is that many folks are motivated by what you’ve shared, the ability to get creative, the ability to be scrappy. And I love what you said at the top of the show where it was a mix of luck. There were some interest rates working in your favor, but there’s also some hard work like following up with the same buyer for four months in a row, not being afraid to have those conversations. But I know that there are probably some people like myself, even Ashley, who have young kids, young families, spouses who maybe don’t want to live side by side. It doesn’t mean that house hacking doesn’t work. It just means you have to find the type of property that would still allow you to house hack in a way that supports your lifestyle. And I go back to Laco, but she also talked about the detached A DU, and maybe that’s the play for you where you buy a home and there’s either maybe an existing a DU in the back or you build an A DU in the back and that’s still house hacking. That’s still a way to leverage your primary home and turn it into some sort of revenue generating activity for you.

James:

Yeah, I’ve been my poor girlfriend now fiance has done all of these house hacks with me, and as soon as I do the live-in kind of renovations on these properties, as soon as it’s nice, really nice to live in, it’s on the next one. I feel so bad. She’s been such a trooper. Luckily she sees the light at the end of the tunnel, like, alright, everything we’re doing here in the late twenties is going to set it up so that we can get that house, or we can build that house that we want in our thirties. So luckily she gets the bigger picture. But yeah, it’s tough. I can’t imagine doing this with kids. We won’t even get a dog. We have two cats. We won’t get a dog because I know dogs will get into everything and next thing you know, he’s eating my tools or something. So yeah, it’s tough. It feels like a young man’s game sometime.

Ashley:

We actually had a guest on that moved every year over 10 years with his family. So they didn’t house hack, but they would move every single year with their kids, and I think they have four kids maybe. So accumulated kids over the years, but moved every single year as a family. Yeah,

Tony:

That’s the hustle that a lot of people don’t see. They see the Instagram post you’re talking about the properties and the cash flow, whatever it may be, but they overlook the hustle and the sacrifice that goes into it. So I guess last question, we can end here, James. What was the moment that you realized that real estate had actually changed your life?

James:

So obviously bar cash flow, $9,000 a month now, or the $800,000 in equity that I might have. Honestly, I went to school for supply chain. I had a corporate nine to five job and having the ability at 26 years old to get up and go, I think I’m done with this after five years of working corporate, which it’s very different than a lot of people’s lives. It’s crazy. And I have now the freedom to work on the properties as I want, but ultimately I can pursue more time doing the things that I like to do that make me money. So right now I work on the properties and then I do a high-end handyman service on the side. So I wouldn’t have had that opportunity if these properties didn’t exist.

Ashley:

Well James, thank you so much for joining us today and telling everyone your journey and your lessons learned along the way. Can you let everyone know where they can reach out to you and find out more information?

James:

Sure. My Instagram is list it with Kit and also James Kit and then I believe, I think that’s it. Yeah.

Ashley:

Well, thank you so much for joining us and congratulations on your success with your real estate journey, and we can’t wait to see how much further you take it. I’m Ashley. He’s Tony. And we’ll see you guys on the next episode of Real Estate Ricky.

Help Us Out!

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

In This Episode We Cover:

- How James makes $9,000 in monthly cash flow with just three properties

- Fast-tracking financial freedom by investing in high-cost-of-living areas

- Saving thousands of dollars with do-it-yourself (DIY) home renovations

- How to wipe out your living expenses with the house hacking strategy

- Several creative ways to put low money down on an investment property

- How to attract your “target tenant” and lower your vacancy rates

- And So Much More!

Links from the Show

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].

Post Comment