GBP/JPY Stumbles at 208.00: What the UK CPI Shock Means for Traders and Your Next Move

Ever wonder why the GBP/JPY dance seems to flip more often than a coin toss in Vegas? Well, today’s move just added another twist. After a brief flirtation with the 208.00 mark thanks to softer UK inflation figures, the pair slumped back down near 207.30 — stalling last week’s hopeful recovery like a car stuck in traffic. The UK’s Consumer Price Index cooling off faster than expected has traders eyeballing potential rate cuts from the Bank of England, casting a shadow over the British Pound. At the same time, the Japanese Yen is flexing its muscles, buoyed by whispers of a Bank of Japan rate hike and political chatter around Japan’s fiscal path. If you’re in the trading game, this tug-of-war says one thing loud and clear: patience might just be your best ally before the big central bank reveals later this week. So, what’s the real play here — a steady slide or a sharp turnaround? Let’s unpack the layers. LEARN MORE

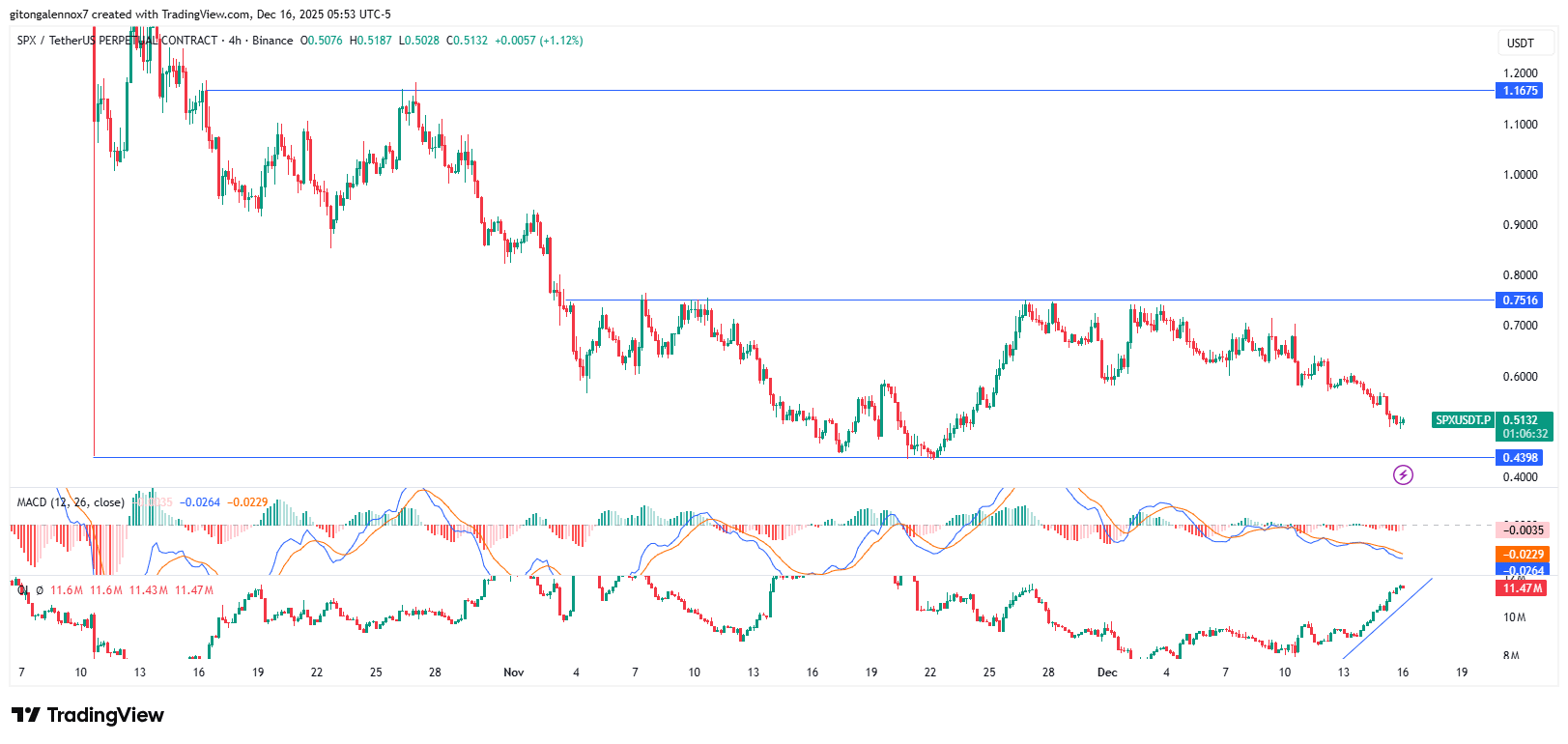

The GBP/JPY cross meets with some supply following an intraday uptick to the 208.00 neighborhood on Wednesday in reaction to softer UK inflation figures. Spot prices drop to a fresh daily low, around the 207.30 area during the early European session and for now, seem to have stalled the previous day’s recovery move from an over one-week low.

The UK Office for National Statistics (ONS) reported that the headline Consumer Price Index (CPI) rose 3.2% over the year in November, marking a notable slowdown from 3.6% in October and missing expectations for a reading of 3.5%. Adding to this, the core gauge, which excludes volatile food and energy items, climbed 3.2% YoY during the reported month, compared to consensus estimates and October’s 3.4% print. The data reaffirms market bets that the Bank of England (BoE) will cut interest rates on Thursday, which, in turn, weighs on the British Pound (GBP) and exerts some downward pressure on the GBP/JPY cross.

The Japanese Yen’s (JPY) relative outperformance could further be attributed to the growing acceptance of an imminent rate hike by the Bank of Japan (BoJ) at the end of a two-day policy meeting on Friday. The bets were lifted by BoJ Governor Kazuo Ueda’s comments last week, saying that the likelihood of the central bank’s baseline economic and price outlook materialising had been gradually increasing. Ueda added that the BoJ is getting closer to attaining its inflation target, backing the case for further policy normalization. Apart from this, a weaker tone around the equity markets is seen as another factor benefiting the safe-haven JPY.

The aforementioned fundamental backdrop suggests that the path of least resistance for the GBP/JPY cross is to the downside. Traders, however, might refrain from placing aggressive bets and opt to wait on the sidelines ahead of the key central bank event risks – the BoE rate decision on Thursday and the latest BoJ policy update on Friday. The latter will play a key role in influencing the near-term JPY price dynamics amid concerns about Japan’s deteriorating fiscal condition on the back of Prime Minister Sanae Takaichi’s massive spending plan and help in determining the next leg of a directional move for the currency pair.

Economic Indicator

Consumer Price Index (YoY)

The United Kingdom (UK) Consumer Price Index (CPI), released by the Office for National Statistics on a monthly basis, is a measure of consumer price inflation – the rate at which the prices of goods and services bought by households rise or fall – produced to international standards. It is the inflation measure used in the government’s target. The YoY reading compares prices in the reference month to a year earlier. Generally, a high reading is seen as bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Post Comment