GBP/USD Locked in a High-Stakes Showdown: Will the BoE Move Trigger the Next Market Avalanche?

Ever wonder what it feels like when a currency pair’s on the edge, testing a crucial resistance level, while the entire market holds its breath? That’s exactly where GBP/USD finds itself right now—rallying above 1.3350 after a solid push on Wednesday, but teetering as investors wait in the wings for the Bank of England’s next move. The dollar’s got a bit of a black eye lately, thanks to a fresh round of tariff threats from President Trump, stirring jitters about the US economy and nudging the pound into a bullish spotlight. Yet, with the BoE set to possibly slash rates—maybe even more aggressively than expected—the question buzzing around is, will the pound hold its ground, or buckle under the weight of shifting policy signals? In the high-stakes game of forex, that split-second decision from the Monetary Policy Committee could make all the difference from gains to gutsy losses. Ready to dive deeper? LEARN MORE.

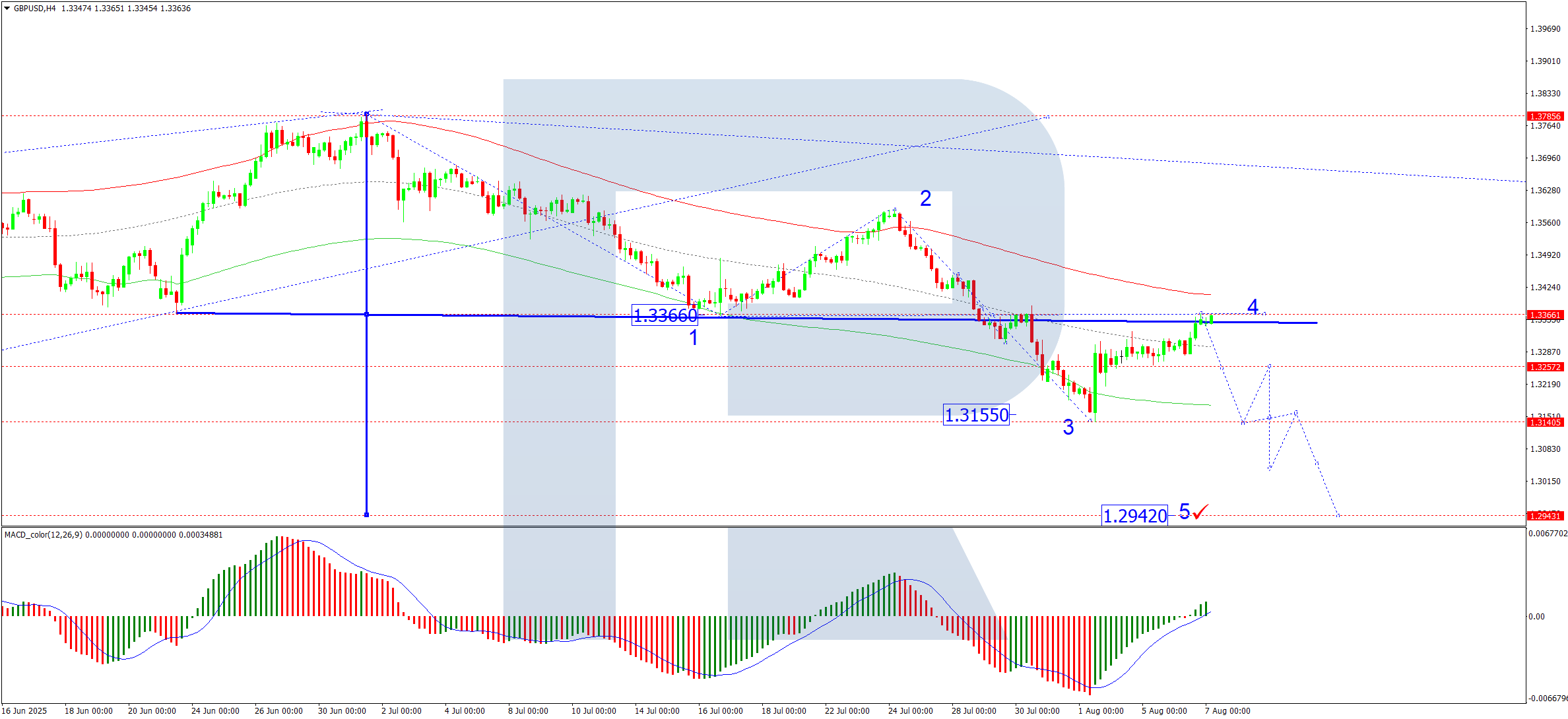

GBP/USD Forecast: Pound Sterling tests key resistance, eyes on BoE

GBP/USD holds its ground and trades above 1.3350 after posting strong gains on Wednesday. Investors stay on the sidelines while waiting for the Bank of England (BoE) to announce monetary policy decisions.

The renewed selling pressure surrounding the US Dollar (USD) allowed GBP/USD to gather bullish momentum on Wednesday. US President Donald Trump’s renewed tariff threats revived concerns over the US economic outlook and weighed on the USD. Read more…

Pound under pressure ahead of Bank of England meeting

The GBP/USD pair climbed to 1.3355 on Thursday as markets braced for today’s Bank of England (BoE) meeting. Traders are closely watching two key factors: the voting split among Monetary Policy Committee (MPC) members and any signals regarding future rate moves.

The central bank is widely expected to cut interest rates by 25 basis points (bps) to 4.00%. However, there is speculation that some members, such as Swati Dingra or Alan Taylor, could push for a more aggressive 50 bps reduction, as seen in May. Should this occur, particularly if accompanied by a shift away from the BoE’s usual cautious tone, the pound could come under significant selling pressure. Read more…

Post Comment