GBP’s Fake CPI Bounce: What Scotiabank Isn’t Telling You That Could Cost Big Bucks—Are You Ready to Play or Get Played?

Ever wonder when a currency’s mood swings start to resemble your Monday mornings? That’s exactly where the Pound Sterling (GBP) finds itself — teetering just above its late June low, trying hard not to spiral into a full-blown nosedive. Think of it like a tightrope walker with a breath held, where one slip could shatter the bullish vibe that’s been hanging on since mid-January. Scotiabank’s sharp minds, Shaun Osborne and Eric Theoret, are sounding alarms as the market buzzes about potential Bank of England (BoE) rate cuts, fueled by a hotter-than-expected UK CPI report. It’s a jigsaw puzzle of fading rate cut hopes and technical signs hinting at bearish tides, leaving traders and investors alike biting their nails. Can the pound hold its ground, or are we staring at a trend flip that might shake up everything we thought was solid? Dive deeper into the twists and turns shaping the GBP’s outlook and why Andrew Bailey’s BoE could be the puppet master pulling the strings. LEARN MORE

The Pound Sterling (GBP) is also steady and attempting stabilization following a recent run of weakness, holding on just above its late June low – a break of which would call for a shift in the bull trend, Scotiabank’s Chief FX Strategists Shaun Osborne and Eric Theoret report.

Markets remain focused on BoE cuts

“The UK CPI release came in higher than expected on both headline (3.6% y/y vs. 3.4% y/y prev. & exp.) and core (3.7% y/y vs. 3.5% y/y prev. & exp.), offering the pound a short-lived pop. Short-term rates markets have seen a marginal fade in expectations for BoE easing however the market continues to price nearly one full 25bpt cut for the next August meeting and a cumulative 50bpts of easing by year-end.”

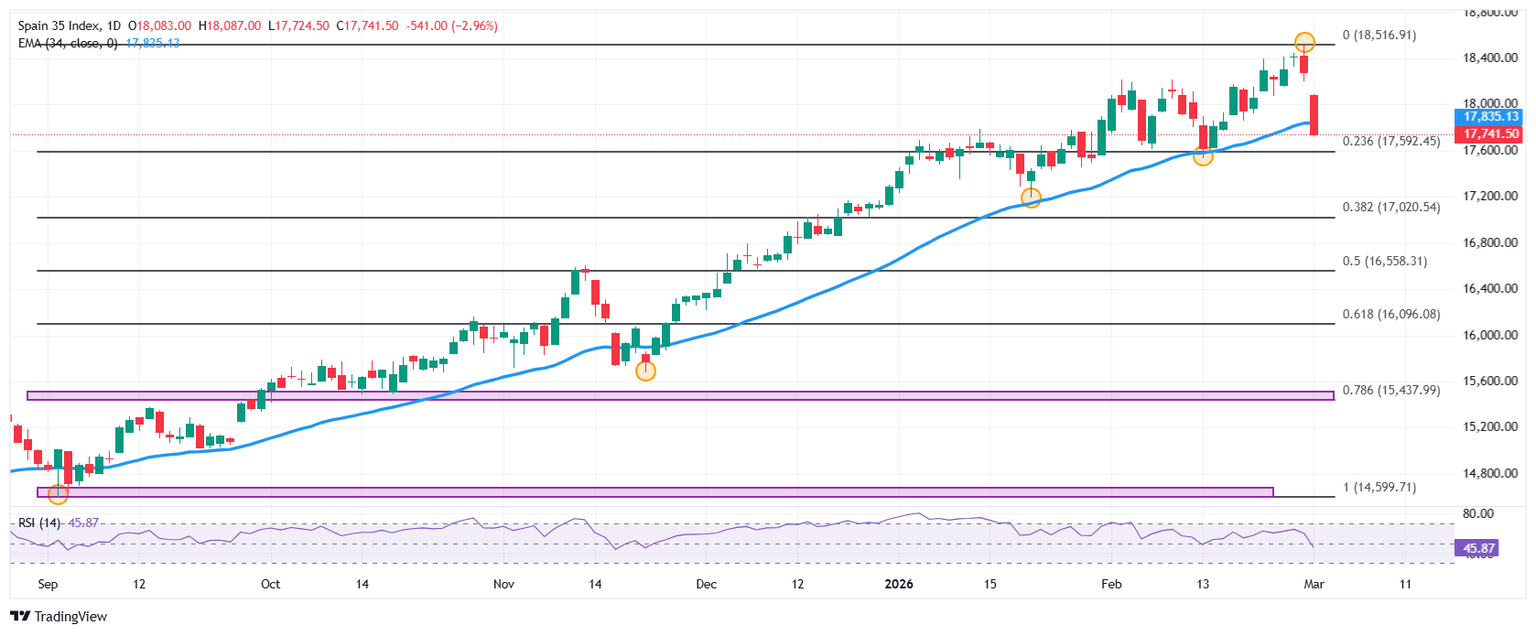

“The RSI has drifted into bearish territory and is now hovering just above the oversold threshold at 30. The recent pullback has been swift, breaking below the 50 day MA (1.3501) that we had seen as offering medium-term support. The June 23 low (1.3371) is a critical near-term support level and its break would violate the bullish trend that we’ve observed since mid-January.”

Post Comment