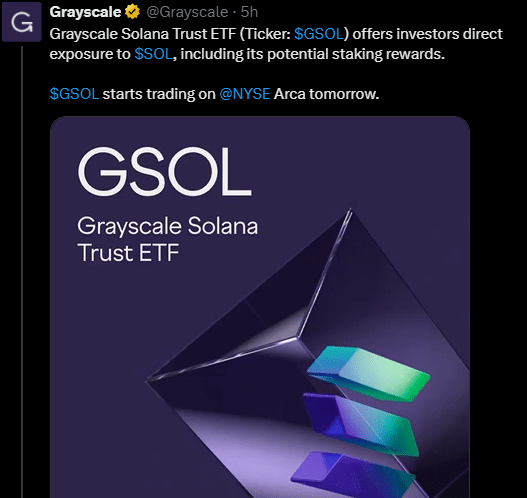

Grayscale’s Solana ETF Launch: Is This the Hidden Catalyst That Could Send SOL Prices Soaring?

So, Grayscale is about to shake things up again with the launch of its U.S.-based Spot Solana (SOL) ETF, following closely on the heels of Bitwise’s similar move. Now, here’s the million-dollar question: will this shiny new ETF debut spark a wave of outflows, or could it actually usher in a tidal wave of fresh money? The market’s mixed signals don’t make it any easier to call — but the mood, at least in the mid-term, leans from neutral right up into cautiously bullish territory. Bloomberg analysts are throwing out some serious projections, expecting over $3 billion in inflows within the next 12 months. And hey, with staking rewards included and a solid four-year trust history backing GSOL, this launch is definitely something worth watching. Yet, despite the buzz, SOL’s price dipped a bit post-launch — a “sell-the-news” vibe lingering like a shadow from past ETF rollouts. Still, it seems some savvy traders are hedging bets on a mid-term rebound… curious to see if their instincts pay off? This could be one ETF debut that keeps investors and analysts talking well into November and beyond. LEARN MORE

Key Takeaways

Will Grayscale SOL ETF’s debut trigger outflows?

It was unclear, but market sentiment was neutral to bullish in the mid-term.

What are analysts’ projections for SOL ETFs?

Bloomberg analysts expect over USD 3 billion in inflows within 12 months.

Grayscale is scheduled to launch its U.S.-based Spot Solana [SOL] ETF (exchange-traded fund), a day after Bitwise made a similar move.

The New York Stock Exchange (NYSE) signed off and certified Grayscale’s product (GSOL), effectively allowing it to begin trading on the 29th of October. In fact, the digital asset manager confirmed the launch, adding that the GSOL would include staking rewards.

Worth noting that the GSOL will be converted into an ETF. However, it has been in operation for four years as Grayscale Solana Trust.

As of writing, the Trust had 525,387 SOL, translating to $102.6 million in assets under management (AUM). About 75% of the stash is staked.

What’s next for SOL price?

The Bitwise SOL ETF (BSOL) raked in $56 million in day-one trading volume and $69.5 million in Daily Net Inflow.

In terms of volume, Bitwise’s BSOL debut performance was an outlier this year, noted Bloomberg ETF Analyst Eric Balchunas.

Reacting to Grayscale’s launch, Balchunas added,

“This is tough. That one day is pretty big. But I guess being 2nd isn’t too bad. The other issuers prob pretty pissed.”

For his part, another Bloomberg ETF Analyst, James Seyffart, estimated that SOL ETFs could haul $3 billion in cumulative inflows in a year. He said,

“Solana’s market cap is 5% of Bitcoin’s and 22% of Ethereum. If they keep up with the flows we’ve seen for ETH and BTC ETFs on a relative basis, that would equate to like $3+ billion in flows over the first 12 to 18 months.”

Market reaction and trader sentiment

But SOL’s price slipped from $200 to $190 despite the incredible debut and the lined-up ETFs.

Well, past crypto ETF debuts were met with “sell-the-news” vibes. And most of the outflows came from Grayscale products.

Hence, the Grayscale launch will be incredible to track and the potential impact on SOL’s price in the short term.

Even so, the Options market data signalled a neutral-to-bullish sentiment in the mid-term.

As illustrated by the 25-Delta Risk Reversal (25RR), the upcoming Option expiries had a 0.86 (neutral) to 3-6 (bullish) readings per the indicator. It meant traders were paying more for upside protection in November.

Put differently, despite the muted SOL price action, some speculators were betting on a potential strong recovery from November.

Post Comment