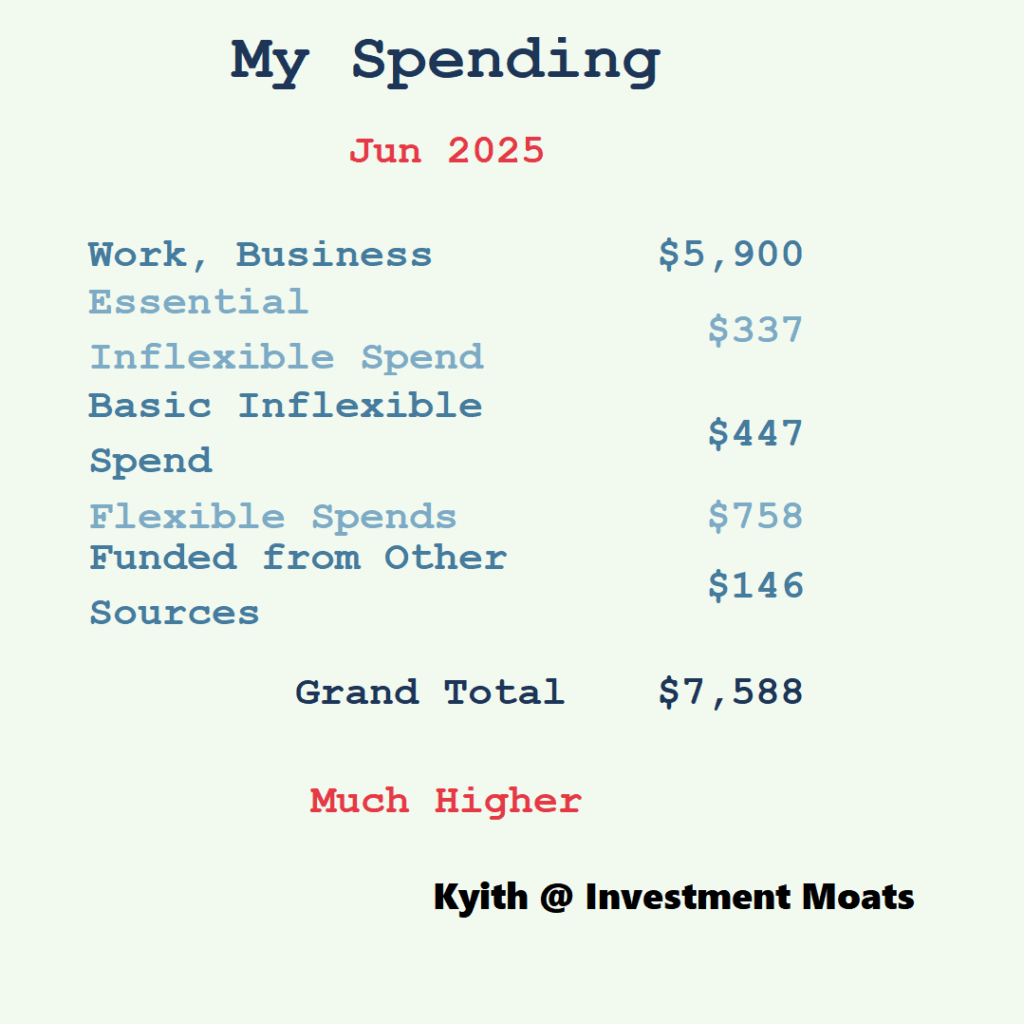

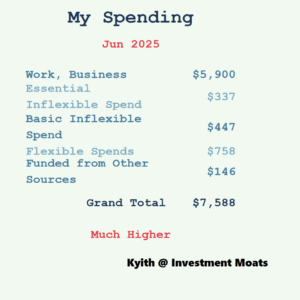

How I Blew $7,588 in June 2025—And Why It Might Be the Smartest Move I’ve Ever Made

You will be able to tune in to a spending profile of someone who is single, older, a fully paid up home. If you spend more than this, then you can ponder why is that and what you think about it. If you spend less than this, then you can ponder why and what do you think about it.

I group my spending based around a few technical grouping:

- Flexible or Inflexible: There are some spending that we can be more flexible with. The spending tends to fluctuate over time. There are some spending that is more inflexible. The impact of this is felt more if you are retrench from work, wish to take a hard pivot in your life or career, planning for financial security or future retirement. A more inflexible spending would require your planned income stream to be more conservative while you can take some more risk if you have flexibility in your spending.

- Finite or Ongoing: There are some spending that will stop at some point but there are some spending that we don’t see it stopping objectively. Finite spending are insurance premiums, mortgage, allowance for kids, allowance for parents etc. Ongoing spending is a certain kind of transport spending.

- Role or Responsibility: What am I currently? Am I a worker? A husband? Or a Son? Some of the spending are group this way so that we are able to see just how much we are spending on something. Some of these responsibility will go away. For example, you spend on some travels, clothes, pay income tax because you are a worker. But if you are planning for a non-working phase of life, would you wish to know how much that you spend today can be peeled away.

In a way, this works for me because I always have an eye from the Financial Independence planning perspective. You might not, and you have your own reasons.

Post Comment