How I Turned a Routine Colonoscopy Into a Medical Claims Goldmine (And How You Can, Too)

Ever felt like navigating health insurance claims is like decoding an ancient scroll? Well, buckle up, because that’s exactly the wild journey I took after my recent colonoscopy at Singapore General Hospital’s private route. I shelled out a hefty $2,137 from my own pocket—part Medisave, part cold hard cash—and thought, “Hey, maybe I should claim that little $177 pre-hospitalization consultation cost too.” Turns out, the devil’s in the deductible details, the co-insurance quirks, and a good sprinkle of patience (big shoutout to my colleague Jiamin for chasing down the claim for me!). If you think health insurance is just about “pay and forget,” think again—it’s a strategic game of navigating rules, submissions, and waiting for those sweet reimbursements that add up… kind of like counting chicken portions in a meal prep plan. Intrigued about how the claim process unfolded and how you might get more back from your healthcare spend? Stick around, it’s gonna get interesting. LEARN MORE

img#mv-trellis-img-1::before{padding-top:76.636713735558%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:120.18779342723%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:51.213282247765%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:121.51442307692%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:52.487562189055%; }img#mv-trellis-img-5{display:block;}img#mv-trellis-img-6::before{padding-top:177.16262975779%; }img#mv-trellis-img-6{display:block;}

Readers of Investment Moats would remember I recently shared about my colonoscopy experience so that you would not feel so apprehensive to go for one yourself. You can read about it here:

I Did My Colonoscopy Going the Private Route of Singapore General Hospital. Full Experience Here.

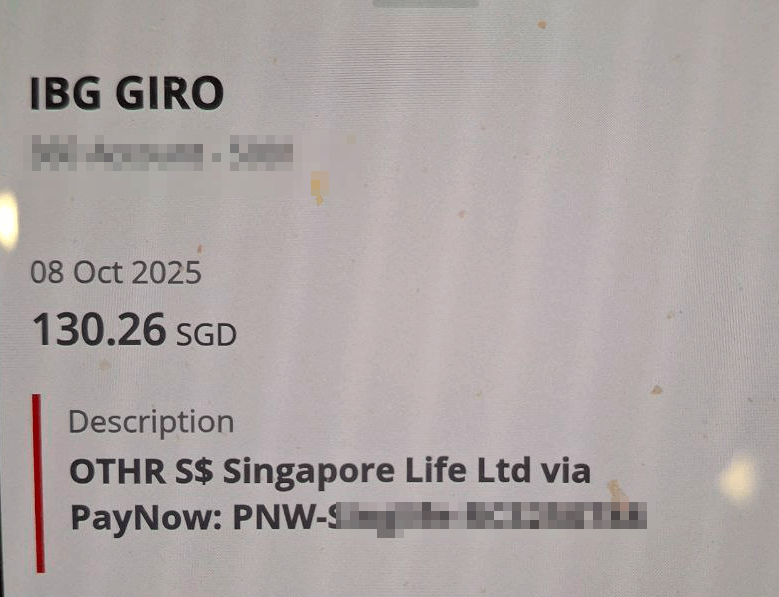

In the write up, I mentioned that I had to pay the whole experience of $2,137 with my own money. $1,249 came from my Medisave and $888 from cash.

The one good thing about working in Providend/Havend is that I can always check with my colleague Jiamin regarding these stuff.

I thought whether I go over the deductible or not, I should submit my pre-hospitalization consultation cost of $177 (which is included in that $2,137 above) as a claim submission.

Well, I got $130 in claims reimbursement! Small amount which is almost equivalent to six months of the chicken cost in my meal prep.

So a quick recap:

- I have a Tier 1 shield plan which should allow me to claim for private hospitalization

- I have a rider that only covers the co-insurance. This means that I have to pay for the deductible.

This was what was automatically e-filed, or automatically submitted by the hospital:

You can find the reference to the deductible in this MOH article here.

So mine would fall under Class B2 and above. Strangely I thought it would be under Day Surgery but I think the deductible limit here is $2,000 and because I only submitted a claim of $1,960, that is $40 below the deductible.

So I had to pay everything myself.

My colleague Jiamin help me submit the pre-hospitalization claim.

The evaluation from Singlife really took a while and I thank Jiamin for chasing it for me.

So let us look at the outcome of this new claim submission:

We are claiming under a pre-hospital treatment, which allows you to claim these consultation and visit costs that take place 180 days prior to treatment.

So now the total accumulated yearly submission is about $2,137, which is now above the deductible. The last submission was $1,960, and you can see here it accounts for the $40 that would make my total yearly submission go over $2,000.

So out of the $177.12, after the $40, we will evaluate the $137.12 for co-insurance.

The Singlife MyShield would pay for most of this but the patient (me) have to pay 10% of the co-insurance:

- 90%: $137 x 90% = $123.3 <— MyShield pays.

- 10%: $137 x 10% = $13.71 <— Kyith have to pay.

But since my rider, Singlife Health Plus, it allows me to offset the co-insurance.

The next section of the bill provides a break down:

Since the $13.71 comes up to be 10% of the amount that I have to pay, 50% of it is borne by Singlife Health Plus ($6.85).

So Singlife will reimburse me $123.3 + $6.85.

My Colleague Jiamin will Share About Claiming in an Upcoming Webinar.

If all of this sounds very challenging, confusing to you, then maybe you want to tune in to our upcoming webinars.

Its called Making Sense of Integrated Shield Plan Claims.

Jiamin will be going through the stuff about claims that might be pretty confusing to you.

The webinar is on Thursday, 23 October 2025 at 7.30 pm.

I should be tuning in.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment