How This $1.5 Million Daedalus Income Portfolio Defied Market Chaos in July 2025—And What That Means for Your Wallet

Ever wondered what it takes to build a portfolio resilient enough to weather not just the usual market turbulence but also the financial storms of history—from the Great Depression to prolonged periods of high inflation? Well, that’s exactly the kind of fortress I’ve been constructing with my Daedalus portfolio, updated for July 2025. This isn’t just about numbers rising and falling; it’s about a carefully crafted strategy aimed at generating steady, inflation-adjusted income to cover the essentials for life—and potentially, forever. If you’ve ever questioned how much peace of mind comes from an investment approach that prioritizes long-term sustainability over flashy gains, this update will hit home. Curious how I balance strategic, systematic, low-cost, and passive management while navigating a market that keeps tossing new surprises our way? Let’s dive in and unravel the current state of the portfolio, its holdings, and the principles behind its design.

img#mv-trellis-img-1::before{padding-top:67.48046875%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:25.9765625%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:64.84375%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:125.18050541516%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:71.983805668016%; }img#mv-trellis-img-5{display:block;}img#mv-trellis-img-6::before{padding-top:64.6484375%; }img#mv-trellis-img-6{display:block;}img#mv-trellis-img-7::before{padding-top:63.801261829653%; }img#mv-trellis-img-7{display:block;}img#mv-trellis-img-8::before{padding-top:74.600638977636%; }img#mv-trellis-img-8{display:block;}

Here is the update for my Daedalus portfolio for July 2025. If work is not too busy, I will try to provide an update where possible.

I explain how I constructed this portfolio in Deconstructing Daedalus Income Portfolio and Why I Currently Invest in These Funds for Daedalus. You might not understand what I wrote below if you haven’t read this post.

All my personal planning notes such as income planning, insurance planning, investment & portfolio construction will be under my personal notes section of this blog. You can also find the past updates in the section.

Portfolio Change Since Last Update

The portfolio was valued at $1.476 million at the end of June and is at $1.526 million at the end of July.

We reported a portfolio change of $50,000 for July 2025.

The portfolio is valued in SGD because that is the currency that I would most likely be spending on.

As of 7th August 2025, the portfolio is valued at $1.511 million.

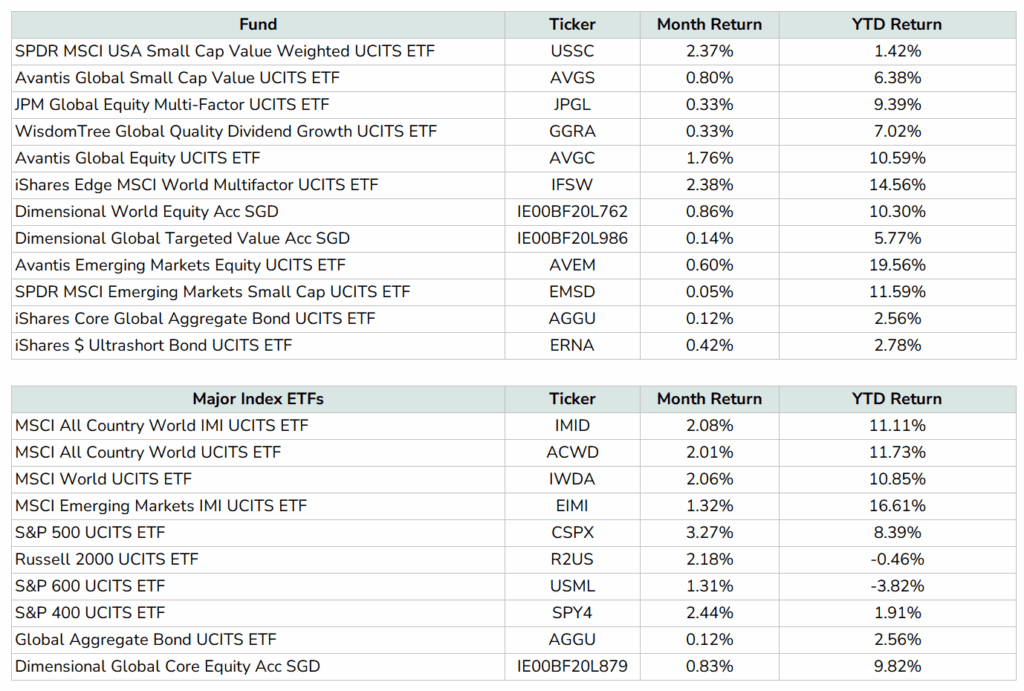

Here are the primary security holding returns for the month-to-date and year-to-date:

The table that shows the fund holdings denotes the month-to-date and year-to-date performance of the funds that I own, against Major Index ETFs. The Major Index ETFs is present to compare the performance. Just to be clear, I do not own the major index ETFs and you should see the top table as what I own.

The returns of all funds are in USD. This includes the performance of the Dimensional funds, which I use the returns of the USD share class so that the returns are comparable. I have also listed the major index ETF performance for comparison.

The market continues to digest and reprice whatever that is in the news.

If you look at the bottom table (Major Index ETFs):

- US Equities, particularly lead by Broadcom, Nvidia and Microsoft recovered the highest. The S&P 500 is still lagging the market this year.

- IFSW and AVGC show better performance compare to JPGL and GGRA due to their exposure to what is working (which is mention in #1). It has been a good year and a half for IFSW, which I happen to have the least exposure to.

- The two small caps fund did well relative to the Russell 2000 and S&P 600. AVGS did not do so well this month because of the strengthening USD. 1/3 of the fund is in International Value which tends to do better when USD is weaker.

- The global aggregate bonds continue to trend higher, though after factoring the weaker USD, it should be negative this year. The role of the bonds is to have positive expected return in the long run, and also to cushion the portfolio volatility. It is also to have more humility in the portfolio.

The portfolio gain 2.11% due to the strengthening USD against the SGD. YTD the portfolio lost 5.66% just from currency alone.

Role of Portfolio

The goal of the portfolio is to generate steady, inflation-adjusted income to cover my essential living expenses. It’s built using a conservative initial withdrawal rate of 2.0–2.5%, which is designed to hold up even under extremely tough market conditions — including scenarios like the Great Depression, prolonged periods of high inflation (averaging 5.5–6% over 30 years), or major global conflicts. In other words, it’s stress-tested to withstand some of the worst financial environments in history.

The income needs to last: from today (age 45) for the rest of your life — potentially forever.

I am currently not drawing down the portfolio.

For further reading on:

- My notes regarding my essential spending.

- My notes regarding my basic spending.

- My elaboration of the Safe Withdrawal Rate: Article | YouTube Video

Based on current portfolio value, the amount of monthly passive income that can be conservatively generated from the portfolio is

The lower the SWR, the more capital is needed, but the more resilient the income stream is.

Nature of the Income I Planned for

Generally, different income strategies produce different types of income streams. They can vary by:

- Consistency: Some provide steady income, others fluctuate over time

- Inflation Protection: Some adjust with inflation, others remain fixed

- Duration: Some last for a set number of years, others are designed to last indefinitely (perpetual)

An income stream based on the Safe Withdrawal Rate framework is consistent and inflation-adjusted, and if we use a low initial Safe Withdrawal Rate of 2.0-2.5%, the income stream leans towards a long duration to perpetual.

Here is a visual illustration of how the income stream will be based on the current portfolio value:

The income for the initial year is based on a 2% Safe Withdrawal Rate. The income for subsequent years is based on the inflation rate in the prior year (refer to the bottom pane of inflation in the previous year). If the inflation is high, the income scales up and if there is deflation, the income is reduced.

Investment Strategy & Philosophy

After trying my best to learn how to invest for a while, the portfolio expresses my thoughts about investing at this point.

The portfolio is run in a

- Strategic: allocation doesn’t change by short-term events.

- Systematic: rules/decision-tree-based implemented either myself or an external manager.

- Low-cost: investment implementation cost is kept reasonably low both on the fund level and also on the custodian level.

- Passive: I spend relatively little effort mentally considering investments and also action-wise.

You can read more in this note article: Deconstructing Daedalus My Passive Income Investment Portfolio for My Essential & Basic Spending.

Portfolio Change Since Last Update (Usually Last Month)

There are no change to the portfolio in July 2025.

Current Holdings – By Dollar Value and Percentages

The following table is grouped based on general strategy, whether they are:

- Fixed Income / Cash to reduce volatility.

- Systematic Passive, which tries to capture the market risk in a systematic manner.

- Systematic Active, which tries to capture various proven risk premiums such as value, momentum, quality, high profitability, and size in a systematic manner.

- Long-term sectorial positions.

Portfolio by Account Source Location

Portfolio by Region Exposure of Securities

Portfolio by Fund, Cash or Individual Security

Portfolio by Strategy.

What Systematic Active Means: Funds that help me execute passively very specific, repeatable underlying securities selection on an ongoing basis. Here are some examples of the systematic active strategies in my portfolio:

- Global Multifactor: From a basket of 1,600 developed market large and mid-cap stocks, rank the stocks by their value, by their 12-month momentum, by their degree of ROE and debt to asset, and then own the top 300. Do this every half-yearly or quarterly. You end up with a strategy that consistently owns 300 companies that are cheaper, quality and have greater momentum relative to a market cap weighted index.

- Small Cap Value: From a basket of 3,000 developed market small cap stocks, rank the stocks based on price-to-book value (include intangibles in the book value). Also rank the stocks by operating earnings minus interest divide by book value. Eliminate the companies with low profitability. What we end up is two group of small cap stocks: The more profitable small caps but not too expensive, and the small caps stocks that are at least profitable but are very cheap. Own the top 30-35% of this cohort consistently. Have a manager that consistently helps me execute this.

The Main Custodians for the Securities in this Portfolio

The current custodians are:

- Cash: Interactive Brokers LLC (not SG)

- SRS: iFAST Financial

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment