Inside the $1.5M Daedalus Income Portfolio: What June 2025 Reveals That Could Change Your Investment Playbook Forever

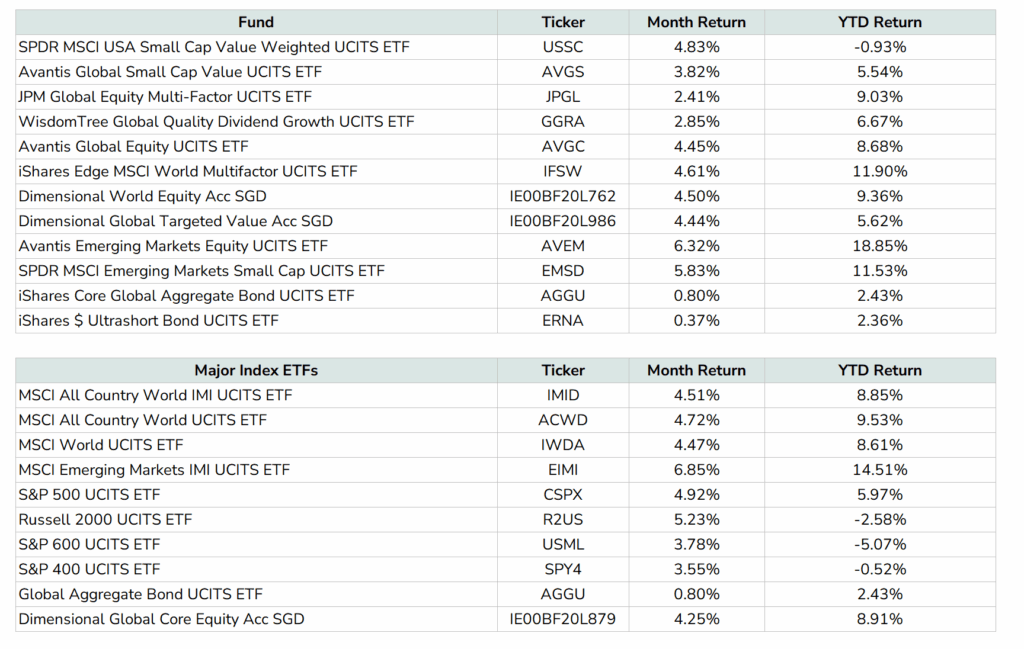

The returns of all funds are in USD. This includes the performance of the Dimensional funds, which I use the returns of the USD share class so that the returns are comparable. I have also listed the major index ETF performance for comparison.

The market continues to digest and reprice whatever that is in the news.

If you look at the bottom table (Major Index ETFs):

- Emerging markets did the best of 6.8% after doing 4.8% last month. Their performance this year has been the best.

- The small caps globally pulled down the All Country World IMI results relative to the index without IMI.

- The smaller size and cheaper companies is not helping the Global Core Equity.

- The difference between the Russell 2000 and S&P 600 is probably healthcare and technology. Small cap technology have been doing better and we can see the better performance of the Russell 2000 compare to the S&P 600.

- Avantis Global Small Cap Value, Dimensional Global Targeted Value continues to do better than the Russell 2000, S&P 600, SPDR MSCI USA Small Cap Value Weighted due to the weaker USD, and monetary conditions easing in the international markets. Although we are observing better performance this month from USSC.

- JPGL, IFSW, AVGC, Dimensional Global Core Equity (which I don’t own in this portfolio) falls within the realm of MSCI World. You can review the performance of these funds against the MSCI World Index. AVGC and Global Core Equity are more levered to the profitability factor, which kind of help them keep up with the MSCI World Index performance, which has become pretty high in the profitability factor. IFSW is a different beast. They have change their methodology (which I should write about in the future). I have the least allocation to IFSW but it has been the best performer these two years.

- Emerging market small cap is not doing as well as international small cap but definitely doing much better than US small caps. They enjoy both the tailwind of correction from the low and USD weakness.

- Despite interest yield remaining high, the Global Aggregate bond continues to earn the coupon returns of the underlying.

The portfolio lost 1.52% due to the weakening USD against the SGD. YTD the portfolio lost 6.85% just from currency alone.

Post Comment