Interactive Brokers Singapore Just Dropped IBKR Lite – Could This Be the Game-Changer Your Portfolio’s Been Waiting For?

Ever wondered why a broker that thrived during the Great Financial Crisis could be your new secret weapon in the wild world of investing? Enter Interactive Brokers — my absolute go-to platform where I keep a cool S$1.5 million tucked away safely in the Daedalus Income portfolio across their US and Singapore arms. Now, here’s the kicker: for the longest time, the coveted commission-free IBKR Lite was just a US playground. But guess what? They finally flipped the script for Singapore investors too! Imagine blending rock-bottom commissions, near-spot currency conversion, and access to a universe of markets, all while skipping the dreaded fee traps. Sounds like a dream, right? Well, buckle up as we dive into how switching to IBKR Lite could shake up your investing game — but with a few twists you gotta know first. Ready to flip the switch? LEARN MORE

img#mv-trellis-img-1::before{padding-top:67.87109375%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:106.88935281837%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:222.12581344902%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:222.12581344902%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:222.12581344902%; }img#mv-trellis-img-5{display:block;}img#mv-trellis-img-6::before{padding-top:222.12581344902%; }img#mv-trellis-img-6{display:block;}img#mv-trellis-img-7::before{padding-top:222.12581344902%; }img#mv-trellis-img-7{display:block;}img#mv-trellis-img-8::before{padding-top:48.92578125%; }img#mv-trellis-img-8{display:block;}

Many readers here would have heard of Interactive Brokers.

They are my go to broker. It is where I hold my S$1.5 million Daedalus Income portfolio as my custodian. I hold the portfolio under an Interactive Brokers LLC, which is the US part of Interactive Brokers. Aside from that Crystalys, my other portfolio is in Interactive Brokers Singapore.

If you are looking for a trusted broker, with competitive low commissions, very very cheap currency conversion at spot, access to the most number of foreign markets, have operated for a number of years, thrived during the Great Financial Crisis instead of suffered, that focus on their technology pipping to keep things efficient, you might want to give Interactive Brokers a try today (at the link above or here)

Some of you did the research on Interactive Brokers and know that there is a commission-free tier call IBKR Lite. You ask if Lite is available for Singaporean investors or the account under Interactive Brokers Singapore.

Lite was only for US people for a long while, which means it was not available for Singapore traders.

But now… Interactive Brokers have made IBKR Lite available for the accounts under Interactive Brokers Singapore!

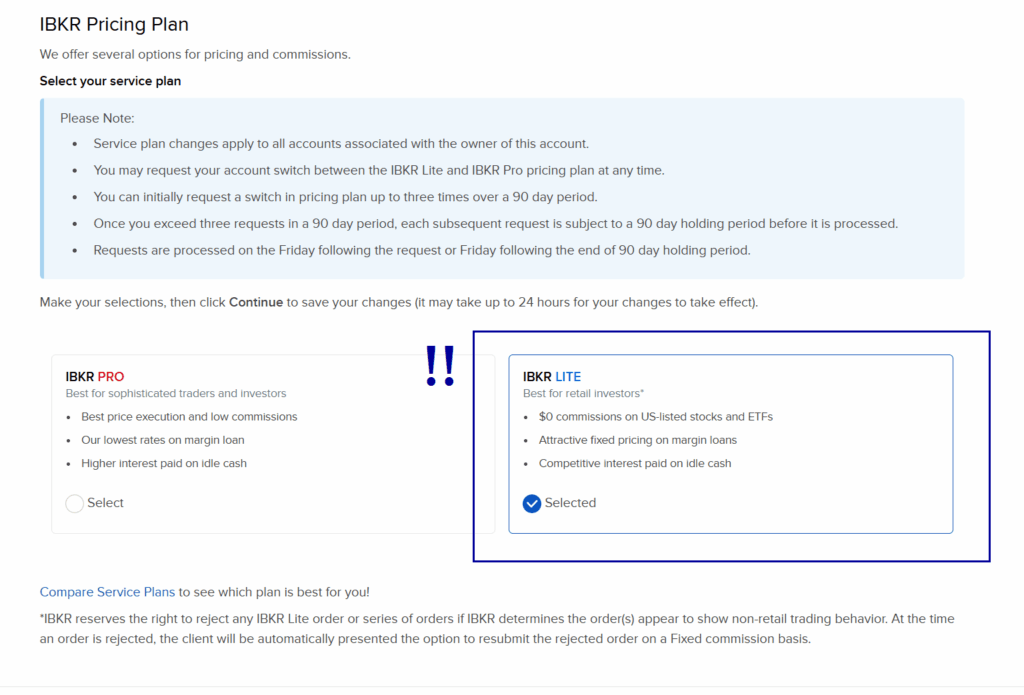

If you go to the account settings, you would see the following:

That means if you are on IBKR Pro, you can switch to IBKR Lite.

It looked very different a day ago, when the IBKR Lite shows a coming soon. So I guess it is live!

Let me talk more about it.

Not Available if Your Account is an Interactive Brokers LLC Account.

I went in to my Interactive Brokers LLC account, and realize that IBKR Lite is not available to me.

So those of you who are still on LLC account should take note.

I don’t think this is a major downer because there are pros and cons of IBKR Lite.

A Difference if You are A More US-Focused Investor.

I was wondering how having free commission will affect me.

IBKR came up with the following clear comparison:

Here are some foot notes:

- IBKR Lite is meant for retail investors. IBKR reserves the right to reject any IBKR Lite order or series of orders if IBKR determines the order(s) appear to show non-retail trading behavior. At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order on a Fixed commission basis. For more information, see IBKR Lite Disclaimers

- Accounts with a NAV of less than USD 100,000 (or equivalent) will be paid at a rate proportional to accounts with a NAV of USD 100,000 (or equivalent) or more. The proportion is determined by the ratio of the account’s NAV to USD 100,000 (or equivalent). This does not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. Please note that the interest paid for IBKR Lite is lower than IBKR Pro. See our Interest Rates for details.

- See our Margin Rates for details.

- IBKR Lite is available to Singapore retail investors who hold individual, joint, or trust accounts. These accounts can be cash or margin.

- Standalone trust accounts with legal entity trustees are not eligible for IBKR Lite

- Regular trading hours for IBKR Lite and IBKR Pro are 09:30 ET – 16:00 ET.

- At the end of each month, IBKR will review your total monthly trading volume of US listed stock and ETF orders. If the combined volume of Overnight Trading Hours (20:00 – 04:00 New York City time) trades or sub-USD 1.00 NMS stock trades exceeds 10% of an account’s monthly US stock trading volume, a commission of the lesser of USD 0.005 per share or 1% of trade value will be charged.

You can check out the full page here.

You will get commission-free trading for only US-Exchange listed stocks and ETFs.

But there is a whole group of disadvantages.

If you are like me with most of my money in UCITS Exchange Traded Funds (as can be seen on Daedalus) then this affect me less. In fact, you are restricted to Fixed Pricing instead of having Tiered or Fixed Pricing on IBKR Pro for other stocks (read most of my ETFs on European exchanges, including Singapore), options and futures.

For IBKR Pro users, the difference between Tiered and Fixed pricing mainly comes down to how commissions are charged and whether exchange/clearing/rebate costs are passed through to you. I am currently on IBKR Pro Tiered, and you can change from Fixed (which is the default) to Tiered with the same instructions as how to switch to IBKR Lite below.

I will provide more info of Tiered vs Fixed later, so as not to take this too far.

Aside from the commission limitation for non-US securities, other limitations is

- lower interest rate on your cash,

- higher cost on your margin,

- higher AutoFx Conversion rate (0.09% vs 0.03%). AutoFx happens when you buy or sell a security in a foreign currency (e.g., buying a USD-denominated ETF when your base currency is SGD), IBKR will Automatically convert the needed amount from your base currency into the trade currency. Do this at the spot FX rate plus IBKR’s small FX commission. This ensures the trade settles without leaving a negative balance in the foreign currency, and

- not have access to API

This is how IB choose to differentiate their services.

Would I Switch over to IBKR Lite?

If you can tell, this affects an investor like me less. I am definitely not unhappy that I don’t have this on IBKR LLC because that is where Daedalus Income Portfolio is customized.

Even for Crystalys (my other portfolio that is on IBKR Singapore), this matter less because the US commission is already so cheap. I am very satisfied even on IBKR Pro, especially coming from a traditional broker.

If you would like to try, here are the instructions.

You can Switch Between IBKR Pro and IBKR Lite 3 Times within a 90-day Period.

If you failed to see the blue part of the screen capture this is what it says:

Please Note:

- Service plan changes apply to all accounts associated with the owner of this account.

- You may request your account switch between the IBKR Lite and IBKR Pro pricing plan at any time.

- You can initially request a switch in pricing plan up to three times over a 90 day period.

- Once you exceed three requests in a 90 day period, each subsequent request is subject to a 90 day holding period before it is processed.

- Requests are processed on the Friday following the request or Friday following the end of 90 day holding period.

The first statement means all associated with the account is affected. Currently, I have two accounts under IBKR one with IBKR LLC and one with IBKR Singapore. Only the IBKR Singapore one is affected but I suspect if you have created sub-accounts under IBKR Singapore, this account switch is affected.

The change request is not immediate and process only on the Friday or if you have done it 3 times within the 90-days, the Friday of the new 90-day window.

Interactive Brokers allow you to try to see which suits you.

How to Switch Your IBKR Pro Tier or Fixed Pricing to IBKR Lite

To change your IBKR Plan from Pro Tier or Fixed to IBKR Lite you can do the following.

Since most of you are likely to be on the mobile I am going to give mobile-based instructions. You should be both on Interactive Brokers Mobile or Interactive Brokers Global Trader.

If you are logged in on both platform, then lets started.

If you click on :

- The three slashes on the top left corner of the Mobile app

- The human silhouette on the top left corner of the Global Trader app

It will bring you to the more admin panel. You will see either of the following:

Click on the Settings on whichever platform you are in.

You will see the following panel in both:

Click on Account Settings.

If you are on Interactive Brokers Mobile, you will see another sub-panel.

In that panel, click All Account Settings. (You won’t see this in Global Trader)

In All Account Settings:

You should see the following options:

You can select IBKR Lite.

The request will be put through, on the next Friday, if you still have not exceed the 90-day window.

Bonus: IBKR Pro Fixed Versus Tiered Pricing

Now, some might not know that on IBKR Pro, there are two different pricing schemes. You can switch between the two different schemes.

The difference between Tiered and Fixed pricing mainly comes down to how commissions are charged and whether exchange/clearing/rebate costs are passed through to you.

1. IBKR Fixed Pricing

- Simple “all-in” rate: IBKR charges you a single flat commission per share (for stocks) or per contract (for options), regardless of the exchange/venue used.

- Exchange & clearing fees included: The flat rate already covers IBKR’s commission plus most exchange and clearing fees.

- No exchange rebates: If your order provides liquidity and the exchange would normally pay a rebate, IBKR keeps it — you don’t see it.

- Good for: People who want predictable costs and don’t want to think about exchange-specific fee structures.

2. IBKR Tiered Pricing

- Pass-through of actual exchange/clearing fees/rebates: You pay IBKR’s low base commission plus any actual exchange or clearing costs, and you receive any liquidity rebates.

- Lower base rate: IBKR’s portion is lower than the fixed rate (e.g., $0.0035/share in US), but total cost depends on where and how your order executes.

- Can be cheaper or more expensive:

- If you trade in ways that earn exchange rebates (posting limit orders), you might save money.

- If you remove liquidity (market orders), you might pay more due to taker fees.

- Good for: Active traders, those who use limit orders effectively, or those who want transparency in fee breakdown.

This can be summarized in the table below:

| Feature | Fixed Pricing | Tiered Pricing |

|---|---|---|

| IBKR Commission | Higher, all-inclusive | Lower, but exchange/clearing passed through |

| Exchange Fees Included? | Yes | No (passed through to you) |

| Exchange Rebates Passed? | No | Yes |

| Cost Predictability | High | Lower if you post liquidity, higher if you take |

| Best For | Simplicity, occasional trading | Active traders, cost-sensitive strategies |

Now… the difference depends on which exchange you trade on, and the trade value of your trade.

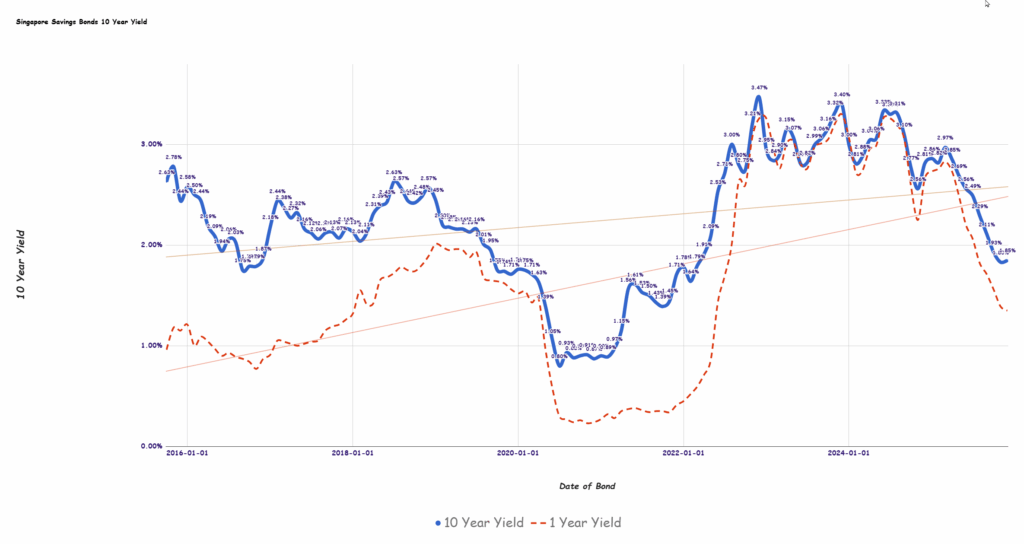

Now since most of my readers are likely on UCITS Exchange Traded funds, that are traded on the London Stock Exchange (LSE), in USD, here is a comparison against various trade value:

IBKR Pro rates for LSE USD:

We’ll assume:

Tiered:

- Commission: 0.05% of trade value (since all examples are well under the first tier threshold of £50 million).

- Min: USD 1.70 per order.

- Max: USD 39 per order.

- Plus ~USD 0.21 external fees per order.

Fixed:

- Commission: 0.05% of trade value.

- Min: USD 1.70 per order.

- Includes external fees (no extra).

It works out to be the following:

| Trade Value | Fixed Pricing (0.05%, incl. fees) | Tiered Pricing (0.05% + $0.21 fees, min/max applied) | Cheaper? |

|---|---|---|---|

| $500 | $1.70 (min) | $1.70 + $0.21 = $1.91 | Fixed |

| $1,000 | $1.70 (min) | $1.70 + $0.21 = $1.91 | Fixed |

| $2,500 | $1.70 (min) | $1.70 + $0.21 = $1.91 | Fixed |

| $5,000 | $2.50 | $2.50 + $0.21 = $2.71 | Fixed |

| $10,000 | $5.00 | $5.00 + $0.21 = $5.21 | Fixed |

| $25,000 | $12.50 | $12.50 + $0.21 = $12.71 | Fixed |

| $50,000 | $25.00 | $25.00 + $0.21 = $25.21 | Fixed |

| $100,000 | $50.00 | Tiered cap: $39.00 + $0.21 = $39.21 | Tiered |

- Fixed pricing wins for trade values under approximately $78,000, due to the added external fees under Tiered.

- Tiered pricing becomes more cost-effective starting around $78k–$80k, because of the $39 Tiered commission cap (plus the fixed ~$0.21 external fees).

- Tiered’s advantage grows significantly for very large blocks, thanks to that cap.

This varies from exchange to exchange.

You can see here, that Kyith choosing Tiered pricing might not be the most optimum. Also shows you bloggers might not know everything.

The Poor Swiss has a good data article showing you this “it varies from exchange to exchange”: Should you use IB Fixed or Tiered pricing in 2025?

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment