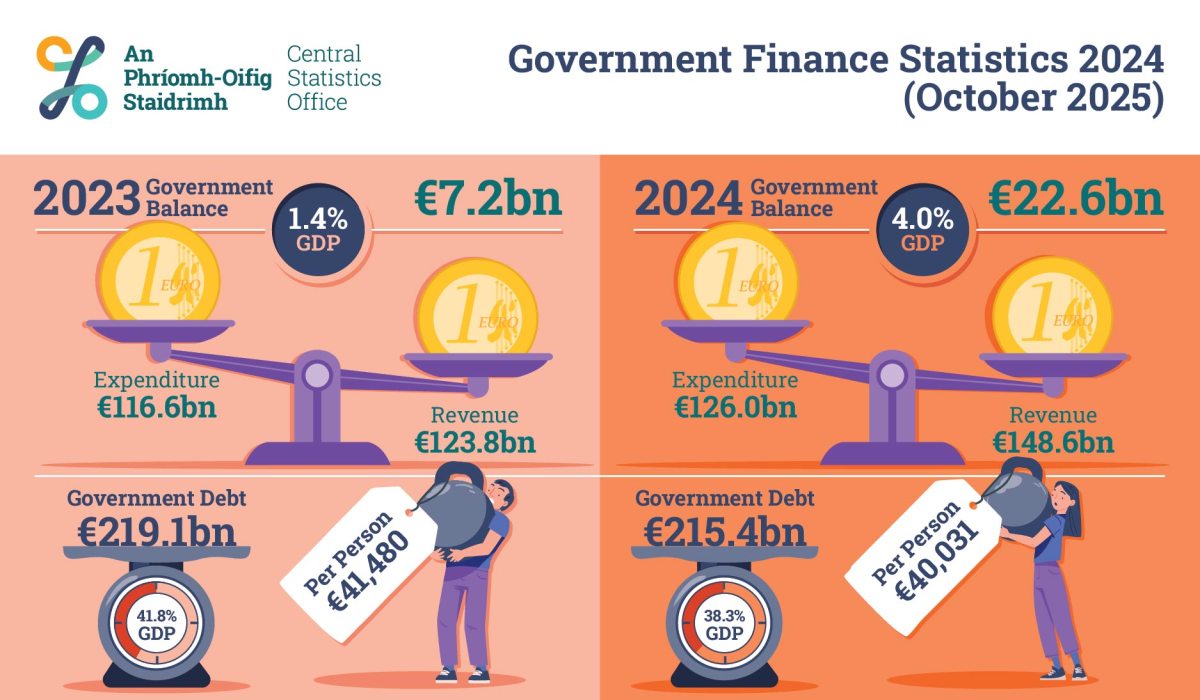

Ireland’s Q2 2025 Shock: Revenue Surge Leaves Government Spending in the Dust—What This Means for Investors!

Ever wonder how a government manages to keep a hefty surplus while spending more? Ireland’s latest Q2 2025 figures are showing exactly that—a €2 billion surplus, even as expenditure ticked upward by €2.2 billion from last year. Sure, revenue climbed too, hitting €34.8 billion thanks to a boost in taxes and social contributions, but what’s truly fascinating is how the balance narrowed from €2.9 billion to €2 billion despite the rising costs. It’s like watching a skilled tightrope walker maintain perfect balance with a heavier load—pretty impressive, right? This snapshot from the Central Statistics Office reveals the resilience and savvy behind Ireland’s public finances, reminding us that economic agility is a real thing — and sometimes, surplus and spending can coexist in harmony. LEARN MORE

The Irish Government recorded a €2bn surplus in the second quarter (Q2) of 2025, according to new figures released today (21 October 2025) by the Central Statistics Office (CSO).

The data, published in the latest Government Finance Statistics Quarterly Results, show continued strength in public finances despite rising expenditure.

Total general government revenue stood at €34.8bn in Q2 2025, an increase of €1.3bn compared with the same period last year.

Expenditure also rose year-on-year, reaching €32.8bn, up €2.2bn from Q2 2024.

As a result, the general government balance narrowed from a €2.9bn surplus in Q2 2024 to €2bn this quarter.

Commenting on the figures, Paul McElvaney, Statistician in the Government Accounts Compilation & Outputs Division, said: “Today’s results for Q2 2025 show that total government revenue stood at €34.8bn, which was €1.3bn higher than in Q2 2024.

“This was driven primarily by an increase in taxes of €1.1bn and social contributions of €0.4bn.

“Total government expenditure also rose to €32.8bn in Q2 2025, which was €2.2bn higher than Q2 2024.

“This was across a range of items, with increases driven by pay, use of goods and services, social benefits, investment and capital transfers.

“This resulted in a government surplus of €2.0bn in Q2 2025.”

The CSO report highlighted that higher tax receipts were the main contributor to revenue growth, supported by a rise in social contributions.

On the spending side, increases were seen across multiple areas, including wages and salaries, use of goods and services, and social benefits, each up by around €0.4bn.

Capital investment rose by €0.2bn, while a one-off capital transfer payment added €0.6bn to expenditure.

Government debt also edged up by €1bn during the quarter.

However, the general government gross debt-to-GDP ratio fell to 33.3%, down 1.2 percentage points from Q1 2025, reflecting strong GDP growth.

The net debt-to-GDP ratio also declined, from 25% to 23.3%, supported by higher holdings of financial assets.

Overall, the Q2 2025 results underline the resilience of Ireland’s public finances, with solid revenue growth helping to sustain a budget surplus despite increased government spending.

Post Comment