Is $5 for SUI Just a Dream—or the Next Big Break Every Investor’s Been Waiting For?

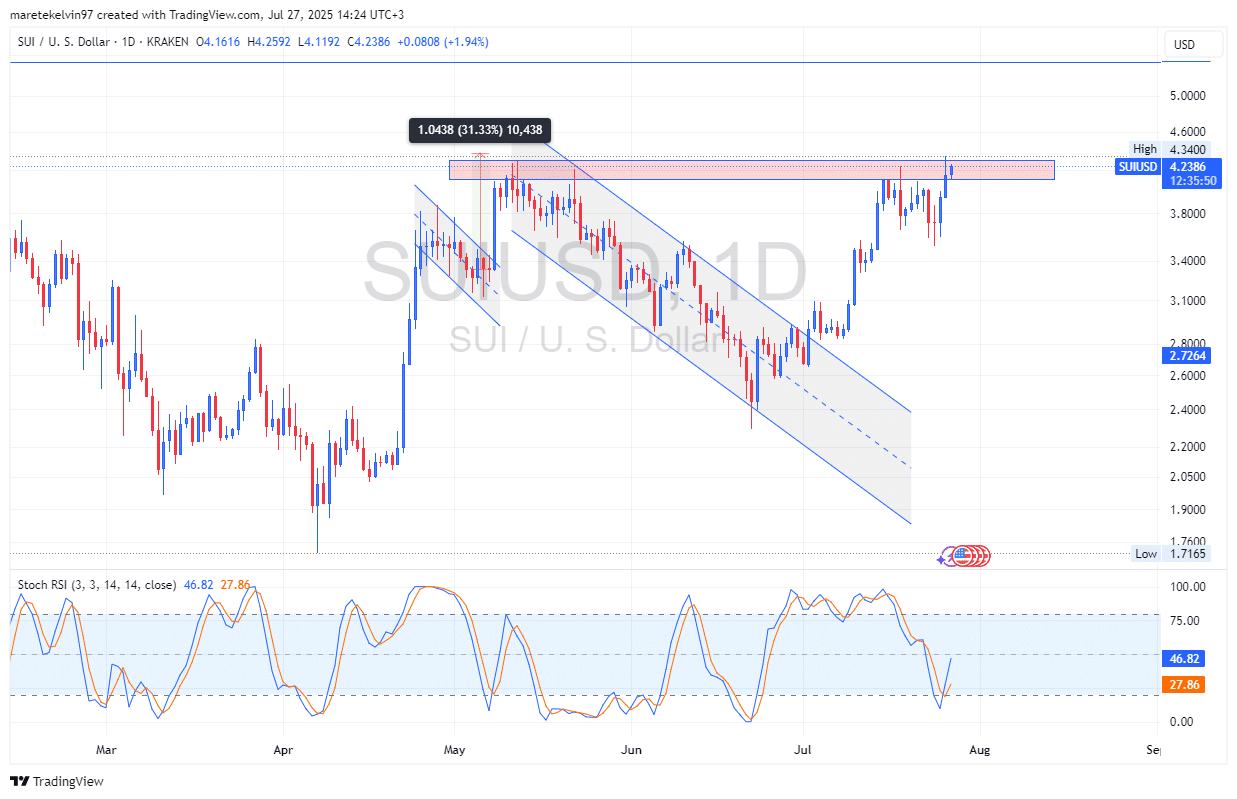

Ever wonder what it takes for an altcoin to quietly steal the spotlight and start firing on all cylinders? Well, Sui [SUI] might just be the underdog you didn’t see coming. After a patient, month-long climb, this token is edging up towards the symbolic $5 mark – a psychological ceiling many altcoins dream of but few actually reach. What’s truly fascinating here isn’t just the steady upward momentum—it’s the cocktail of technical signals, like the RSI hovering in oversold territory and liquidation zones nestled around $4.4 to $4.6, hinting at a potential explosive short squeeze. Could this be the moment where SUI flips the script and surges past expectations, rewiring the whole altcoin game? Investors and traders are leaning in, their eyes glued to that critical $4.5-$4.6 price band, eager to see if a breakout could rocket SUI to new highs. It’s the kind of setup that makes you wonder—are we on the cusp of witnessing a classic crypto comeback story?

Key Takeaways

SUI is closing in on $5 after a steady month-long rally, with RSI indicating an oversold zone. Liquidation clusters around $4.4–$4.6 may spark a short squeeze that could drive prices further up.

Sui [SUI] has been quietly outperforming other altcoins recently. After nearly a month of steady gains, the altcoin is now inching closer to the key price level at $5— a milestone that could soon be within reach.

On the daily chart, SUI is gaining momentum after sweeping the liquidity at around $4.2 supply zone.

Interestingly, the momentum does not seem to fade soon. Sui’s Relative Strength Index (RSI) is also hovering at an oversold territory, suggesting a potential reversal to shoot higher.

Derivatives positioning hints a bullish rally

In the derivatives market, the bulls are still in control. At press time, the Long/Short Ratio stood at 51%.

This suggested that investor in long positions were still dominant, reinforcing the confidence level on this anticipated bullish run.

The liquidation heatmap data from CoinGlass is adding more weight to the accumulating momentum. The metric indicated a concentration of stop-losses and liquidation clusters at around $4.4 price level.

If SUI pushes into that zone, a cascade of forced buybacks could kick in, a historical move that often triggers short squeezes and drives price action fast and hard.

Is $5 a done deal?

It is not guaranteed since there is nothing certain in crypto ever, however, the signs are stacking up.

With price structure still leaning bullish, leverage also bullish and key liquidity pools just overhead, SUI looks technically poised to make a run. The bullish bias in winning against all odds.

For now, investors and traders alike will want to keep an eye on the $4.5 to $4.6 price range.

A clean breakout above that could unlock momentum that could push the token to $5 or even beyond to possibly set a new all-time high.

Post Comment