Is Astrea 9 the Hidden Investment Time Bomb Everyone’s Ignoring? Here’s What You Need to Know Before It’s Too Late.

In the thick of my chaotic work grind, a new Astrea private equity bond issue quietly popped up—like that unexpected coffee hit you didn’t know you needed. Azalea Investment, under the big Temasek umbrella, has been the architect behind this bond series for nearly a decade, and now they’re rolling out Astrea Capital 9. Intriguing, right? You’ve got A-1 and A-2 bonds in different currencies, retail-accessible, and then the mysterious Class B PIK bond that pays interest in kind—think more debt, not cash. Sounds like a puzzle, especially when the coupons look sweeter than the current Singapore Treasury Bill yields hovering below 2%. But here’s the kicker: before you get starry-eyed, is the allure worth the risk hidden beneath the shiny returns? Ever wonder why those naysayers vanish until a new issue pops up, only to come crawling back—if at all? This deep dive unpacks the intricate mechanics, the layers of leverage, and the cautious optimism behind a bond that’s anything but straightforward. Buckle up — it’s going to be a revealing ride. LEARN MORE

img#mv-trellis-img-1::before{padding-top:51.106639839034%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:83.061889250814%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:50.5859375%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:65.72265625%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:25.68359375%; }img#mv-trellis-img-5{display:block;}img#mv-trellis-img-6::before{padding-top:54.659685863874%; }img#mv-trellis-img-6{display:block;}img#mv-trellis-img-7::before{padding-top:123.07692307692%; }img#mv-trellis-img-7{display:block;}img#mv-trellis-img-8::before{padding-top:115.44532130778%; }img#mv-trellis-img-8{display:block;}img#mv-trellis-img-9::before{padding-top:88.8671875%; }img#mv-trellis-img-9{display:block;}img#mv-trellis-img-10::before{padding-top:85.05859375%; }img#mv-trellis-img-10{display:block;}img#mv-trellis-img-11::before{padding-top:72.58382642998%; }img#mv-trellis-img-11{display:block;}img#mv-trellis-img-12::before{padding-top:117.16247139588%; }img#mv-trellis-img-12{display:block;}img#mv-trellis-img-13::before{padding-top:78.125%; }img#mv-trellis-img-13{display:block;}

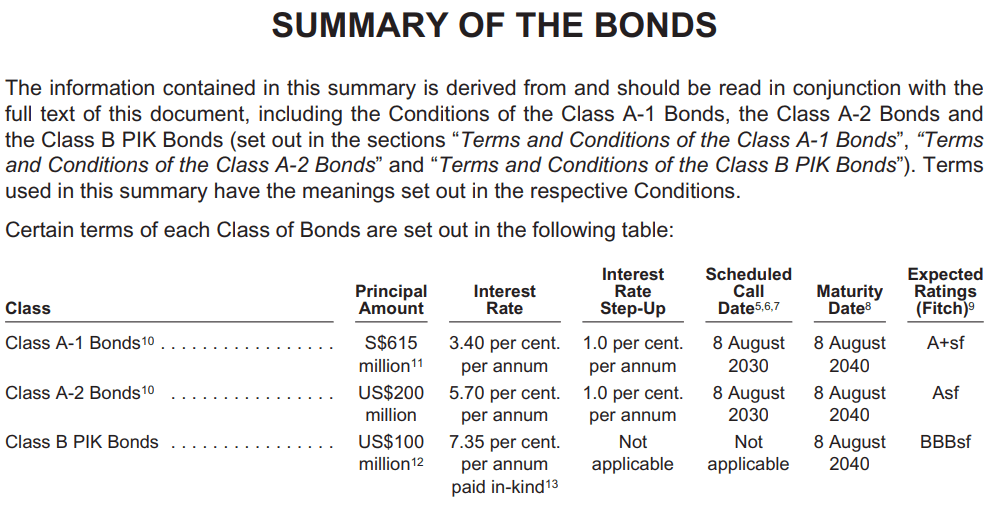

So apparently in the midst of my hectic work, there is this Astrea PE (private equity) bond that is issued. Azalea Investment, which is under Temasek have been structuring this bond for the last decade.

So this time they are also doing it:

The A-1 bond is in SGD and and A-2 bond is in USD. I think both can be subscribed by retail. You would have to be an AI (accredited investor) to subscribe to the Class B PIK bond. PIK stands for payment-in-kind bonds. Instead of the interest being paid in cash, the bond holder receives more debt. So the cash flow ain’t great but they should get that 7.35% p.a. return at maturity in a greater principal (due to the coupon payment as additional debt).

I think many look at the interest of 3.4% and 5.7% to be very attractive especially when the Singapore Treasury Bill interest is below 2%.

My reader on Telegram asked for my view:

It just that there always naysayers about them e.g Astrea 8 bond yield~ 4.35% is not worth the risk. End up, current t bills and SSB yields had dropped significantly this year Those that dissed Astrea 8 yield suddenly gone missing until this new launch again. It is the same for previous launches but so far there have been no blow up.

I think those naysayers probably disappeared because they have better things to diss about!

But I don’t know man… I seen enough of those “so far there have not been any blow up” until the blow up actually happen.

If it hasn’t happen doesn’t mean it will never happen.

I think I shared my views about the Astrea bonds in the past. The most latest one is here: Will Not be Subscribing to the Astrea 8 Private Equity Bond Issue, But You May Find it Suitable.

I am not going to share whether I think this fixed income compensate or does not compensate the risk.

I invest in the AGGU, and also the Amundi Global Aggregate bond and I would not call them without risk.

You hold a portfolio of fixed income and assume the risk. And you hope that you get the return that sort of compensate the risk.

That is how we should look for all investments.

I think my reader was wondering if there are unknown risks that were not brought to the surface for the Astrea bonds.

Personally I think its a bit mix. If we are investing in a PE bond, issue by a fund, whose objective is to invest in a portfolio of private companies, the risk is much higher.

There is a reason why the returns from Private Credit is higher than this 3.4%.

Here is the structure of the Astrea Capital 9:

Okay.. I am going to explain a little of this structure in my own words and I am likely not going to use the right words because my brain is fxxking taxed from trying to think around Universal Life Insurance (my research project for Providend) these few days. So I am not going to control my words.

Azalea Asset Management, somewhat far indirectly own by Temasek sets up this company Astrea Capital 9 Pte. Ltd. A company is like a fund and a fund is like a company. There is a set of trustee (in this case DBS) that watches over the entity for the trust’s beneficiary.

The purpose of this Astrea Capital 9 is to invest in a bunch of PE funds (see the pinky boxes below). The way they fund it is almost half through debt and half through equity.

If you ask me… anything that is leverage 50% debt to the asset value looks dangerous. If an adviser colleague brings a case of 50-60% leverage based on lombard lending, I be like… can reduce the risk a bit or not… can don’t take so much risk. Maybe reduce to 30%?

The difference some would say is…. the underlying funds don’t get revalued so often and so the aggregate value doesn’t change so much. And if it doesn’t change so much, the loan-to-value doesn’t get volatile so easily.

Fxxk as I write about this… I kind of miss the days of looking at heavily leverage shipping companies and loan covenants during my stock picking days.

Anyway… here are the funds that form the assets of this Astrea 9:

I am not a private equity person (I think there is a difference there) and so I cannot tell you if these funds are good or not good. The general idea is if the value of these funds are stable… then the LTV is stable.

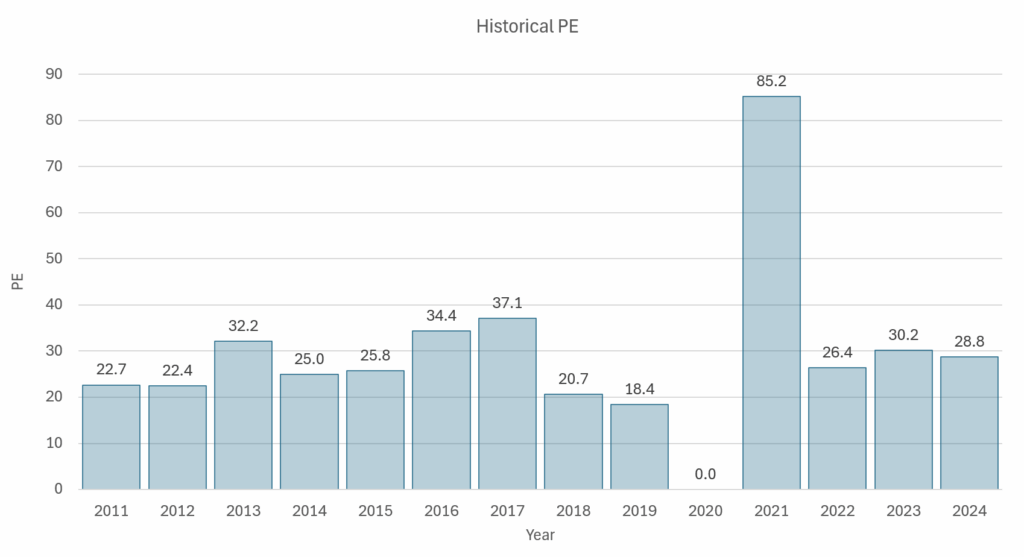

The returns of the underlying funds come in a return of principal value that is higher than the original capital. A limited partner, or the investor, commits an amount of capital, and the underlying PE funds call from the capital over time. Calculating returns is challenging which is why Internal Rate of Return (IRR) is one way to calculate. Each form of performance return calculation has its strength and weakness but very often confuses the novice investor such as the businessman who has a lot of money but are very new to this space.

The other return is the capital distributions that take place over time.

Astrea 9, as the owner of these PE funds, will receive both of these over time.

They set out a structure of accumulating the distributions so that they can match the principal liability for different class of fixed income holders. They will prioritize the money to return the principal for the Class A-1 then A-2 bond holders. The equity investors are the last in queue.

The Astrea series is basically setup less with the idea for big equity return for all but with the idea that principal return for the bond holders is of adequate importance.

I have not come across many entity that structure their cash flow in such a way to provision for their bond holders this way.

Actually there is a more detail flow chart:

I see this flow chart I feel very high.

You can think about it in a different way: If this thingy is no risk… why the f do we need an elaborate decision tree such as this.

The next question is… would there be adequate distributions from the funds to provide for the interest or to return the capital in 5 years (although the actual maturity of the bonds is 15 years)?

The average age of the funds is 5.5 years.

While it is possible for funds to return distributions earlier, usually it takes after 5 years for the meaningful distributions to come.

In my previous article: Your VC Fund’s Performance Returns is also a Single Draw from a Wide Range of Possible Returns, there is this data chart:

These charts basically shows in general how much distributions the funds in various vintages are distributing. Half of the funds own by Astrea 9 is before 2020 and half after and so I think the manager is trying to find a sweet spot there.

This illustration from the Astrea 9 prospectus explains the J-Curve where in the earlier years, limited partners (LP) will see them having more cash outflow (from their pockets) into the fund but perhaps after 5 years the funds are likely to see the distributions.

It makes sense to think about what you wish to achieve for your portfolio and decide on your mix.

The risk is… the underlying business (as a cohort) suffer and so less money is flowed to the funds, which is flowed to Astrea 9.

The underlying funds don’t die. Their values might become smaller, and would explain the distributions would take longer…

But would that be enough?

At around page 200 of the prospectus, they provide some simulations about what would happen if the capital distributions were reduce, based on various sensitivity analysis. What is illustrated is the interest payment period after the first five years till year 15.

The sensitivity analysis looks sensible but I didn’t really think around the subject enough because I don’t have the bandwidth to think it through.

At this point, I wonder how many readers I have lost from looking at the conservative structure, thinking around the capital distributions.

If this is way over your head, know that there are always some risks to investing. This is probably not a shit coin that can easily be rugpulled.

If an entity, distant from Temasek rugpulls you, then you know what to do in the next election.

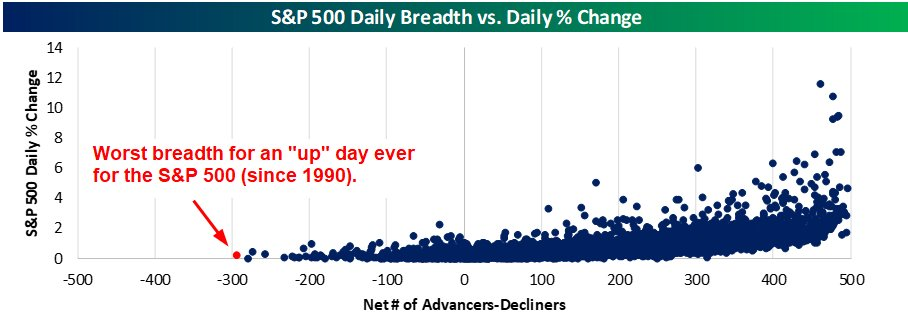

I think it is always challenging to nail down if something has priced in certain risk or have not. It is usually a mixture of data work, and experience after looking at these stuff for a while. Many of these stuff has those asynchronous risk where the return is very stable, stable, stable but there are some events, however improbable that could really fuck things up.

The Astrea stuff feels more like this.. and they have put in measures in place.

If you put in money, don’t say I recommend you.

Finally, I leave you with the Singapore yield curve from Yesterday versus a week ago:

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment