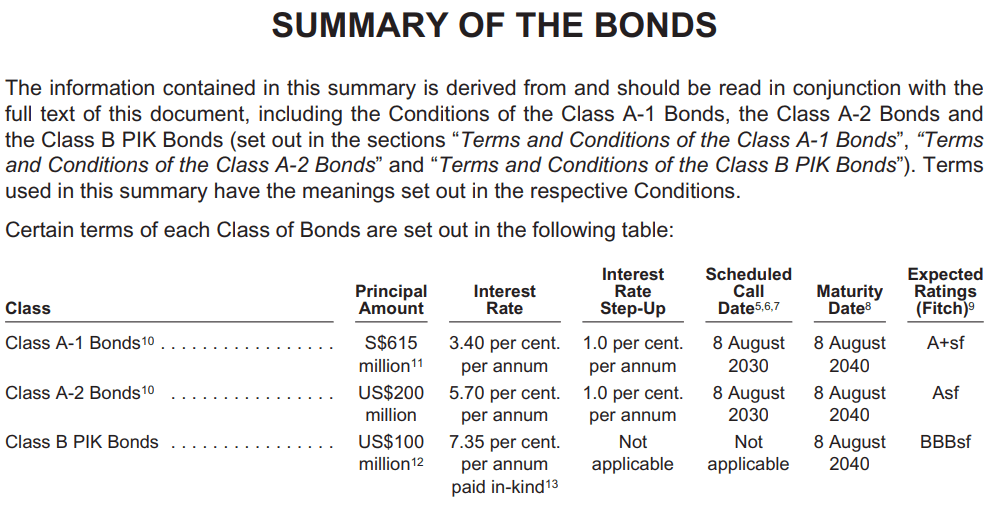

I have not come across many entity that structure their cash flow in such a way to provision for their bond holders this way.

Actually there is a more detail flow chart:

I see this flow chart I feel very high.

You can think about it in a different way: If this thingy is no risk… why the f do we need an elaborate decision tree such as this.

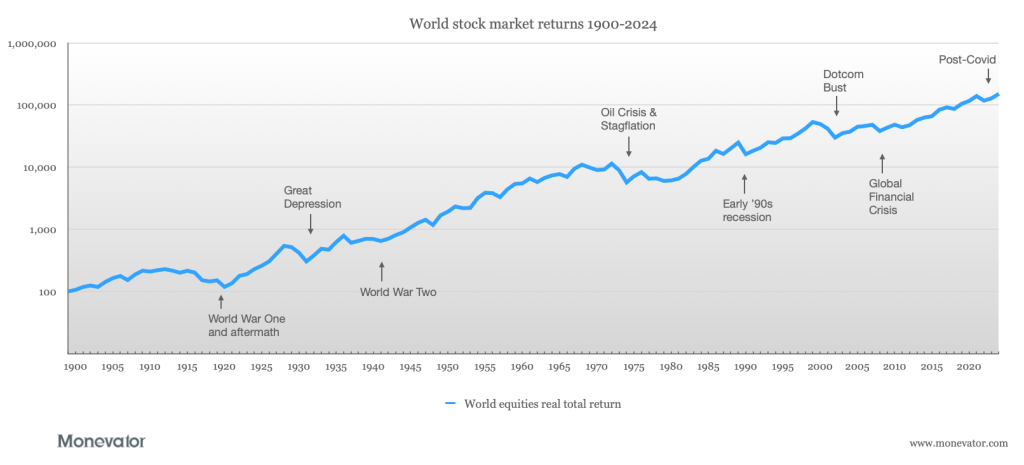

The next question is… would there be adequate distributions from the funds to provide for the interest or to return the capital in 5 years (although the actual maturity of the bonds is 15 years)?

Post Comment