So this time they are also doing it:

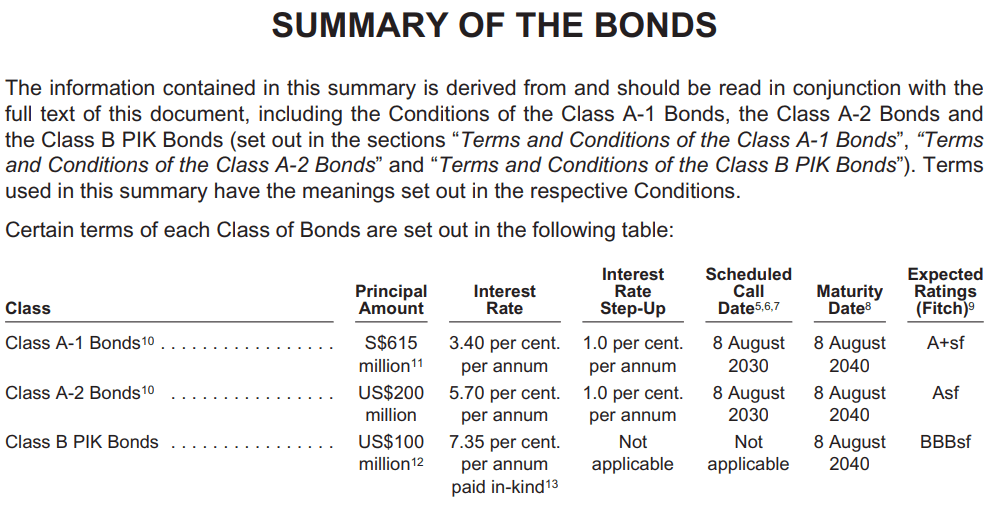

The A-1 bond is in SGD and and A-2 bond is in USD. I think both can be subscribed by retail. You would have to be an AI (accredited investor) to subscribe to the Class B PIK bond. PIK stands for payment-in-kind bonds. Instead of the interest being paid in cash, the bond holder receives more debt. So the cash flow ain’t great but they should get that 7.35% p.a. return at maturity in a greater principal (due to the coupon payment as additional debt).

I think many look at the interest of 3.4% and 5.7% to be very attractive especially when the Singapore Treasury Bill interest is below 2%.

Post Comment