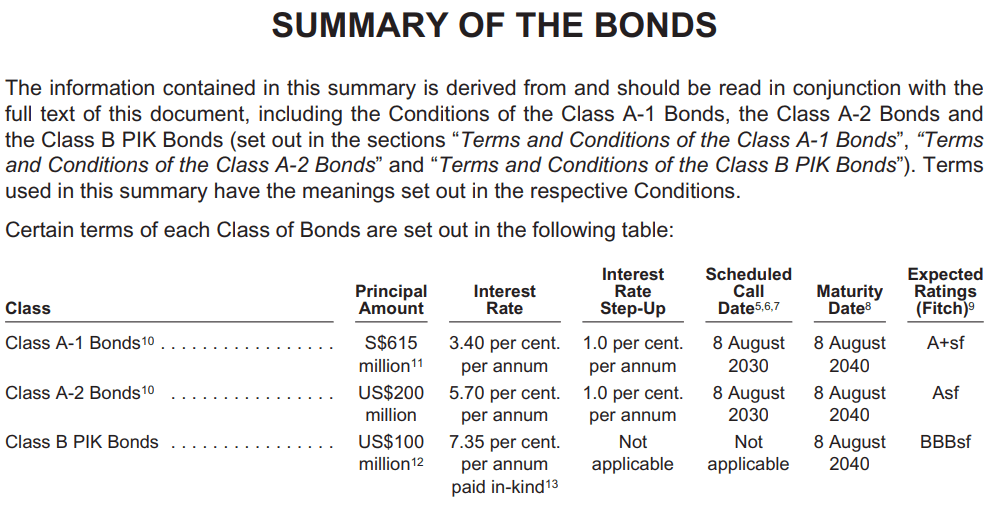

Azalea Asset Management, somewhat far indirectly own by Temasek sets up this company Astrea Capital 9 Pte. Ltd. A company is like a fund and a fund is like a company. There is a set of trustee (in this case DBS) that watches over the entity for the trust’s beneficiary.

The purpose of this Astrea Capital 9 is to invest in a bunch of PE funds (see the pinky boxes below). The way they fund it is almost half through debt and half through equity.

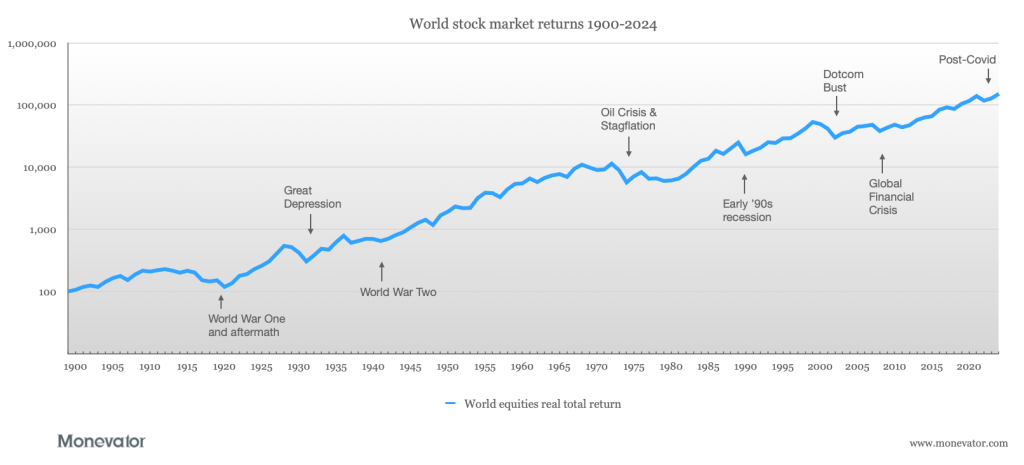

If you ask me… anything that is leverage 50% debt to the asset value looks dangerous. If an adviser colleague brings a case of 50-60% leverage based on lombard lending, I be like… can reduce the risk a bit or not… can don’t take so much risk. Maybe reduce to 30%?

Post Comment