Is Bitcoin’s Surge Fueled by a $20M ETF Play and China’s Hidden Money Supply Move? Here’s What You’re Not Seeing

Bitcoin’s recent sprint past the $110,000 mark might have some scratching their heads and others throwing high-fives — but what’s really propelling this digital gold’s bullish streak right now? Is it simply a matter of China’s expanding money supply flooding the markets with liquidity, or are U.S. institutional investors quietly stacking up Bitcoin via spot ETFs, signaling a deeper confidence in crypto’s staying power? Yet, before we start popping virtual champagne bottles, there’s a catch: heavy options selling pressure coupled with a cooling retail sentiment could throw a wrench in the works, stalling what looks like a promising rally. The market’s at a fascinating crossroads — do buyers have what it takes to push through resistance, or is this momentum just a teasing mirage? Let’s unpack the forces at play as the week closes out. LEARN MORE

Key Takeaways

What factors are driving Bitcoin’s recent bullish momentum?

Rising liquidity in China and institutional inflows into U.S. spot ETFs are fueling Bitcoin’s upward trend.

What could limit Bitcoin’s near-term rally despite positive indicators?

Heavy options selling pressure and weakening retail sentiment may create resistance and stall momentum.

Bitcoin [BTC] has maintained bullish momentum over the past day, rising by 1.28% and opening a candle above $110,000 for the first time since the 12th of October.

AMBCrypto analyzed the market to identify the key factors driving this momentum and what they could mean heading into the weekend.

China’s liquidity push and institutional moves

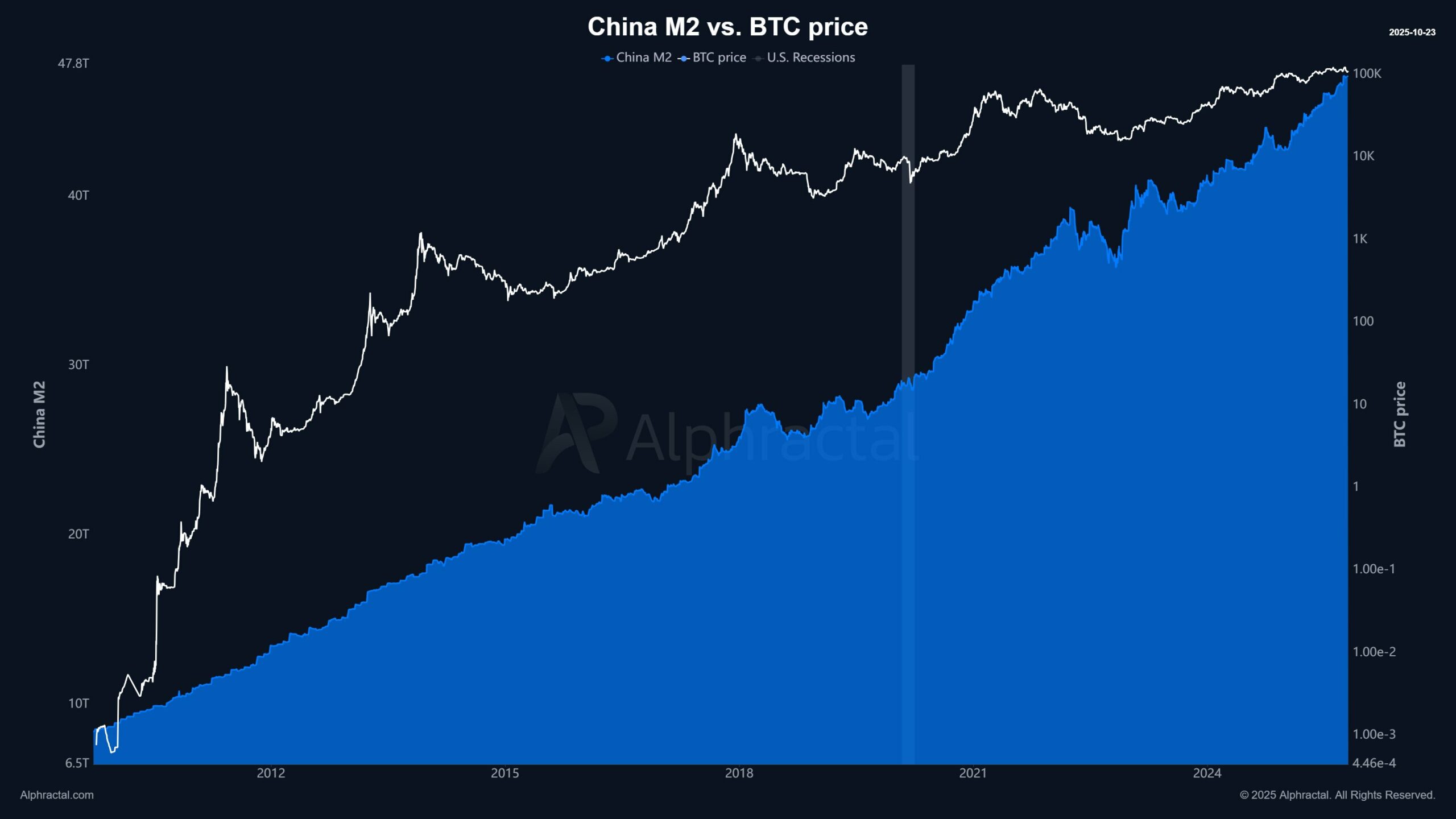

Bitcoin’s recent surge appears linked to the growing M2 money supply in China.

The country’s M2 has continued to expand, recording a 0.87% increase over the past month, while global liquidity has fluctuated between $127 trillion and $128 trillion.

Rising liquidity suggests higher cash circulation in the Chinese market, which could flow into assets like Bitcoin.

The recent approval of a Solana [SOL] ETF in Hong Kong could also indicate growing investor readiness to deploy capital into digital assets, a move China may soon replicate.

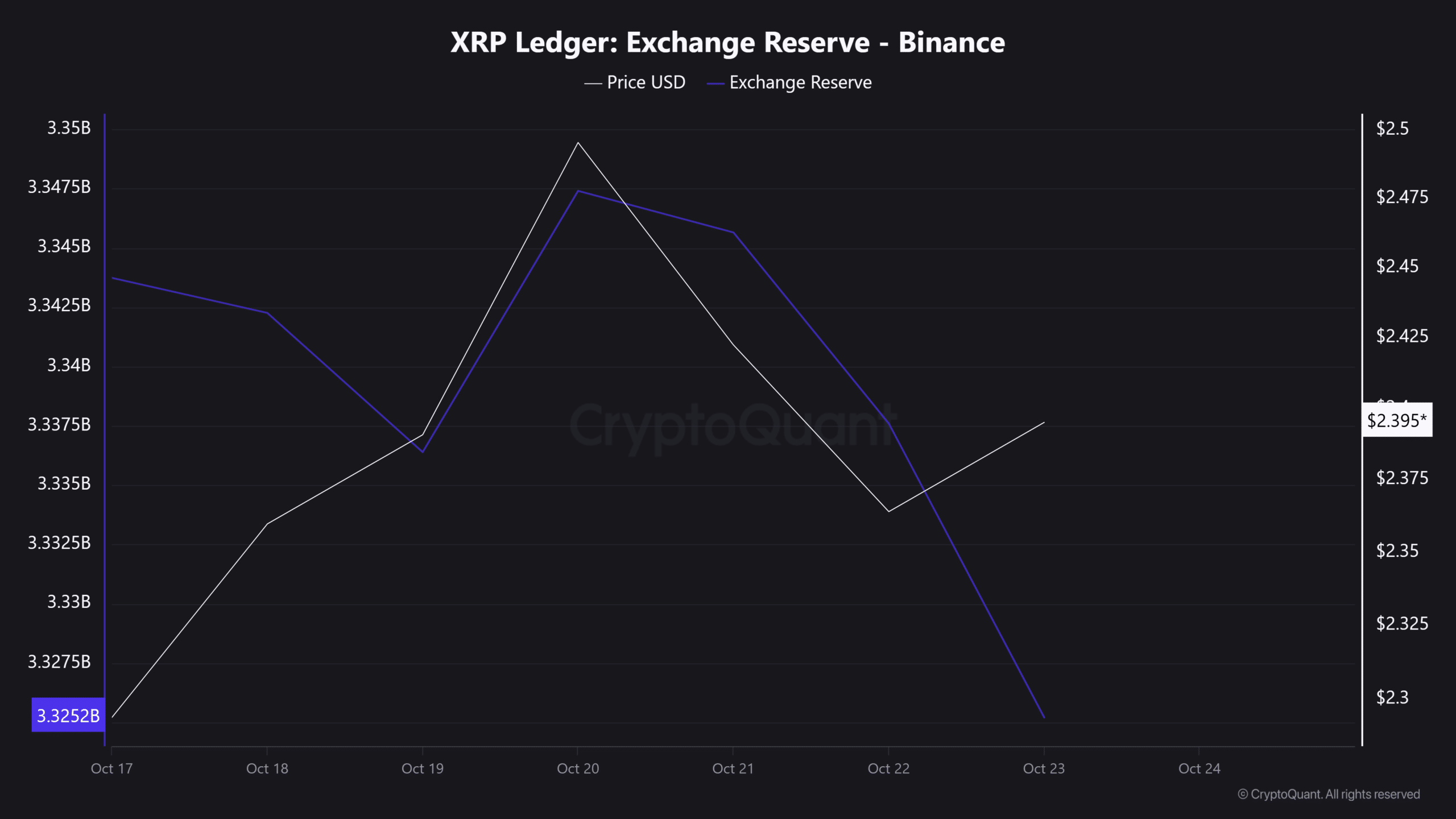

In the United States, institutional investors are also positioning themselves ahead of the weekend.

Data shows that U.S. spot Bitcoin ETFs saw a $20 million inflow this week, signaling renewed confidence. This comes as the U.S. M2 supply remains flat, with 0.0% growth recorded over the same period.

Market indicators signal accumulation potential

On-chain and off-chain indicators suggest that Bitcoin’s bullish setup remains intact. The Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL) metric shows that Bitcoin has entered a cooling phase, indicating investor discomfort.

Historically, such stress among short-term holders often precedes accumulation phases and eventual price recoveries; a similar setup may now be forming.

Bitcoin’s dominance has also risen by 1.57% in the past day, as of writing, reflecting renewed investor confidence.

A rising dominance typically means investors are reallocating funds from altcoins into Bitcoin, strengthening its position and setting the stage for a potential rally if momentum persists.

Resistance ahead

Not all investors share the bullish sentiment. Data from the Bitcoin Options Net Premium Inflow shows heavy selling pressure between $109,000 and $115,000, BTC’s current trading range.

This indicates that traders are using options to hedge against possible price drops. If selling pressure increases, this zone could act as strong resistance and weaken market confidence.

As the week draws to a close, institutional traders are expected to retreat from the market, leaving retail investors to determine whether Bitcoin’s bullish momentum will hold.

At press time, retail participants appeared to be easing their buying activity, with data showing they sold approximately $48 million worth of Bitcoin today.

Should retail sentiment remain bearish, Bitcoin’s chances of a near-term rally appear limited.

Post Comment