Is Ethena’s ENA Token Poised to Break $1, or Are Whale Sell-Offs About to Drag It Under?

When whales start moving—especially with a hefty 34 million ENA whale deposit into Binance—you know the waters are stirring, whether the surface looks calm or not . Sentiment shows a hopeful glimmer, with ENA inching up by over 3%, but beneath lies a classic tug-of-war: distribution risks versus bullish momentum. It’s like watching a high-stakes poker game where the big players keep pushing chips forward while others bet on a breakout. The cup-and-handle pattern flashing on the charts teases targets between $1.00 and $1.25—but the shadow of whale-driven selling looms large, challenging whether this rally can hold firm. So, is this just yet another whale-played shakeout, or is ENA primed to push through resistance and surprise the skeptics? Dive in as we break down the charts, spot volumes, and liquidation data, uncovering whether the bulls have enough muscle to outsmart the whales this time around. LEARN MORE

Key Takeaways

Whale deposits of 34 million ENA into Binance spark distribution risks despite improving sentiment. Meanwhile, cup-and-handle targets $1.00–$1.25, but distribution still shadows bullish momentum.

Whales have intensified sell-side activity on Ethena [ENA], with a wallet transferring 34 million ENA worth $22.65 million into Binance over two weeks.

This included a recent 5 million ENA deposit valued at $3.81 million, adding further weight to supply-side pressure.

At press time, ENA traded at $0.7613, up 3.28% daily, reflecting improving sentiment despite consistent sell flows.

Such consistent inflows to exchanges often signal distribution. With over 140 million ENA already sold by whales, investors are questioning whether buyers can absorb this mounting pressure effectively.

ENA’s cup-and-handle points to upside targets

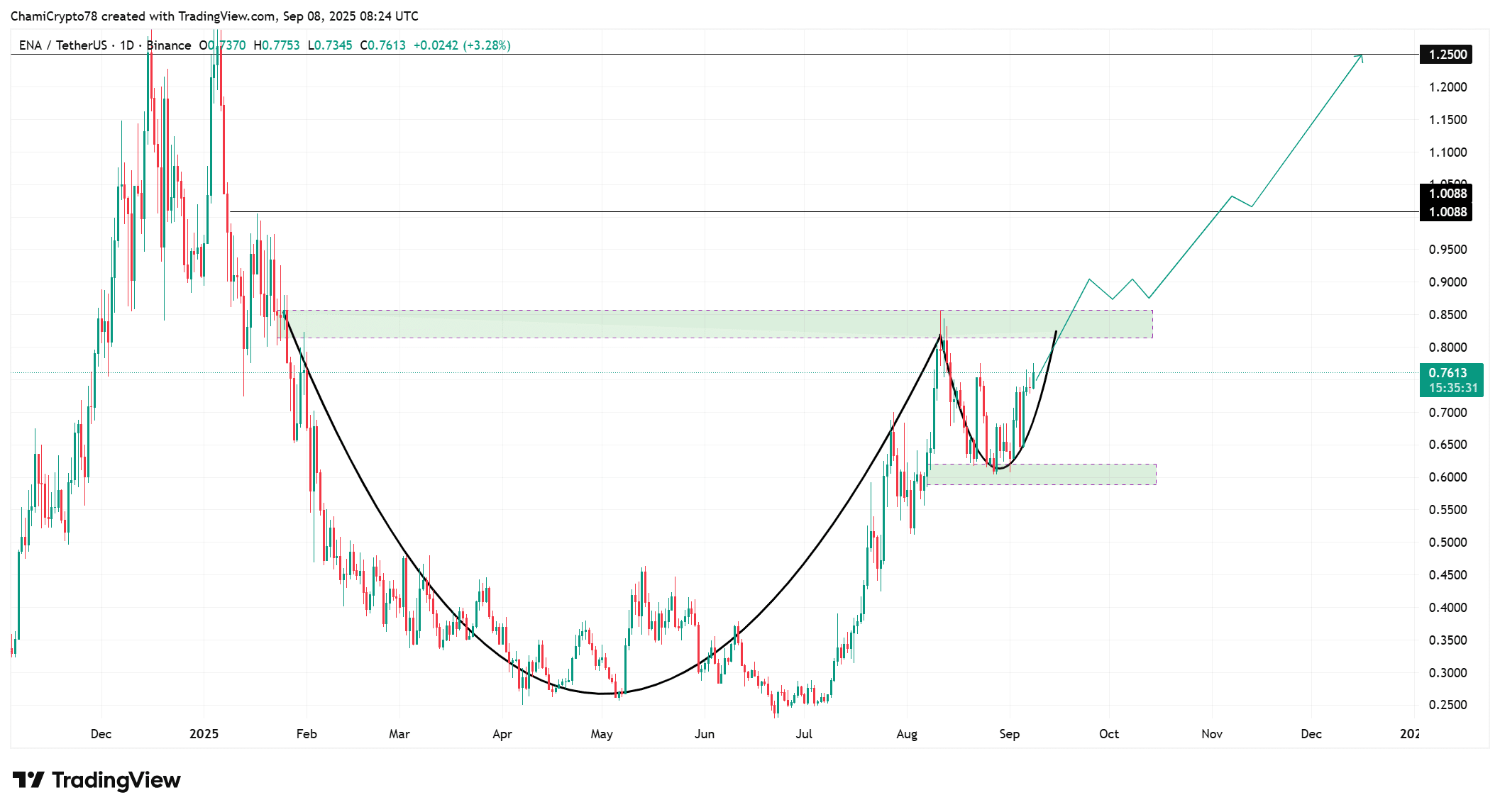

Despite whale-driven risks, ENA’s daily chart showed a clear cup-and-handle formation at press time, a pattern historically associated with continuation breakouts.

The setup pointed toward key upside targets of $1.00 and $1.25, provided bulls were able to secure control above the immediate resistance near $0.85.

Notably, the support has been tested multiple times near $0.65. Failure to hold above the neckline could stall momentum, though the setup still left room for expansion.

Spot trading activity signals rising participation

Spot Volume data showed “heating” conditions at press time, with heightened participation and strong demand validating price action. For context, volume surges often precede major directional moves.

But still, with whales continuing to increase their exchange inflows, the sustainability of this rally remained contested.

Even so, retail and mid-tier buyers appeared willing to counterbalance distribution. This history kept sentiment fragile as both sides exerted pressure.

Source: CryptoQuant

Do short liquidations confirm bullish pressure?

Liquidation data showed more than $500K worth of short positions erased within the last 24 hours, compared to lighter long-side liquidations.

This short squeeze forced buy-backs, providing upward momentum. When paired with the cup-and-handle structure, the conditions boosted the bullish case.

In fact, liquidation trends may support higher levels if bulls clear resistance and push Ethena toward $1.00 and $1.25.

Source: CoinGlass

Can ENA hold firm despite whale activity?

ENA faced a critical test as whale inflows into Binance continue to mount against a backdrop of bullish technical signals.

While distribution raised short-term risks, the cup-and-handle setup, strong spot activity, and short-side liquidations provided bulls with significant leverage.

The token’s next move depends on whether technical strength can outweigh whale selling.

Post Comment