Is PUMP Poised for a Breakout This Week, or Is It Just Another Mirage in the Crypto Jungle?

Ever find yourself caught at the crossroads of market hype and cautious skepticism? That’s exactly the tightrope Pump.fun’s native token, PUMP, is walking right now. Despite a fresh breeze of positivity hinting at a market turnaround, PUMP’s short-term outlook is still more wary than wily. It’s sort of like watching a sprinter poised at the starting line—ready, but waiting for that crucial signal to surge forward. What’s that signal? A steady rise in Open Interest and a breakthrough rally past the $0.005 supply zone—once those align, the game could change dramatically for PUMP. Until then, it’s a lesson in patience and prudence, reminding us all that even promising opportunities need their moment to truly shine. Curious to see if this token is gearing up for a real breakout or just another false alarm? LEARN MORE

Key Takeaways

Is this the time to buy Pump.fun’s native token?

While the market might be turning around, PUMP is still not bullish in the short term.

What needs to change for PUMP to become bullish?

A rising Open Interest and a rally past the $0.005 supply zone would flip the outlook bullishly.

Pump.fun [PUMP] saw an 11.87% surge in daily trading volume, and was up 2.45% in 24 hours at the time of writing. The Open Interest moved higher by 2.05% over the same period – Only indicative of minor bullish sentiment.

The utility token of the memecoin launch platform pump.fun benefited from Bitcoin’s [BTC] price bounce past the $108k short-term resistance. The altcoin market has also been doing well, including the memecoins.

Dogecoin [DOGE] hiked by 3.5% in 24 hours, and the market could have a bullish start to the week. However, traders should be aware that the longer-term structure of PUMP is bearish. Unless the price beats a key resistance zone at $0.0052, a bullish short-term outlook would be laced with risk.

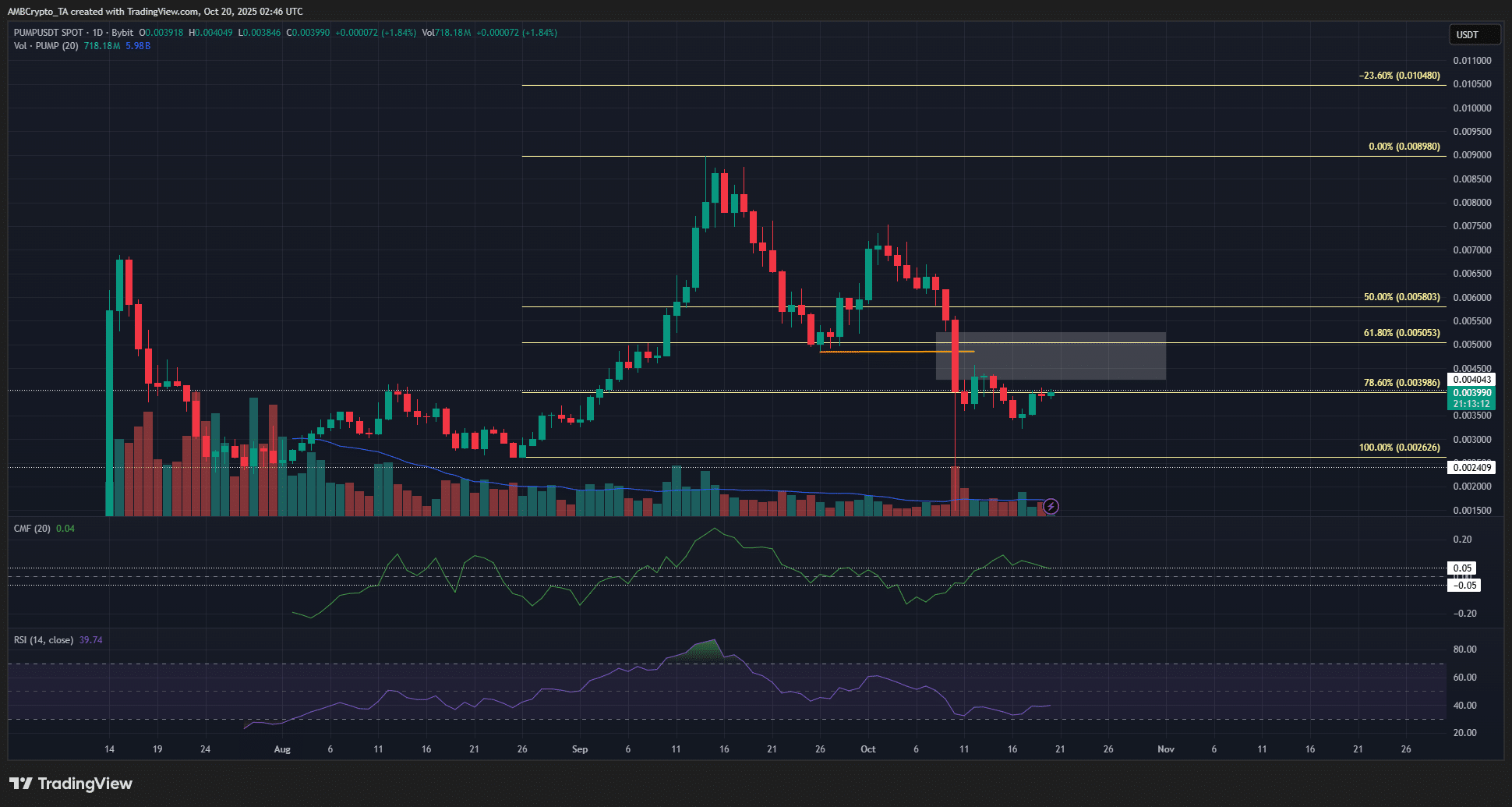

Decoding PUMP’s price action

On the 1-day chart, PUMP seemed to have a bearish market structure. When it fell below the swing low at $0.0048 (orange), the market structure shifted bearishly. Moreover, the selling pressure during the structure shift was so high on Friday that a large imbalance (white box) was left behind.

At the time of writing, PUMP was treading water beneath the 78.6% Fibonacci retracement level. Bulls will want this level flipped to support quickly and trigger a rally beyond $0.0052. The CMF had a reading of +0.04, showing that buying pressure was not significantly bullish.

Additionally, the RSI on the daily chart was still below neutral 50 – A sign that downward momentum was prevalent.

Source: Coinalyze

Since the Friday crash, the Spot CVD has slowly been climbing, underlining spot demand behind PUMP. While the Open Interest rose too, it has been leashed and motionless over the last two days

A hike in Open Interest alongside a rally past $0.005 would be an encouraging sight for PUMP bulls. Until then, a bearish short-term outlook would be preferable.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Post Comment