Is the Bank of Japan Ready to Shock Markets Again? Inside the Yen’s Unstoppable Surge and What It Means for Investors

Ever wondered what happens when a currency takes a sudden leap back from the brink, fueled by whispers of government intervention and global rate decisions? The Japanese Yen (JPY) did just that on Tuesday during the Asian session, snapping back from its lowest against the dollar in over two weeks. Japan’s Economics Minister Minoru Kiuchi’s words stirred the markets, hinting that the government might step in to steady the ship—and traders, savvy as ever, quickly adjusted their sails ahead of pivotal Federal Reserve and Bank of Japan meetings later this week. Of course, amid rising service-sector inflation in Japan and contrasting expectations of aggressive US rate cuts, the Yen’s resurgence feels like watching a high-stakes chess game unfold in real-time. Yet, with the fresh optimism around US-China trade talks and Japan’s new Prime Minister Sanae Takaichi’s ambitious plans, one might wonder—how far can the Yen really rally before hitting its ceiling? Intrigued? LEARN MORE

The Japanese Yen (JPY) gets a strong lift during the Asian session on Tuesday as comments from Japan’s Economics Minister Minoru Kiuchi fueled speculations about a possible government intervention to stem further falls in the domestic currency. This, along with some repositioning trade ahead of the crucial Federal Reserve (Fed) and the Bank of Japan (BoJ) rate decisions this week, assists the JPY to recover sharply from an over two-week low touched against its American counterpart the previous day.

Meanwhile, data released on Monday showed that Japan’s service-sector inflation rose for the second consecutive month in September and reinforced bets for gradual rate hikes by the BoJ. In contrast, traders have fully priced in that the US central bank will lower borrowing costs two more times by the year-end. Apart from this, the uncertainty over US-China trade talks underpins the JPY, though expectations of aggressive fiscal spending under Japan’s new Prime Minister Sanae Takaichi might cap gains.

Japanese Yen bulls look to regain control amid fears of government intervention

- Japan’s Economics Minister Minoru Kiuchi said this Tuesday that it is important for foreign exchange (FX) moves to be stable and reflect fundamentals, adding that he will scrutinize its impact on Japan’s economy.

- Japan’s Prime Minister Sanae Takaichi said that she wants to realise a new golden age of the Japan-US alliance. Moreover, US President Donald Trump said that we are signing a new deal with Japan, and it is a fair deal.

- Data released on Monday showed that Japan’s Services Producer Price Index accelerated to 3.0% in September, reaffirming bets for further tightening by the Bank of Japan and also lending support to the Japanese Yen.

- This marks a significant divergence in comparison to the growing market acceptance that the US Federal Reserve will lower borrowing costs by 25-basis-points at the end of a two-day policy meeting on Wednesday.

- Moreover, traders have been pricing in a greater possibility of another rate reduction by the US central bank in December. This keeps the US Dollar bulls on the defensive and further exerts pressure on the USD/JPY pair.

- Meanwhile, Takaichi is known for her pro-stimulus stance and could resist early tightening by the BoJ. Hence, the BoJ policy update on Thursday will be looked at for guidance about a rate hike in December or early next year.

- Trump said ahead of his expected meeting with Chinese leader Xi Jinping that the US and China were poised to come away with a trade deal. Trump added that he could sign a final deal on TikTok as early as Thursday.

- The optimism remains supportive of the upbeat market mood and might contribute to capping any meaningful appreciating move for the safe-haven JPY, which, in turn, should help limit losses for the USD/JPY pair.

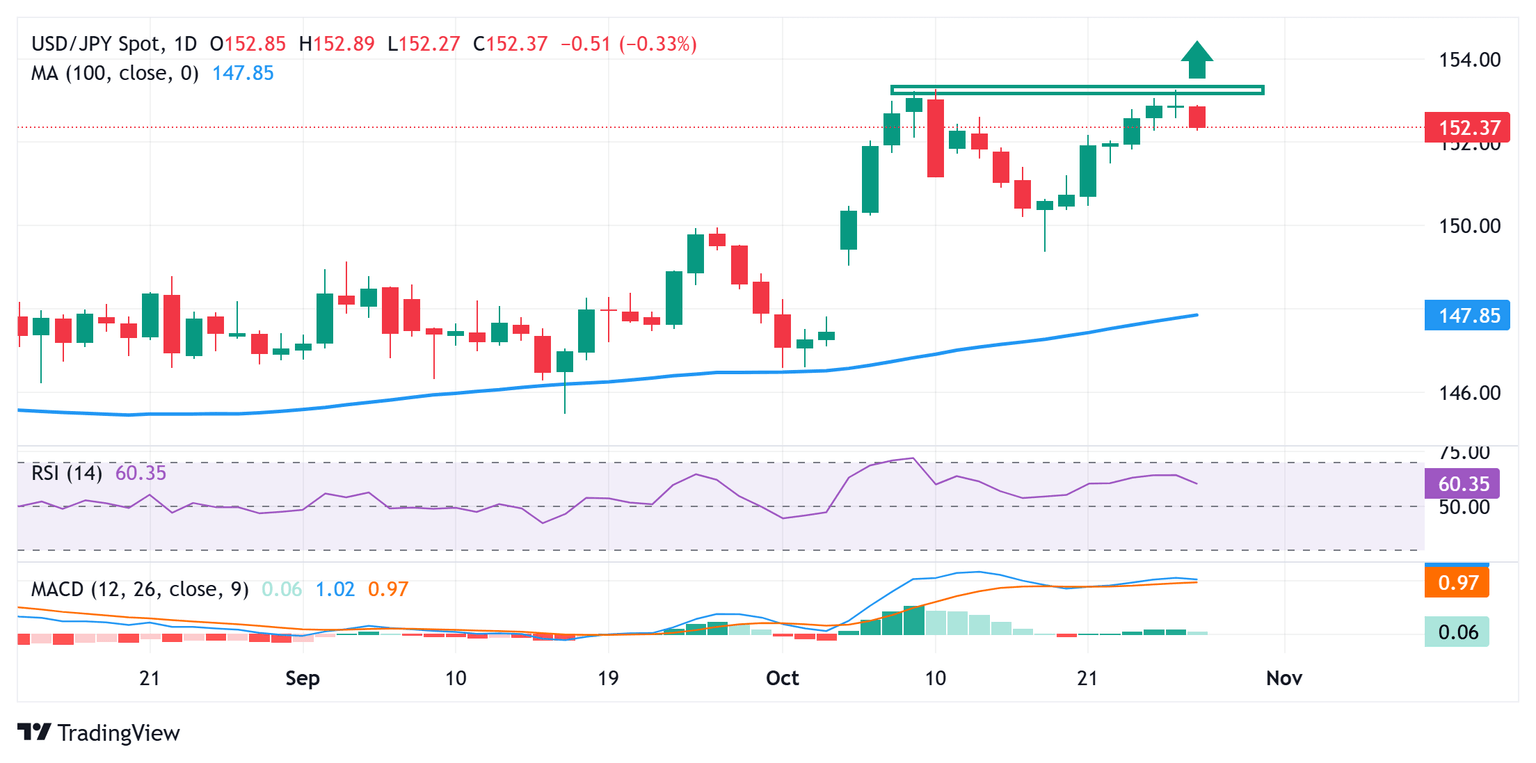

USD/JPY turns vulnerable below 152.00; bears could aim towards challenging 151.00

A failure near the monthly swing high, around the 153.25-153.30 region, and the subsequent fall warrant some caution for the USD/JPY bulls. However, positive oscillators on the daily chart back the case for the emergence of some dip-buyers near the 152.00 round figure. A convincing break below the latter could negate the positive outlook and pave the way for deeper losses towards the 151.10-151.00 zone with some intermediate support near the 151.50-151.45 area.

On the flip side, the 152.90-153.00 region now seems to act as an immediate hurdle ahead of the 153.25-153.30 zone, above which the USD/JPY pair could aim towards reclaiming the 154.00 round figure. The momentum could extend further towards the next relevant resistance near mid-154.00s en route to the 154.75-154.80 region and the 155.00 psychological mark.

Japanese Yen Price Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.18% | -0.23% | -0.64% | -0.05% | -0.12% | -0.24% | -0.24% | |

| EUR | 0.18% | -0.05% | -0.46% | 0.13% | 0.06% | -0.08% | -0.06% | |

| GBP | 0.23% | 0.05% | -0.39% | 0.18% | 0.12% | -0.01% | -0.02% | |

| JPY | 0.64% | 0.46% | 0.39% | 0.58% | 0.51% | 0.39% | 0.38% | |

| CAD | 0.05% | -0.13% | -0.18% | -0.58% | -0.07% | -0.19% | -0.20% | |

| AUD | 0.12% | -0.06% | -0.12% | -0.51% | 0.07% | -0.12% | -0.12% | |

| NZD | 0.24% | 0.08% | 0.00% | -0.39% | 0.19% | 0.12% | -0.01% | |

| CHF | 0.24% | 0.06% | 0.02% | -0.38% | 0.20% | 0.12% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Post Comment