Is the Crypto Market Reset Just the Beginning? Uncover the Hidden Signals Behind the Latest Altseason Surge!

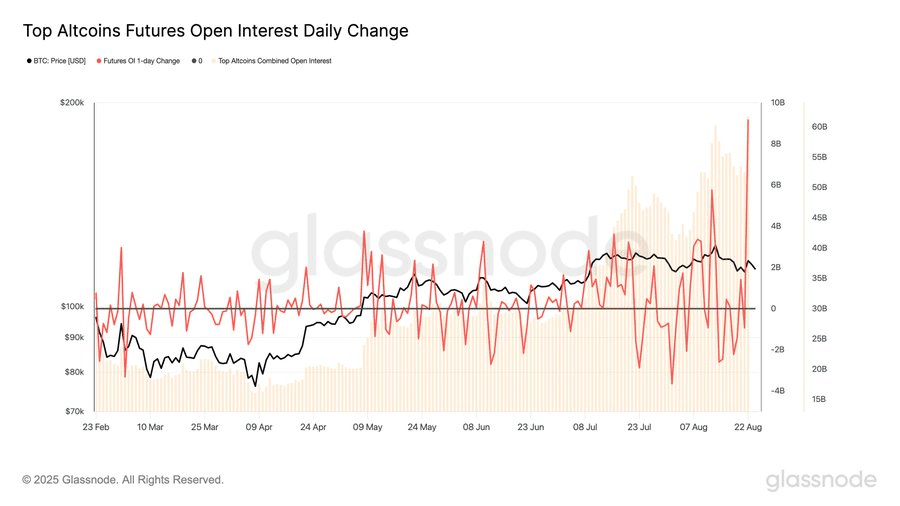

Ever noticed how the crypto market sometimes feels like a wild rodeo –-brimming with excitement one moment and throwing you off the next? Well, here we are again, with Altcoin Open Interest soaring to a staggering $61.7 billion, while the Altcoin Season Index hit 61 for the first time since early 2025. Sounds like the breakout we’ve been waiting for, right? But hold your horses… fading rotational flows are casting a shadow of doubt. So, the big question looms: Is this the dawn of a lasting altseason or just another flash in the pan that leaves traders biting their nails?

In less than three days, the crypto universe lost nearly $20 billion, with Bitcoin alone shedding about $10 billion, reminding us that, even now, this cycle’s still very much BTC-led. Bitcoin’s dominance slid to a multi-month low of 57%, reinforcing a cautious, risk-off vibe across the market. Meanwhile, altcoin futures Open Interest exploded—up $9.2 billion in a single Friday—setting new all-time highs amidst muted flows. It’s almost like everyone’s eyeing an altseason, but are we charging into a storm blindfolded?

If you’re scratching your head, wondering whether traders are just front-running an altseason or setting the stage for heightened volatility, you’re not alone. History’s shown us that such setups come with a fair warning: surging leverage can deepen pullbacks, and unless rotational flows pick up, this heat might just fizzle out sooner rather than later. Ready to dive deep into what’s driving these seismic shifts and whether your portfolio should be buzzing or bracing? Let’s unpack the latest intel together.

Key Takeaways

Altcoin Open Interest hit $61.7 billion as the Altcoin Season Index hit 61 – Its first test since early 2025. And yet, fading rotational flows raised doubts about whether this breakout signals a lasting altseason or not.

In less than 72 hours, the crypto market shed nearly $20 billion, with Bitcoin [BTC] alone losing roughly $10 billion and showing that this cycle is still very much “BTC-led.”

Backing this, Bitcoin dominance [BTC.D] slipped to multi-month lows at 57%, while TOTAL2 (ex-BTC cap) fell in tandem. All in all, rotational flows remained flat, reinforcing a risk-off market.

Altcoin OI surges despite muted flows

Against that backdrop, Altcoin Futures Open Interest (OI) blew up +$9.2 billion on Friday, 22 August, taking the total alt OI (red line) to a fresh all-time high of $61.7 billion. This pointed to rising leverage in alts, despite short-term chop.

Typically, spikes in OI tend to track Bitcoin’s price action.

However, top altcoin OI (beige bars) has steadily climbed from $20 billion in March to $60 billion by late August, adding nearly $40 billion, outperforming BTC’s $30 billion OI growth over the same period.

Put simply, the altcoin market might be overheated. Traders might be front-running an altseason, but with rotational flows muted, could this feed a volatility loop instead?

Altcoin index breaks out, but history urges caution

High leverage across alts amplified the pullback.

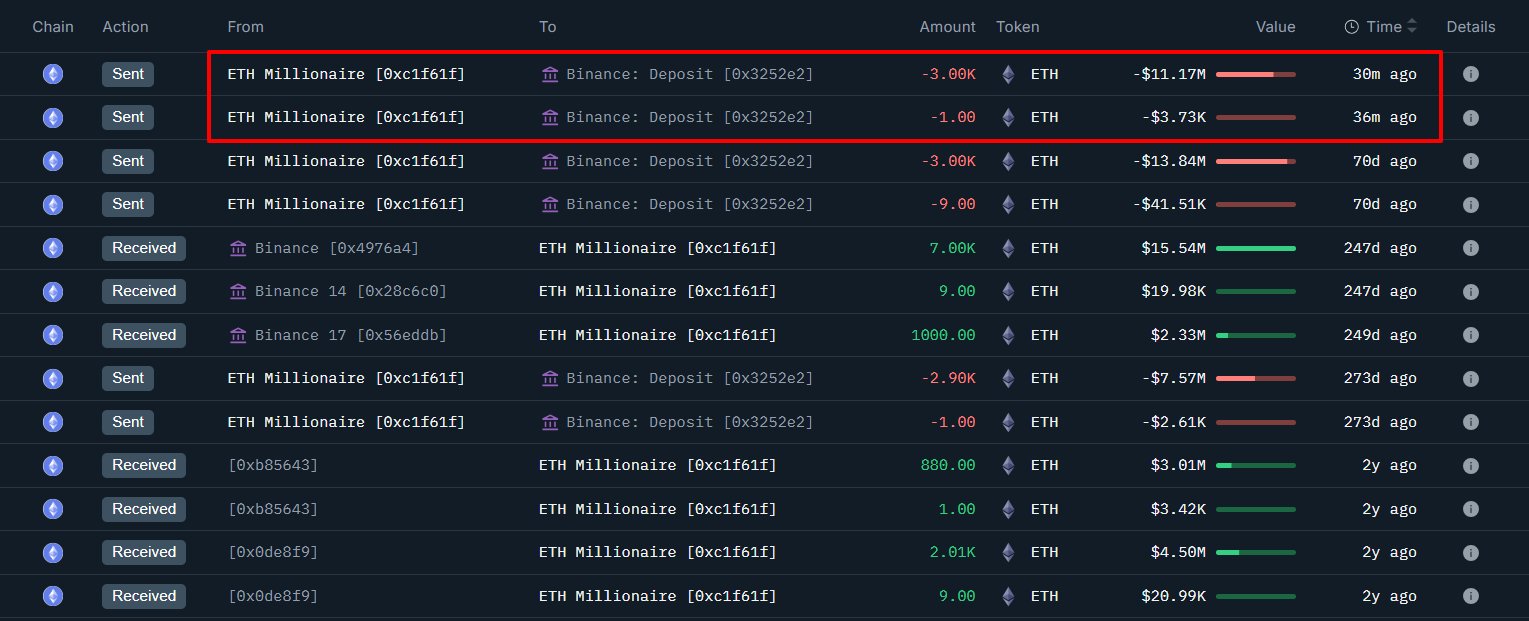

Supporting this, top altcoin Ethereum [ETH] saw a nearly 4% drop in OI over the past 24 hours, aligning with its 3% price decline. All while Bitcoin contained its drop to 2.68%.

Having said that, top altcoins have endured deeper hits, initially triggered by BTC’s correction, but magnified as leverage got flushed out.

This dragged the Altcoin Season Index down to 56 from 61 just a day prior.

History offers a warning

A similar setup back in late Jan-early Feb capped the altseason.

The index hit 61, but BTC’s 18% monthly drop pushed it down to 20 by the end of Q1. Ethereum fell even harder, hitting a monthly low of $1,440 and other altcoins followed suit.

For now, the market is showing signs of stress: Altcoins remain vulnerable, leverage is getting flushed, and any rebound may be short-lived unless rotational flows pick up, capping the altseason again.

Post Comment