Is the Dow’s record surge on softer inflation the green light investors have been waiting for—or just a trap?

Ever wonder what happens when the Dow Jones decides to throw a surprise party and busts through the 47,300-point ceiling like it owns the place? Well, hold onto your hats, because that’s exactly what happened last Friday. The DJIA stomped its way to record highs, fueled by a juicy twist — the US Consumer Price Index came in cooler than expected. Investors? They went from cautious to downright greedy, betting on the Federal Reserve to ease off the gas pedal with not one, but two interest rate cuts before the year wraps up. Now, isn’t it fascinating how markets can dance to the tune of inflation numbers that still hover stubbornly above the Fed’s target? But here’s the kicker: despite stronger-than-expected business surveys, consumer confidence took a nosedive, leaving us all wondering if this optimism is built on solid ground or just a clever illusion. Curious to dive deeper into this economic rollercoaster? LEARN MORE

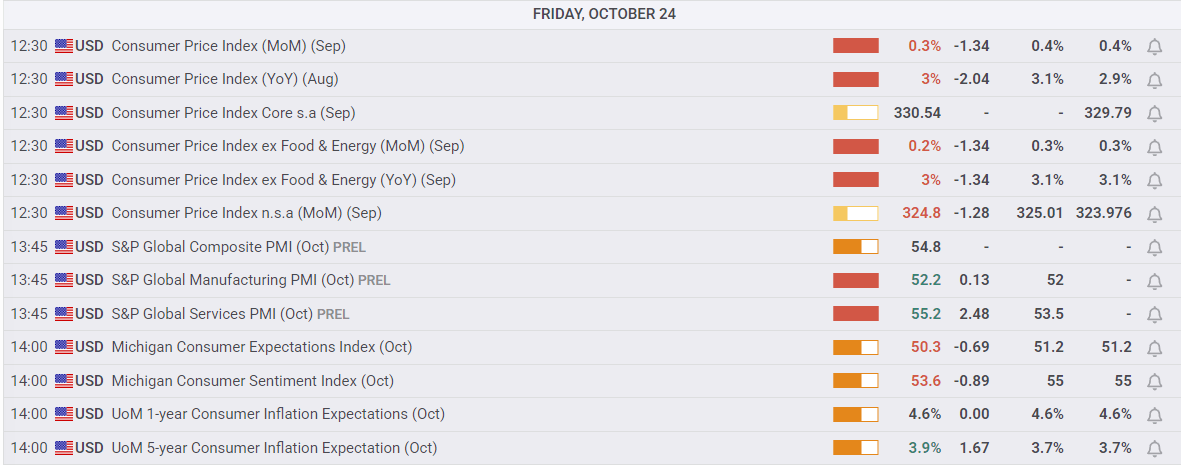

The Dow Jones Industrial Average (DJIA) lumbered into record highs on Friday, posting intraday bids north of 47,300 for the first time ever. Investor sentiment hit high gear after US Consumer Price Index (CPI) inflation came in below expectations, keeping hopes for further interest rates from the Federal Reserve (Fed) pinned to the ceiling.

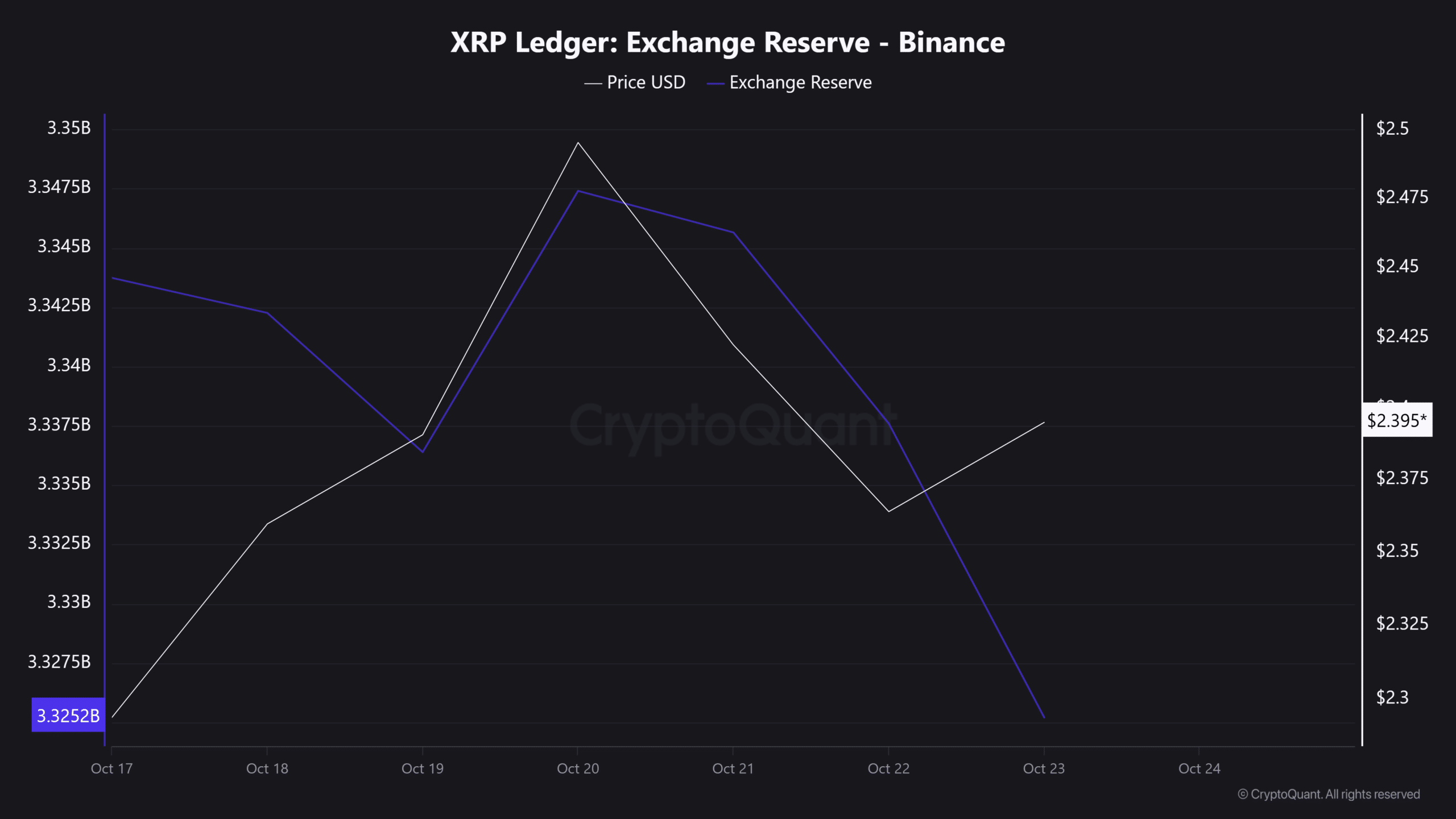

Headline CPI inflation came in at 3.0% YoY in September, clocking in just below the expected hold at 3.1% and sending investors scrambling to pick up risk assets on expectations that the Fed is now locked into two quarter-point interest rate cuts by the end of the year. US CPI metrics broadly came in below expectations, and markets are brushing off the fact that most inflation readings continue to run well above the Fed’s 2% mandate.

Rate cut bets continue to climb on not-hot inflation data

According to the CME’s FedWatch Tool, rate market bets of back-to-back interest rate cuts in October and December are over 95%. Rate traders have also pulled forward the date for the first interest rate cut in 2026 up to March from April.

September’s Purchasing Managers Index (PMI) survey results also surprised markets to the upside, with the Services component rising to 55.2 versus the expected 53.5. However, despite the upswing in business confidence, consumers remain notably more downbeat, with the University of Michigan Consumer Sentiment Index declining to 53.6 from 55.0. UoM Consumer 5-year Inflation Expectations also rose again, climbing to 3.9% from 3.7%.

Dow Jones daily chart

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Post Comment