Is the Next Big Crash Brewing? Uncover How Deep Amundi Global Aggregate Bond A12HS and iShares AGGU Could Plunge Based on Shocking Past Data!

Ever wondered what happens when the “default” fixed income index takes a hit and how it compares to a short-duration bond fund? Well, after breaking down the drawdown details for the LionGlobal Short Duration Fund, I decided to roll up my sleeves and apply the same lens to the Bloomberg Global Aggregate Bond Index (hedged to USD). It’s the heavyweight champion in bonds—holding 19,000 securities, with an average maturity hovering at 8.1 years and a yield that whispers 3.4%. Now, before you yawn at averages and numbers, this isn’t just about stats—it’s about understanding what those drawdowns really mean for your financial planning and portfolio resilience. Spoiler alert: while index fixed income tends to recover, duration isn’t just a number on paper—it’s your financial future’s heartbeat. Ready to dive into the nitty-gritty of bond durations, drawdowns, and what it all means for your strategy? Let’s get to it. LEARN MORE

img#mv-trellis-img-1::before{padding-top:51.07421875%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:59.66796875%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:42.307692307692%; }img#mv-trellis-img-3{display:block;}

I thought since I did a drawdown for the LionGlobal Short Duration Fund in my last article, I just use the same methodology and did a drawdown on the Bloomberg Global Aggregate Bond Index (Hedged to USD).

The Bloomberg Global Aggregate Bond Index is like the default fixed income index.

- It holds 19,000 securities

- Average yield to maturity of 3.4%

- Average maturity of 8.1 years.

- Effective Duration of 6.3 years.

- Average coupon of 2.87%

This is my 13% fixed income allocation in Daedalus express with AGGU, which is a Irish Domiciled UCITS Accumulating ETF. For those who wish for a SGD hedged one, it will be the Amundi Global Aggregate Bond A12HS from Poems or Endowus.

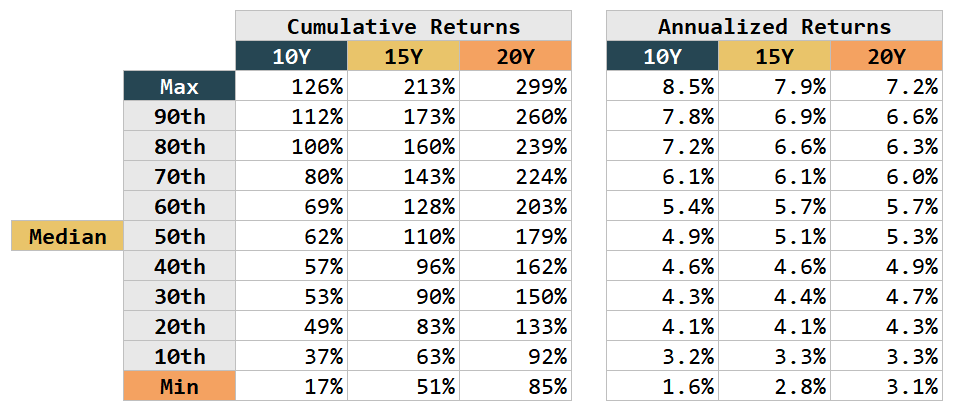

We have data from Jan 1990 to Aug 2025 which is about 35.5 years.

Here is how the drawdown look like:

Now you can contrast this to the 2.2 years duration LionGlobal Short Duration fund:

Most of your eyes will be drawn to the similarity and differences in that big drawdown. The Global Aggregate Bond index has a larger degree of drawdown (-13% vs -7.5%) and also a longer recovery (57 months vs 29 months and the SGD hedged one have not recovered yet).

But I think the underlying lesson is also that index fixed income will recover, but you got to respect the duration of the portfolio of securities.

And so you got to think about it from the financial planning perspect.

The second thing is, aside from this big drawdown, notice the difference in the smaller drawdowns.

They are in the 1-2% range.

Can you accept this kind of drawdown?

It is a good question to ask.

You are taking on greater term risks in the hope of higher potential returns. But in a way pushing duration out from 2.2 years to 6.2 years is more but it still gives you adequate financial planning flexibility.

Sometimes, these things are not binary.

In my Financial Returns Data in One Post, I tabulated a lot info on the Global Aggregate bond index.

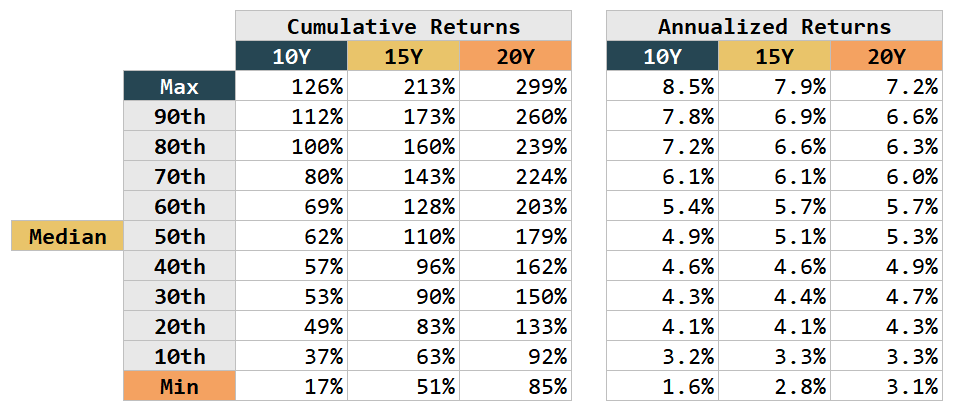

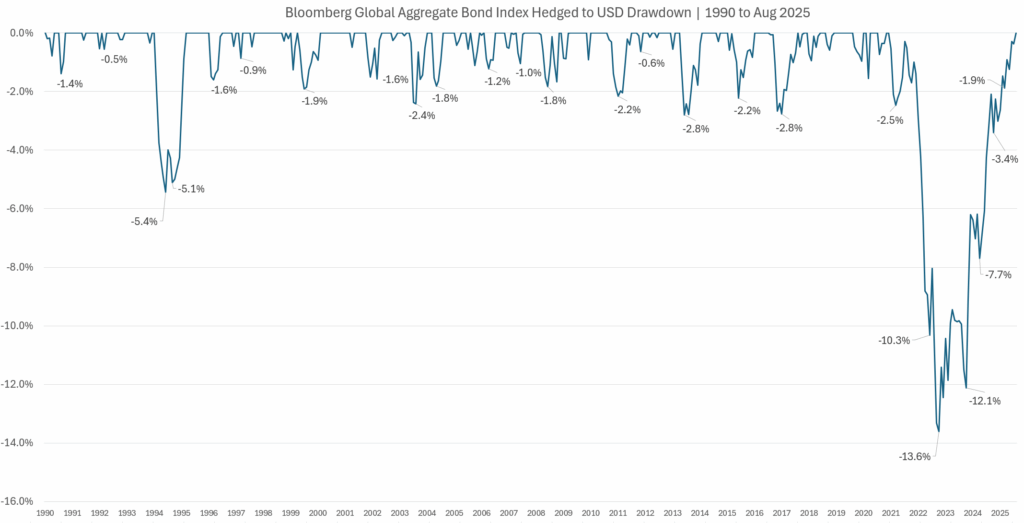

The table below is extracted from there and shows the cumulative (or total) return and annualized return of the Global Aggregate Bond hedged to USD if you hold for 10-years, 15-years and 20-years:

This is imagine you got $20 million and decide to sink the whole money lump sum into either months from Jan 1990 to Dec 2024 (not Aug 2025).

And as you see even some of the more pessimistic returns at 20th percentile is similar to the LionGlobal Short duration bond. This is despite the drawdowns you see in the previous charts.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment