Is the Stock Market’s Unstoppable Rally a Genius Play or a Ticking Time Bomb?

Volatility fluctuates

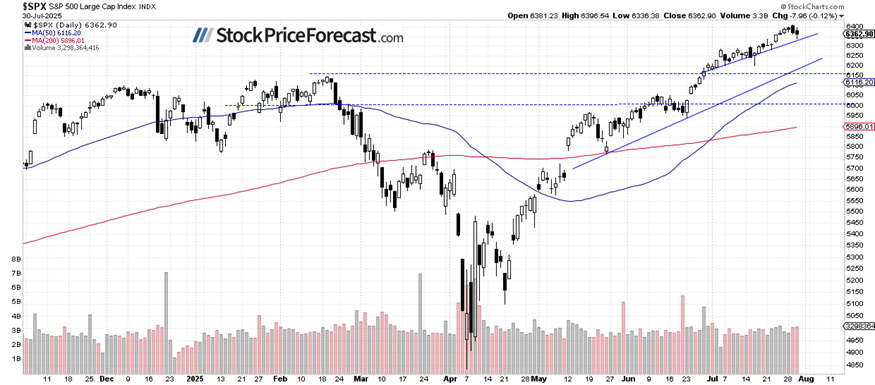

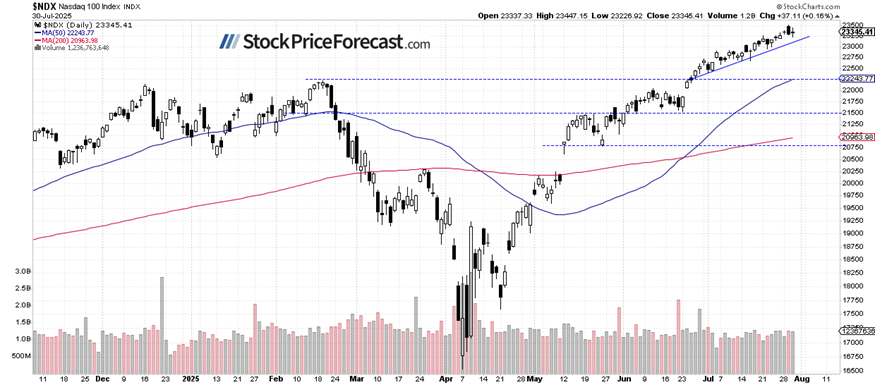

The VIX (Volatility Index) fell to a local low of 14.70 on Tuesday before rebounding to 17.3 and then pulling back.

The decline in VIX reflected declining investor fear (declining gold prices indicate the same thing), but the sharp reversal may signal a short-term market top.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

Post Comment