Is TRON’s TRX About to Break Free or Crumble? Here’s the $0.319 Turning Point Bears Don’t Want You to See!

TRON just took a hit below the $0.333 mark — a stubborn breach that’s got the market scratching its head. On one side, fundamentals are looking shaky: declining Total Value Locked, chain revenue shrinking, and trading volumes slipping like a greased slide. On the other, bullish traders are holding tight, heck, even doubling down with a $110 million boost to the treasury from Bravemorning Limited. It’s like watching a heavyweight bout where both fighters refuse to tap out — but the bell hasn’t rung yet. So here’s the million-dollar question: Is TRX gearing up for a rebound, or are we staring down the barrel of $0.319? The stakes are high, the signals mixed, and if you’re in the game, now’s the time to ask yourself — what’s your next move? LEARN MORE

Key Takeaways

TRON fell below $0.333 as weak fundamentals clashed with bullish longs and a $110 million treasury boost, leaving its next move uncertain. Is $0.319 the next stop for TRX?

TRON [TRX] slipped deeper into bearish territory after breaching support levels at $0.3440 and $0.333 within two weeks.

Yet, the sell-off comes as weak on-chain metrics collide with bullish long bets and a $110 million treasury boost – Leaving traders split on what happens next.

At press time, TRX traded at $0.3313, down 2.07% in 24 hours, per CoinMarketCap. On top of that, daily trading volume rose 1.37% to $885.36 million, suggesting active participation despite selling pressure.

Why is TRX’s value dropping?

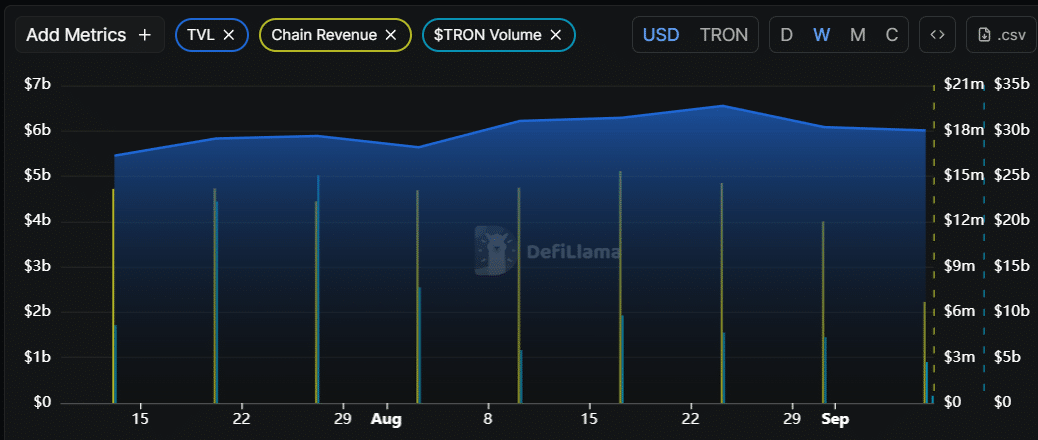

The potential reason behind this continuous price decline seemed to be the current market uncertainty, along with declining Total Value Locked (TVL), Chain Revenue, and TRON’s Trading Volume.

DeFiLlama data showed TRON’s TVL dropped from $6.28 billion in early August to $6.009 billion at press time.

At the same time, Chain Revenue fell from $6.68 million to $5.33 million, while Volume halved from $9.65 billion to $4.51 billion.

If these metrics failed to recover, downside pressure on TRX prices could intensify.

TRX’s technical outlook turns bearish

AMBCrypto’s technical analysis showed that TRX has slipped below the $0.333 support, opening the door to further downside.

On the daily chart, as given below, the latest breakout candle strengthened this bearish outlook by forming a hammer pattern.

Looking at the price action, it can be inferred that, if TRX stayed below the $0.333 level, it could see another 3.90% dip toward the $0.319 support.

If this momentum continued, the price could even reach the $0.297 level.

Additionally, at press time, the Average Directional Index stood at 29.42, confirming a strong directional trend. That trend suggested continued selling momentum if fundamentals weakened further.

Derivatives and $110M injection into TRX treasury

Despite bearish price action and weak fundamentals, traders appeared to be strongly betting on long positions.

CoinGlass data showed that TRX’s Long/Short ratio reached 1.2406 at press time, its highest level since early August 2025.

This indicated strong bullish sentiment among traders, with 55.37% holding long positions while 44.63% remain short.

Another catalyst in favor of TRX holders is the expansion of the TRX treasury through a $110 million investment from its largest shareholder, Bravemorning Limited.

The shareholder exercised all outstanding warrants, adding 312.5 million TRX to the company’s treasury.

This move pushed Tron Inc.’s treasury holdings beyond $220 million, signaling long-term confidence even as price action weakened.

Post Comment