Is Trump’s ‘Biggest Deal Ever’ the Hidden Trigger Propelling Bitcoin Beyond $120K?

Ever wonder what happens when two economic powerhouses suddenly decide to call a truce instead of throwing punches? Well, grab your coffee because the U.S. and the EU just flipped the script on what looked like an impending tariff showdown — slashing those tariff threats in half and lighting up global markets like fireworks on the Fourth of July. After months of back-and-forth that had traders biting their nails, this surprise trade deal dropped at none other than Trump’s golf resort in Scotland, signaling a much-needed sigh of relief across the financial landscape. It’s like the biggest heavyweight match just turned into a friendly handshake—big news for nearly a third of global trade, sparking waves from Wall Street to the crypto world. Curious how this unexpected détente is reshaping investments and what it means for the next big market moves? Trust me, you don’t want to blink here. LEARN MORE

Key Takeaways

The U.S. and EU struck a surprise trade deal, slashing proposed tariffs in half and triggering a global market rally. Investors cheered what many saw as a de-escalation of global economic tensions.

After months of rising tensions fueled by tariff threats, the United States and the European Union have finally struck a framework trade agreement that eases fears of a full-blown economic standoff.

Announced at Donald Trump’s golf resort in western Scotland, the deal followed a one-hour meeting with EU President Ursula von der Leyen.

It imposed a 15% import tariff on most EU goods, half the originally threatened rate.

A pause in the tariff wars

The move marks a clear de-escalation in transatlantic trade tensions. Together, the U.S. and EU account for nearly a third of global trade, making this agreement a meaningful reset in increasingly uncertain economic times.

Remarking on the same, Trump told Reuters,

“I think this is the biggest deal ever made.”

Echoing similar sentiments, von der Leyen added,

“We have a trade deal between the two largest economies in the world, and it’s a big deal. It’s a huge deal. It will bring stability. It will bring predictability.”

Impact on the traditional and crypto market

Needless to say, markets responded swiftly to the announcement of a finalized U.S.-EU trade deal.

The S&P 500 surged past the 6,400 mark, while Futures tied to the Dow Jones rose by 180 points and the Nasdaq 100 gained 0.4%.

The renewed risk appetite wasn’t limited to equities alone.

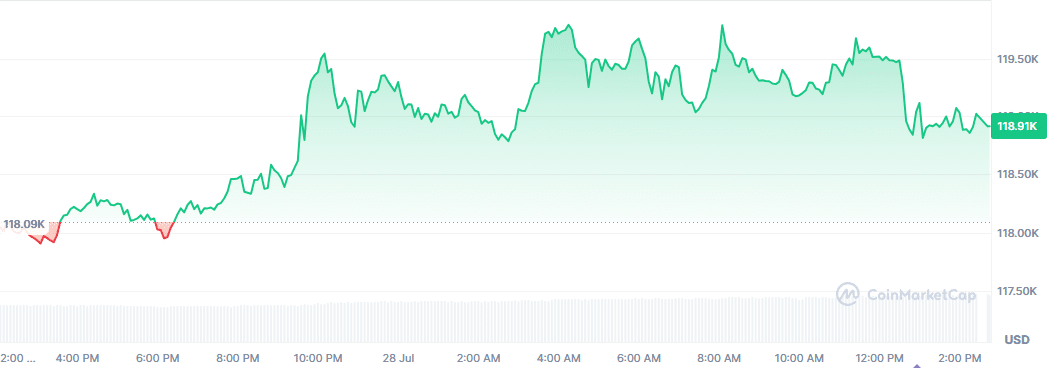

Bitcoin [BTC], too, saw an immediate reaction, breaking through the $120,000 mark for the first time in nearly two weeks before settling slightly lower at $119,551.88.

Ethereum [ETH] also gained traction, rising over 3.5% in the past 24 hours to trade around $3,930, while Binance Coin [BNB] recorded a 7% daily surge, according to CoinMarketCap.

However, despite the renewed optimism in both equities and crypto, the market wasn’t without its casualties.

In the past 24 hours alone, over 94,542 traders were liquidated, amounting to losses of more than $255.81 million, as per CoinGlass data.

The Crypto Fear and Greed Index ticked up to 67, from 64 the day before, returning to last week’s “Greed” territory.

That’s up from 64 the day before and mirrors levels seen last week.

‘Tail risk’ removed, but for how long?

Seeing these shifts, Thomas J. Lee, the CIO & Portfolio Manager at Fundstrat Capital, took to X and noted,

“This removes a negative “tail risk” event = good for equities.”

This is a sharp contrast to the 7th of July, when Bitcoin plunged below $108,000 after Trump imposed 25% tariffs on imports from Japan and South Korea, triggering widespread jitters.

This time, the softer stance toward Europe is being read as a stabilizing gesture, not a disruptive one, potentially setting the stage for more sustainable upside.

Post Comment