Is Trump’s ‘Revenge Tax’ About to Shake Your US Investments—And How to Outsmart the Storm Before It Hits?

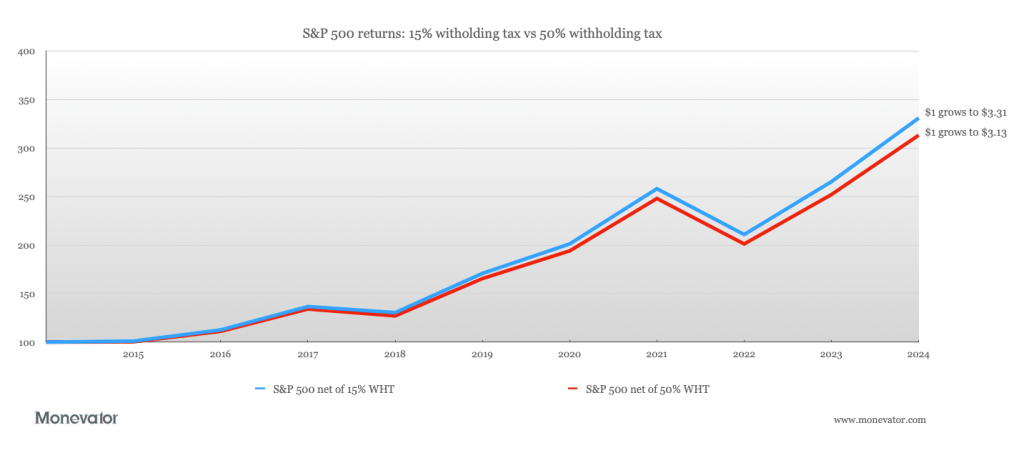

Synthetic ETFs don’t have to pay US WHT. They duck the tax by using a financial derivative to pay the index return – as opposed to the normie approach of actually holding the shares that comprise the index.

This isn’t regarded as a tax dodge.

Synthetic S&P 500 ETFs have been operating since 2010. They’ve accumulated billions in assets under management. They’re not in the cross-hairs of the IRS.

iShares, Xtrackers, and Amundi have all launched new synthetic S&P 500 ETFs in the last few years as word spread that their withholding tax advantage gave them the edge over physical ETFs.

Post Comment