Is Trump’s ‘Revenge Tax’ About to Shake Your US Investments—And How to Outsmart the Storm Before It Hits?

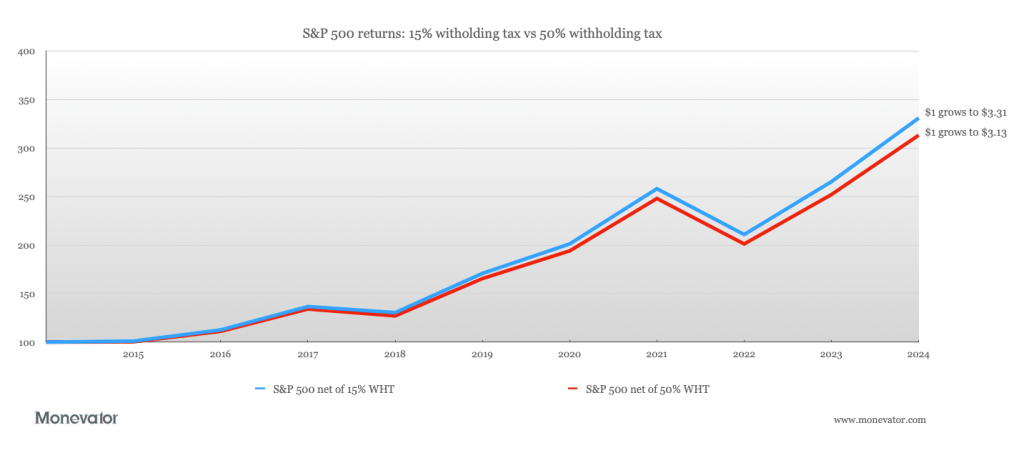

Irish-domiciled ETFs are typically structured as Irish corporations and pay withholding tax at the fund level, so UK domiciled funds could gain a competitive advantage in that scenario.

There’s also a Section 899 exemption for ‘United States-owned’ foreign corporations. This applies if more than 50% of the entity’s vote or value is held by US persons.

Could that mean we’d be protected from Section 899 by funds from US firms like iShares, Vanguard, or State Street? Again, I’m not an international tax lawyer on a MAGA retainer. (Though I wish I was paid like one).

Post Comment