Is Trump’s ‘Revenge Tax’ About to Shake Your US Investments—And How to Outsmart the Storm Before It Hits?

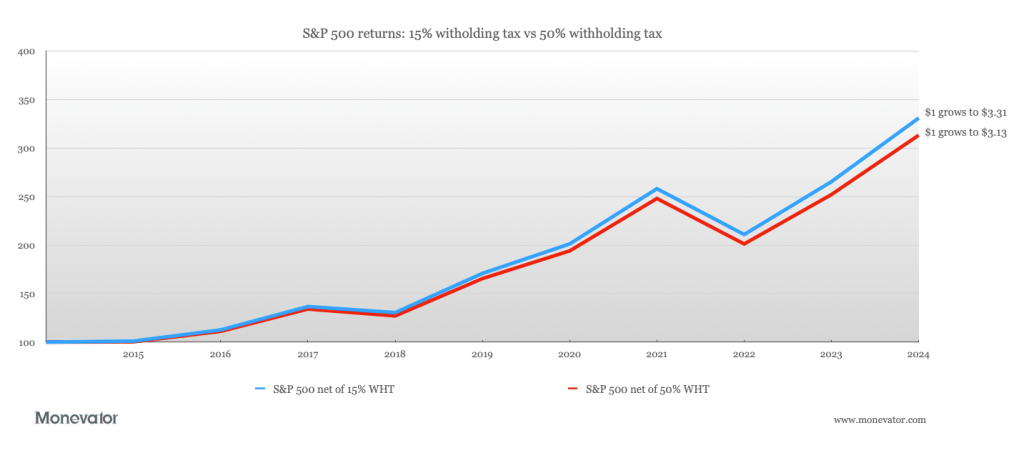

Right now, you’re typically in for 15% WHT on US securities held via an Irish-domiciled fund or ETF. You get 50%-off the main rate due to a Double Taxation Agreement (DTA) that exists between the United States and Ireland.

UK domiciled funds also qualify for the 15% withholding tax rate. Mighty Blighty has a deal with Uncle Sam, too.

Fund managers have to actively claim the rebate, which I imagine is much like wangling a gift voucher out of your mobile phone provider: “Only valid when accompanied by an original receipt, recent dental X-ray, and proof of being heir to the throne…”

Post Comment