Jito Prices Plummet, But JTO Whales Are Quietly Stacking Up—Discover the Secret Move That Could Rewrite the Market Rules!

So, here’s the tea: Jito [JTO] has just taken a nosedive, plunging close to its all-time low with a 12% drop in just one day. Not exactly the kind of drama investors like to see—but before you hit the panic button, hold on. What if I told you there’s a quiet army of whales quietly stockpiling JTO tokens right now? Yes, those big fish are stepping in at the dip, scooping up assets both on spot and futures markets. It’s kind of like a backstage hustle unfolding while most are busy worrying about the crash. Add to that the Futures market showing a surge in buyer dominance, and suddenly the narrative shifts from total collapse to “maybe, just maybe, we’ve got a potential rebound on our hands.”

And hey, if you’re into charts and technical patterns, you’ll be curious to know that JTO is nestled within a bullish flag setup—a classic consolidation phase that’s often the calm before the storm. If buying momentum kicks into overdrive, we might be on the brink of a sharp reversal. But here’s the kicker: will this whale accumulation and Futures bullishness be enough to stop the bleeding and ignite a turnaround? Only time and the market’s mood will tell. Meanwhile, the token holds its breath, and so do we.

Key Takeaways

What signals suggest Jito might recover despite its recent decline?

Whale accumulation and buyer dominance in the Futures market point to potential stabilization or rebound.

What technical pattern is JTO currently forming?

JTO is consolidating within a bullish flag pattern, indicating a possible reversal if buying momentum strengthens.

Jito [JTO] prices are approaching the token’s all-time low after a 12% drop over the last 24 hours, as of writing.

The sharp decline has shaken investor confidence, but a few encouraging on-chain signals suggest the token may not be entirely out of the fight yet.

Could the building on-chain factors save the token from collapse?

Whales are stepping in at the dip

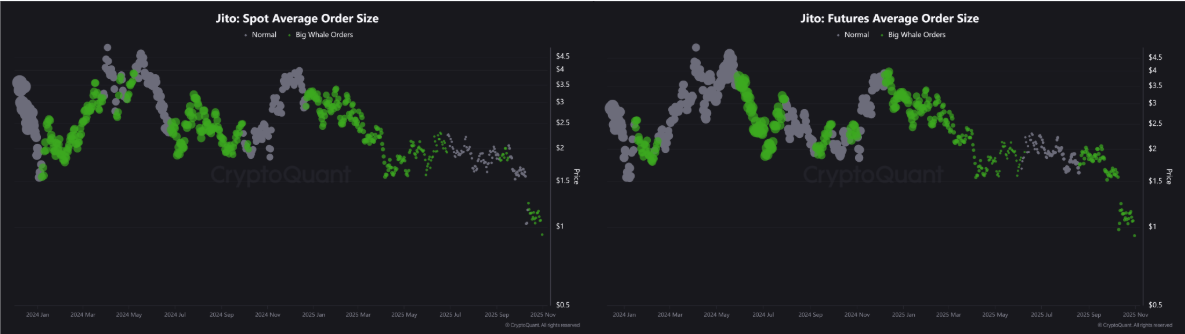

Large investors are steadily accumulating JTO across both spot and futures markets, as shown by recent Average Order Size data.

This quiet but consistent buying activity suggests that high-cap traders view the current price levels as a long-term opportunity.

Historically, similar accumulation phases have often led to short-term rebounds or helped stabilize falling prices, signs that Jito may be entering a potential recovery phase.

JTO buyers dominate the Futures market

Alongside whale accumulation, buyers are clearly dominating Jito’s Futures market. The CryptoQuant data indicates a surging dominance over the past few days.

The increased long positioning indicates that JTO traders and investors are expecting a recovery or, at the very least, a temporary price correction.

Usually, when Futures market sentiment aligns with whale accumulation, a bullish price push always follows.

Interestingly, the buyers are chipping in at the perfect time when the seller’s momentum is nearing an end. On the daily chart, the altcoin Stochastic RSI was approaching an oversold region at press time.

The strength of any potential reversal will depend on how bullish investors respond, as the altcoin is currently in a consolidation phase.

At the moment, the token remains confined within a bullish flag pattern, signaling a possible breakout if buying momentum builds.

Will it be enough to stop the fall?

While Jito’s short-term outlook remains uncertain, on-chain metrics and technical indicators suggest a possible turning point.

If whale demand continues to build and buyers maintain dominance in the derivatives market, JTO could avoid slipping into a full collapse.

Post Comment