Lighter DEX’s Bold Move: Why Repaying Users in Stablecoins Could Change the Game After a Massive Outage

Ever wondered what happens when a glitch locks you out of your own trading account during a market freefall? Well, Lighter’s recent mishap gave over 2,000 traders a harsh lesson in digital vulnerability — a database hiccup right when crypto markets crashed, leaving users stranded and staring at serious losses. But here’s the twist: instead of just shrugging it off, Lighter is stepping up to the plate, rolling out compensation in stablecoins and points to make things right before unveiling its much-anticipated token. It’s a bold move that not only aims to rebuild trust but also sparks a fascinating debate about responsibility in the decentralized exchange space. Can a platform turn a technical failure into a growth opportunity? Let’s dive into what this means for Lighter’s users and the evolving perp DEX landscape. LEARN MORE

Key Takeaways

Why is Lighter compensating traders?

A database failure during October’s crash locked users out, causing heavy losses across 2,000+ accounts.

What’s next for Lighter’s users?

Compensation starts Monday in stablecoins and points, ahead of the platform’s token launch.

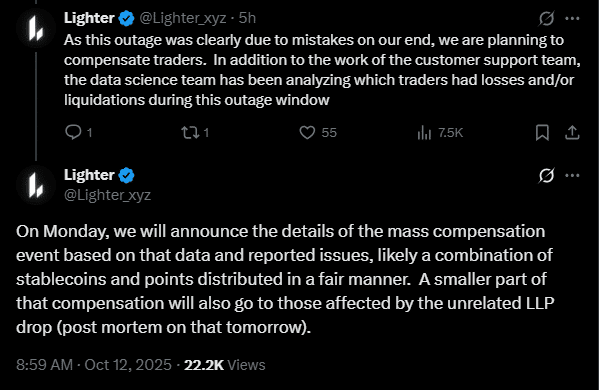

Lighter decentralized exchange (DEX) has announced plans to fully compensate traders who were affected during the recent system outage.

In a post on X (formerly Twitter), the platform said that it would roll out repayment for over 2000 users who were impacted by the 4.5-hour downtime on the 10th of October.

Lighter added that victims would receive stablecoins and points (used for farming its upcoming token) as part of the compensation package.

Crypto flash crash impact

According to Lighter, the outage was triggered by the database upgrade hiccup, just after the Friday market crash.

Over that period, users couldn’t enter or exit trades, leading to over 2000 affected victims. Per its post-mortem, 367 users lost over $10K while 38 traders lost over $100K. Overall, 2008 users lost over $1K.

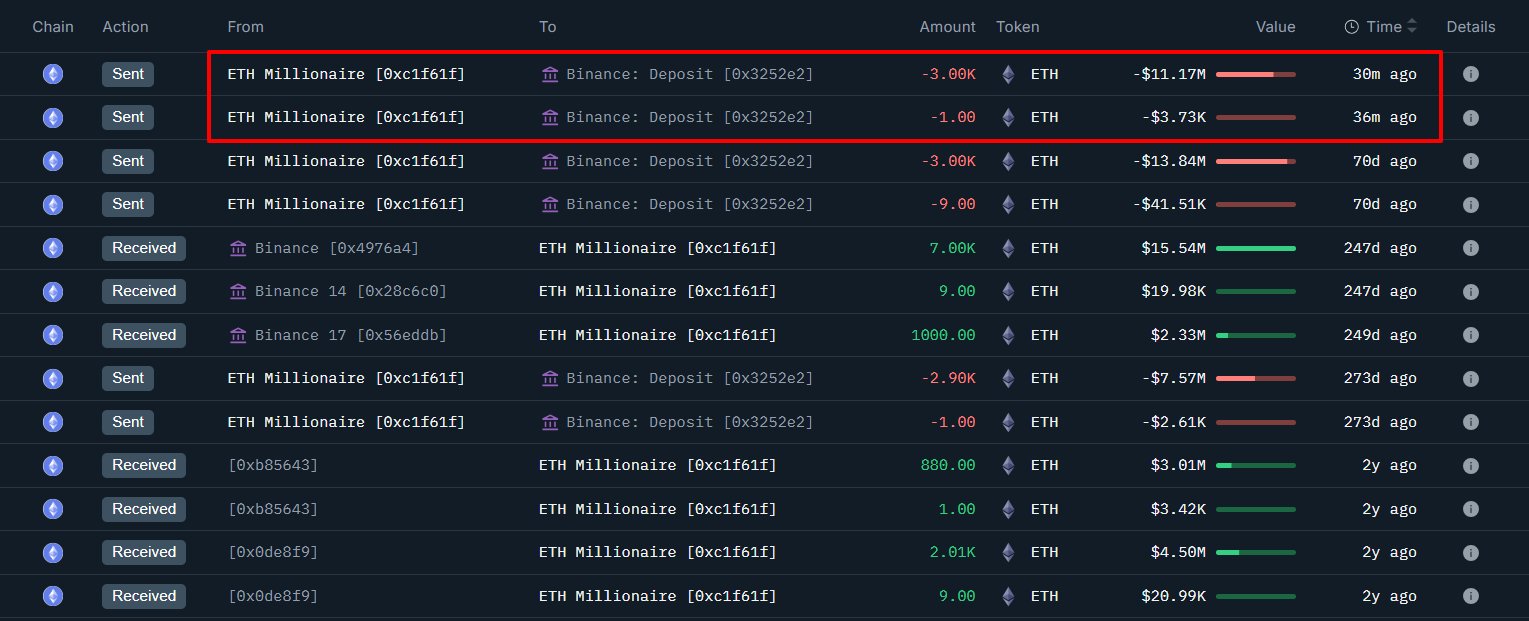

However, the crash on the 10th of October also overwhelmed other leading platforms like Binance [BNB] and Robinhood. Although Binance co-founder Yi He didn’t commit to refunding losses, she reiterated that they’ll address every complaint on a case-by-case basis.

Lighter challenges Hyperliquid’s lead

That being said, Lighter is a perp DEX based on Ethereum [ETH]. Alongside Aster [ASTER], the duo seeks to challenge Hyperliquid’s [HYPE] dominance in the perp DEX space.

Interestingly, Lighter has been on a tear lately. As of October, it saw $93 billion in Perp Volume while Hyperliquid raked in $109 billion over the same period.

But the growth isn’t surprising as the platform doesn’t charge retail users fees. Only high-frequency flow and API pay fees to access the platform.

However, Lighter could release its native token later in Q4, 2025. Currently, it’s running the second phase of its point farming, allowing users to get a share of the token supply.

As a result, the farming could juice its overall perp volume as users chase its upcoming token launch.

Meanwhile, the broader Perp DEX segment posted mixed results after the Friday crash.

Notably, HYPE’s price was down another 6% in the past 24 hours. MYX Finance [MYX] also dipped 4% but ASTER rebounded 4%.

Post Comment