Mantle Rockets 12% – The Unexpected Catalyst That Could Skyrocket MNT Past $1.40 Sooner Than You Think!

Mantle just pulled off a rally that’s turning heads — shooting up 12.31% to hit a 7-month high of $1.26, before settling back at $1.21. What’s really got me intrigued? The whales are swimming back in with a hefty 937K buys, and futures are buzzing with a 26% spike in Open Interest. It’s like watching a blockbuster sequel where the big players are making their dramatic return to the spotlight. But here’s the million-dollar question: is this bullish momentum the start of a new upward saga, or are we bracing for some rollercoaster volatility or a sharp reversal? The market’s throwing out some tantalizing clues — from aggressive accumulation in the spot market to heavy outflows hinting at upside pressure, plus futures data signaling a burgeoning long demand. As someone who’s seen trends rise and fall like tides, I can’t help but wonder where Mantle’s path leads next. Buckle up — things are heating up. LEARN MORE

Key Takeaways

Mantle’s $1.26 rally drew whales back with 937K buys, futures saw a 26% Open Interest spike and momentum turned bullish. Could volatility or a sharp reversal be next?

Mantle [MNT] rallied 12.31% to a 7-month high of $1.26 before easing back to $1.21 at press time.

Over the same period, the altcoin’s market cap surpassed $4 billion for the first time in 7 months, reflecting steady capital inflow.

Mantle whales make a comeback

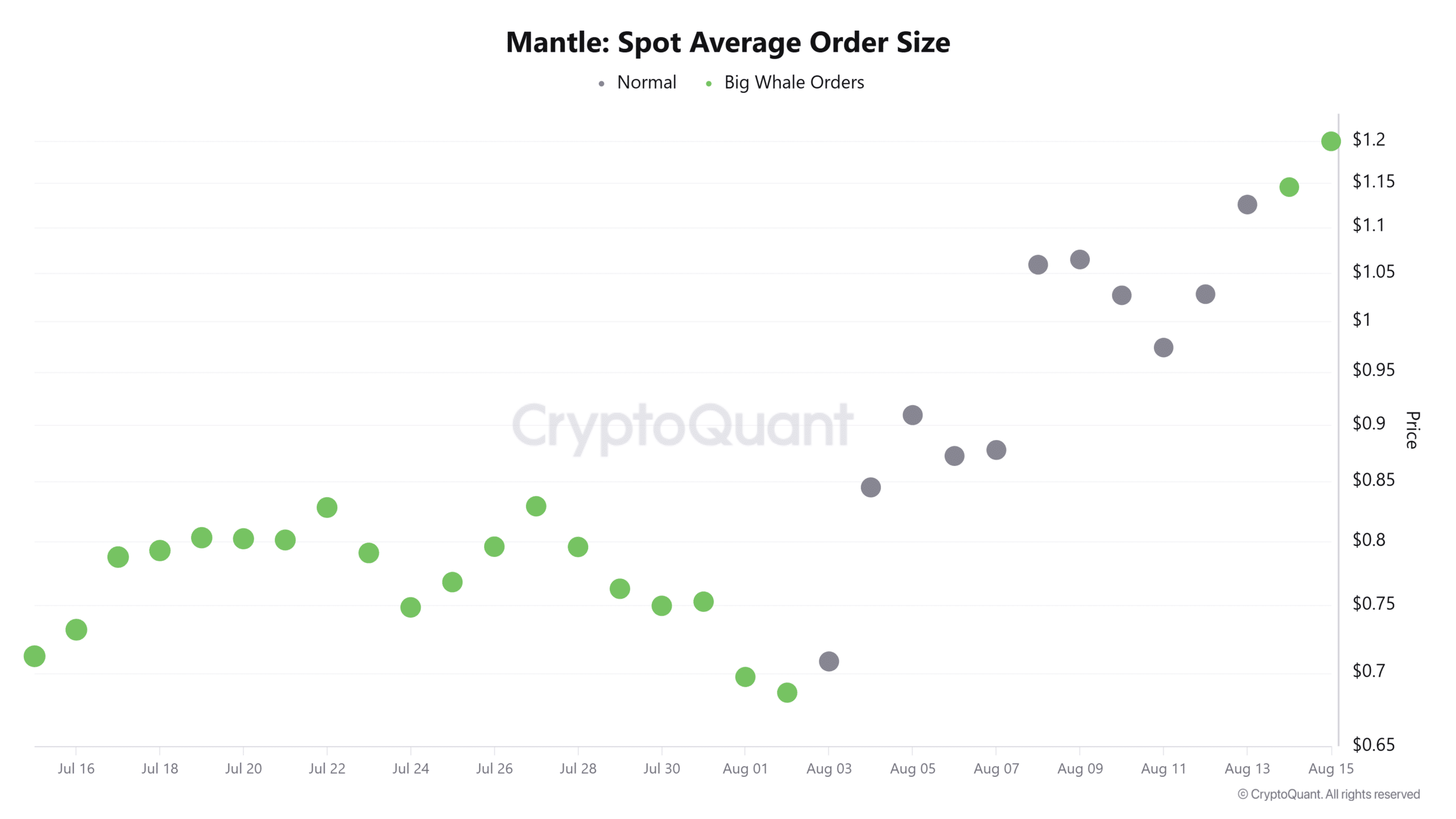

After taking a step back from the spot market 13 days ago, Mantle whales re-entered. Spot Average Order Size data from CryptoQuant showed that Mantle showed Big Whale Orders between the 15th and the 16th of August.

Typically, when the spot market records whale orders, it signals heightened whale participation across supply and demand.

Naturally, Spot Buy vs. Sell Volume suggested these whales were in accumulation mode. According to Coinalyze, Mantle recorded a positive Buy/Sell Delta for two straight days.

On the 15th and the 16th of August, Mantle saw a cumulative 937K in Buy Volume against 455K in Sell Volume. This produced a positive Delta of 480k, a clear sign of aggressive accumulation.

On top of that, exchange flows echoed the trend.

According to CoinGlass, Mantle recorded negative Spot Netflow for a sustained period. At press time, this metric stood at -$5.73 million, highlighting heavier outflows than inflows. Historically, higher outflows have preceded stronger upside pressure.

Futures turn increasingly bullish

Having said that, derivatives data pointed to an equally strong shift.

According to CoinGlass, Derivatives Volume jumped 14.19% to $103.6 million, while Open Interest (OI) climbed 26% to $80.6 million, at press time.

When Volume and OI rise together, it signals deeper participation and inflows into futures.

Meanwhile, Mantle’s Long/Short Ratio hit 1.01, with longs accounting for 51.7% and shorts for 48.3% of positions.

When futures record a higher demand for longs, it indicates that most market participants are mainly betting long.

Buyers push momentum to the limit

According to AMBCrypto’s analysis, whale demand has reignited Mantle’s momentum.

For that reason, Mantle’s Moving Average Convergence Divergence surged to 0.11, at the time of writing, indicating strong demand.

At the same time, its Stochastic RSI hiked to 89, touching the overbought zone, further confirming the buyer’s dominance.

In fact, such momentum signals firm upward bias but often carry warnings of volatility.

If buyer momentum holds, Mantle could reclaim $1.20 and eye $1.40 as resistance. However, fading whale demand or renewed selling could drag MNT back toward $1.05.

Post Comment