Monero Defies the Odds: How a Devastating 51% Attack Sparked an $11 Surge and What It Means for Crypto Investors Now

Ever wonder what happens when a cryptocurrency like Monero, praised for its privacy and decentralization, faces a 51% attack on its total hashing power? It’s like watching a high-wire act without a safety net—thrilling yet nerve-racking. Monero [XMR] surged impressively, jumping $11 in just 24 hours and landing among the top gainers. Yet, beneath this price spike lurks a shadow: the unsettling reality that Qubic commandeered over half of Monero’s hashrate, threatening the very fabric of its network integrity. This isn’t just a blip; it’s a glaring reminder that even the most resilient cryptos can face existential risks. So, are these gains a fleeting victory lap, or could this attack trigger a deeper tumble in XMR’s price? Dive deeper to understand what this means for the future of Monero and what moves savvy investors might consider next. LEARN MORE

Key Takeaways

Monero saw a 51% attack on total hashing power, impacting its integrity. XMR jumped by gains during this period, but the attack raised a threat of price decline.

Monero [XMR] rose by $11 in 24 hours as per data from CoinMarketCap, clinching the third position among top gainers.

Price climbed from $256 to $266 at the time of press. The volume surged by more than 56% with $83.38 Million traded on the day.

These positive gains were however at the risk of being wiped out. This followed the attack on the network’s integrity.

Impact of Monero’s network attack on price

The attack saw Qubic control more than 50% of Monero’s hashrate alone. Qubic noted that the Monero incident was a test but did represent what Qubic stood for.

From this, Qubic mined more than 80% of the blocks in a very short period.

The activity raised concerns over its price stability. Price dropped immediately but recovered shortly afterward. This meant the drop could have presented an opportunity to go long.

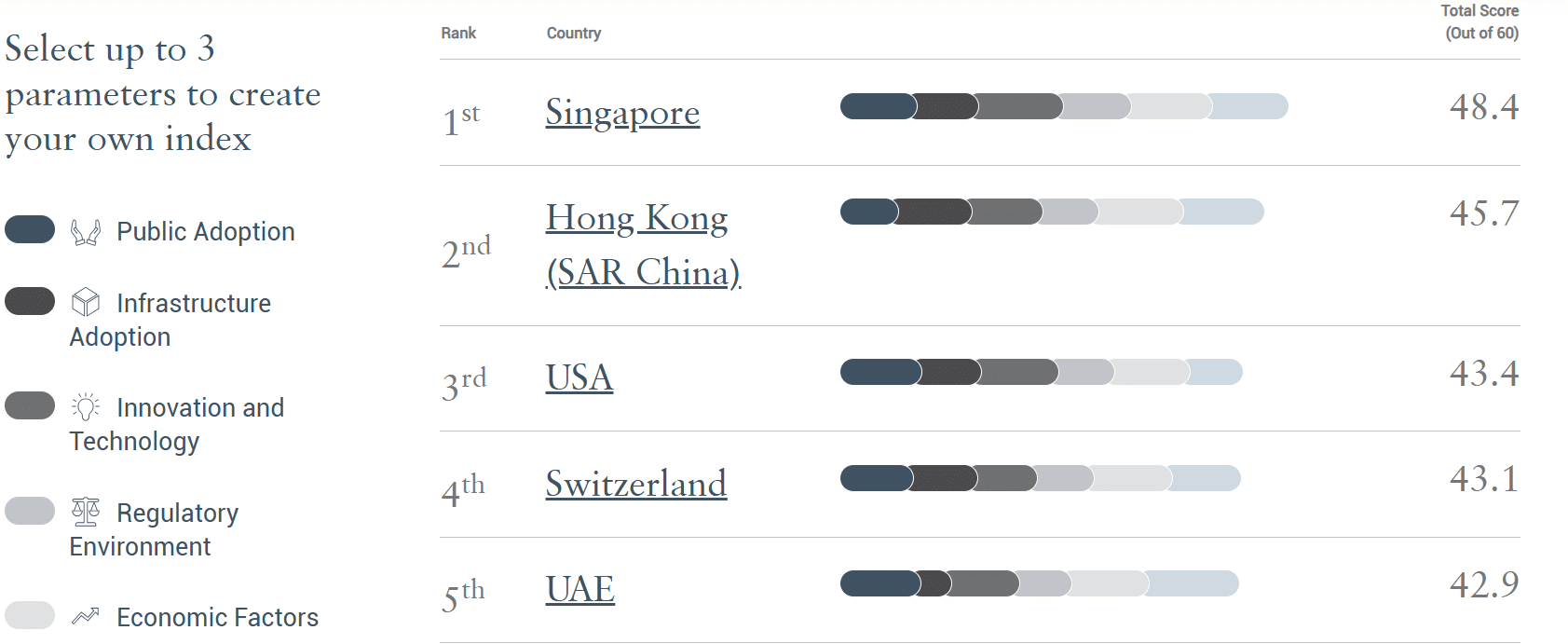

Moreso, the decentralization of the cryptocurrency was threatened following the concentration of power from one source.

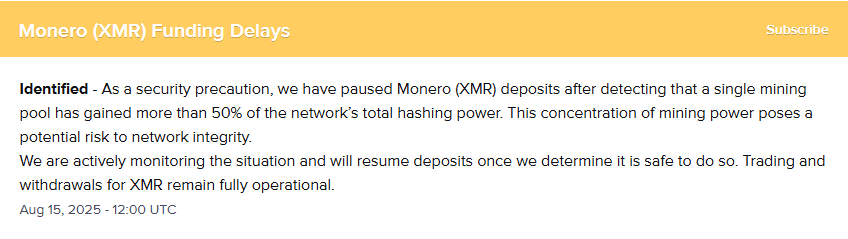

The hashrate peaked at 2.71 GH/s. This led to Kraken suspending deposits but trading and withdrawals were maintained. Kraken would only resume deposits after careful consideration on the safety.

Meanwhile, the Fear and Greed index was neutral as per CFGI. This showed the sentiment had cooled off, potentially after Qubic’s clarification.

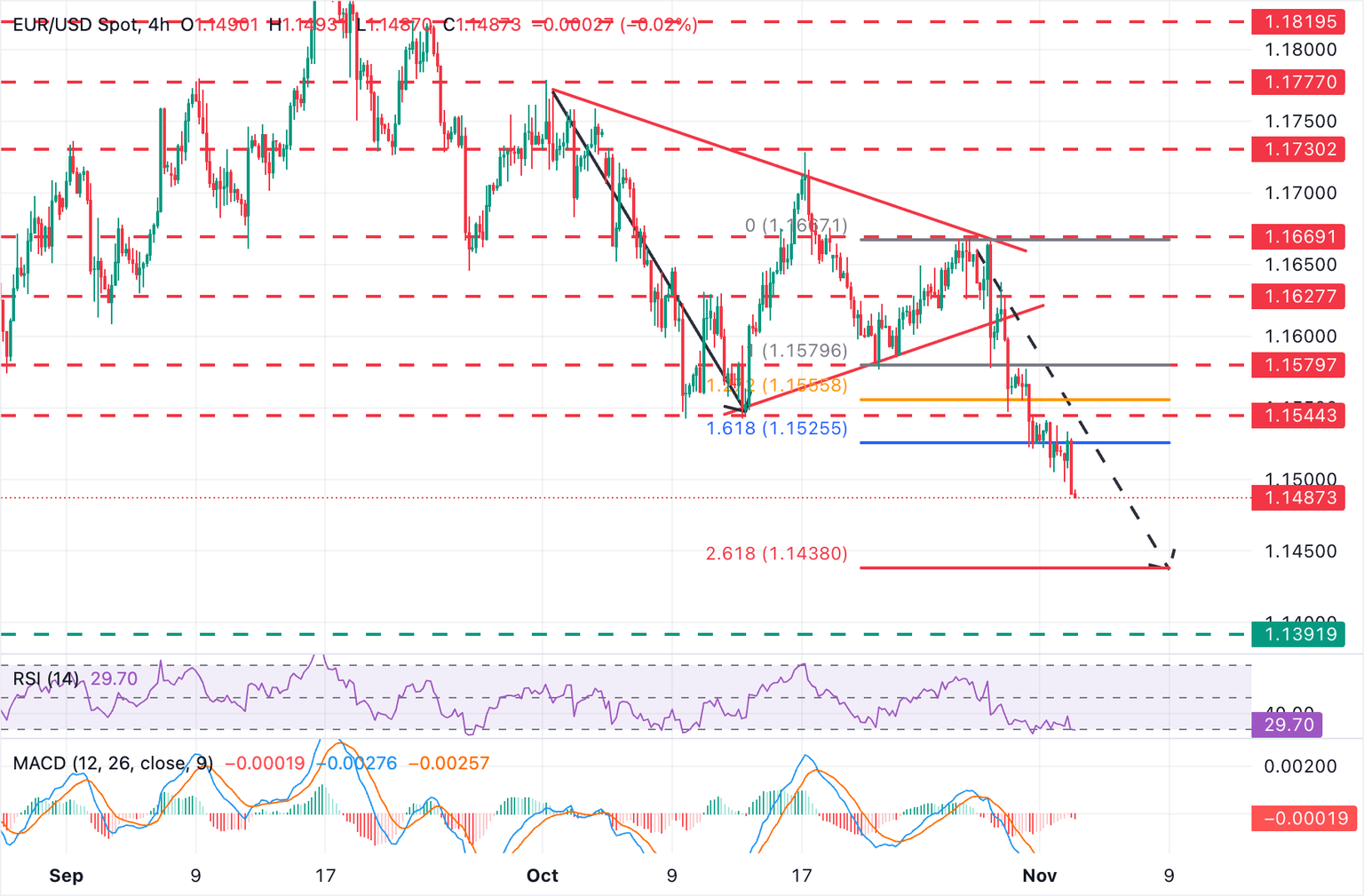

XMR price breaks above descending channel

On the charts, XMR had broken above a descending channel on the hourly time frame. The pattern has been in play for more since the 8th of August, when another sharp drop was experienced.

Despite the risks arising from the network compromise, XMR’s money flow was rising as volatility cooled off. The Chaikin Money Flow (CMF) was at 0.31 while Relative Volatility Index (RVI) dropped from 93 to 64.

The price of XMR appeared to be entering a pullback. Price could drop to $257. The ultimate test for XMR’s next move lied on this level.

A break below the trendline would subject the altcoin back to a bear structure rendering the current scenario a bull trap. Alternatively, respecting the level would validate the bullish breakout.

Long liquidations outweigh short positions

The liquidation heatmap was concentrated with long leverage orders as per CoinGlass data. The largest concentration was between $250 and $234 where more $1 million XMR were longed.

Few shorts had formed just above $266. This was an indication that very few traders were interested in betting against the recent resurgence.

Final take

The XMR attack which Qubic deemed as a test for its computing power could expose the crypto to scrutiny following Monero’s history. Failure to regained decentralized power risked XMR price crash.

Post Comment