Nasdaq 100 Rally Hits a Wall—Is the Elliott Wave Warning of a Sharp Drop to 23,270 the Wake-Up Call Investors Can’t Ignore?

Ever find yourself staring at the NASDAQ 100, wondering if it’s about to pull a fast one or keep on soaring? Well, just two weeks ago, when the index hovered around 24,520, the Elliott Wave Principle hinted at an impulsive five-wave climb targeting a sweet spot between 24,770 and 25,570 for a temporary top. Fast forward to today—the index hit 24,958, right smack in that zone, before doing an intra-day dance back down. It’s like watching a pro athlete reach the peak of their jump—now the question is, did we just catch the intermediate W-3 wave reaching its ceiling? Maybe so. And honestly, are we chasing a small extra bounce up to 25,300 worth the risk, or just peanuts in front of a steam train? Negative divergences are flashing red on the indicators, and the real test will be if the price drops below 24,505, confirming a pullback is underway. But buckle up, because the real action might be just around the bend—a retracement of between 23.6% to 38.2%, setting the stage for what could be a final sprint towards an extended fifth wave pushing toward the 26,600 zone, before the bears come knocking again. Curious to see if this Elliott Wave story unfolds like a page-turner or a market thriller? Dive into the details and charts that map this whole journey. LEARN MORE

In our previous update about the NASDAQ 100 (NDX), when the index was trading around 24520, we found that, according to the Elliott Wave (EW) Principle, the index is in an impulse (five-wave) move up from the early April lows, targeting 24770-25570 for an interim top.

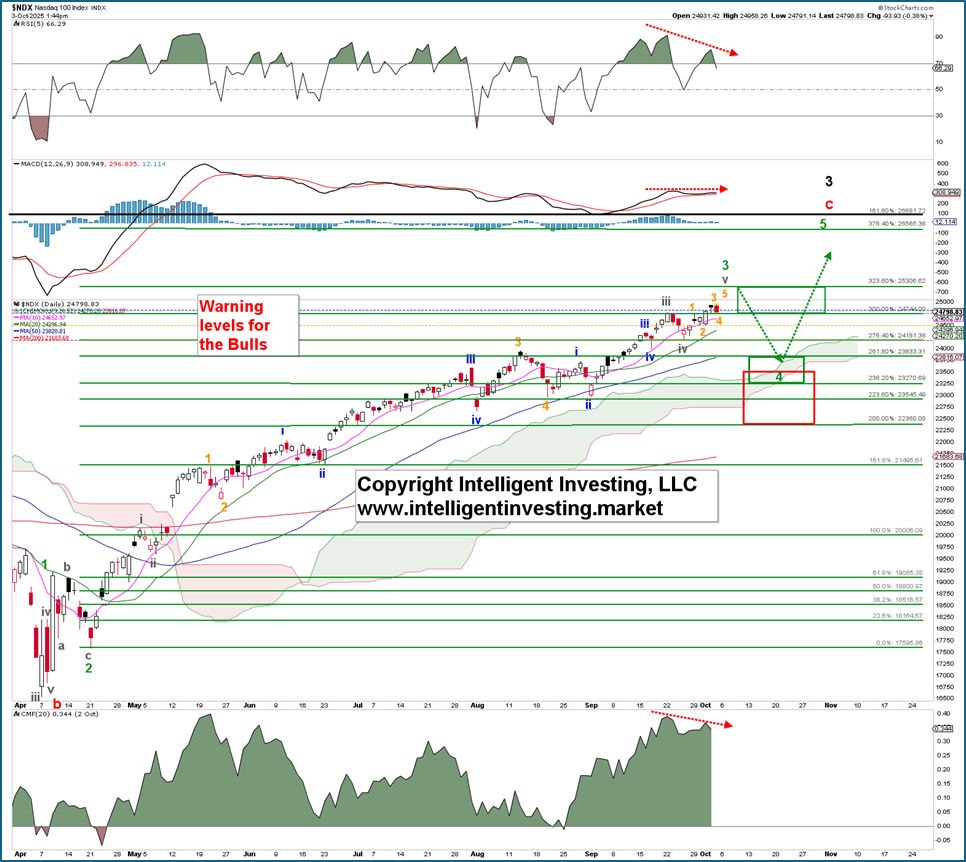

Fast forward two weeks, and the index reached 24958 today. It is perfectly within the ideal target zone and reversed intra-day. Therefore, the odds are increasing that the intermediate (green) W-3 top has been hit. See Figure 1 below.

Figure 1. Our preferred short-term Elliott Wave count for the NDX

We can allow one smaller (orange) W-5 to reach as high as ~25300, but it is no longer necessary, and that would be like picking up pennies in front of a steam train. Thus, the index has, as expected, entered the zone where the likelihood of a pullback, the green W-4, is high. Additionally, there’s plenty of negative divergence (red dotted arrows) on the technical indicators. However, since these are conditions, not trade triggers, the price will now need to break below the orange warning level* at 24505 to confirm this thesis.

Regardless, the green W-4 is inevitable and should ideally retrace 23.6-38.2% of the green W-3, the red target zone between 22360 and 23500. However, since in bull markets “the downside disappoints and the upside surprises,” while the 4th and 2nd waves are often equal in length, a drop to the orange target zone at 23270-23830 is more likely. From there, we can expect one last fifth wave, the green W-5, to target a point close to the ideal black 161.80% Fibonacci extension, approximately 26680, which is also the green 376.4% extension—a typical extended fifth-wave target—at 26565. Once reached, a bear market like 2022 will follow for the black W-4. See Figure 2 below.

Figure 2. Our preferred long-term Elliott Wave count for the NDX

*These levels, which serve as our safety nets, as drops below these levels increase the chance (25%, 50%, 75%, 100%, respectively) that the top is in are raised as the index rises: 1st, blue: 24816; 2nd, gray: 24741; 3rd, orange: 24505; 4th, red: 24186.

Post Comment