Nasdaq September Futures Face Crucial Test at 23,748: Will This Support Hold or Spark a Market Shakeup?

Ever wondered what it takes for the Nasdaq September futures to make or break key momentum? Right now, we’re teetering on the edge—literally perched atop the 4-month rising channel with the VAH playing the role of the last line of daily defense. Acceptance back above that pivotal 24,052 level? That’s your green light to chase targets at 24,542 and even 24,846, reigniting bullish hopes. But hey, don’t get too comfy just yet—slide below 23,748 on a daily close and we might just see a cascade down toward 23,258, then 22,955, possibly hitting the POC near 22,464. It’s that classic “hold or fold” moment into the week’s closing bell, with momentum oscillators and volume profiles writing the script. So, what’s your move gonna be? Stick to the playbook or go rogue? Dive into the daily pivots, pressure points, and strategic ladders before you decide—because in these markets, hesitation isn’t just a pause, it’s a risk. LEARN MORE

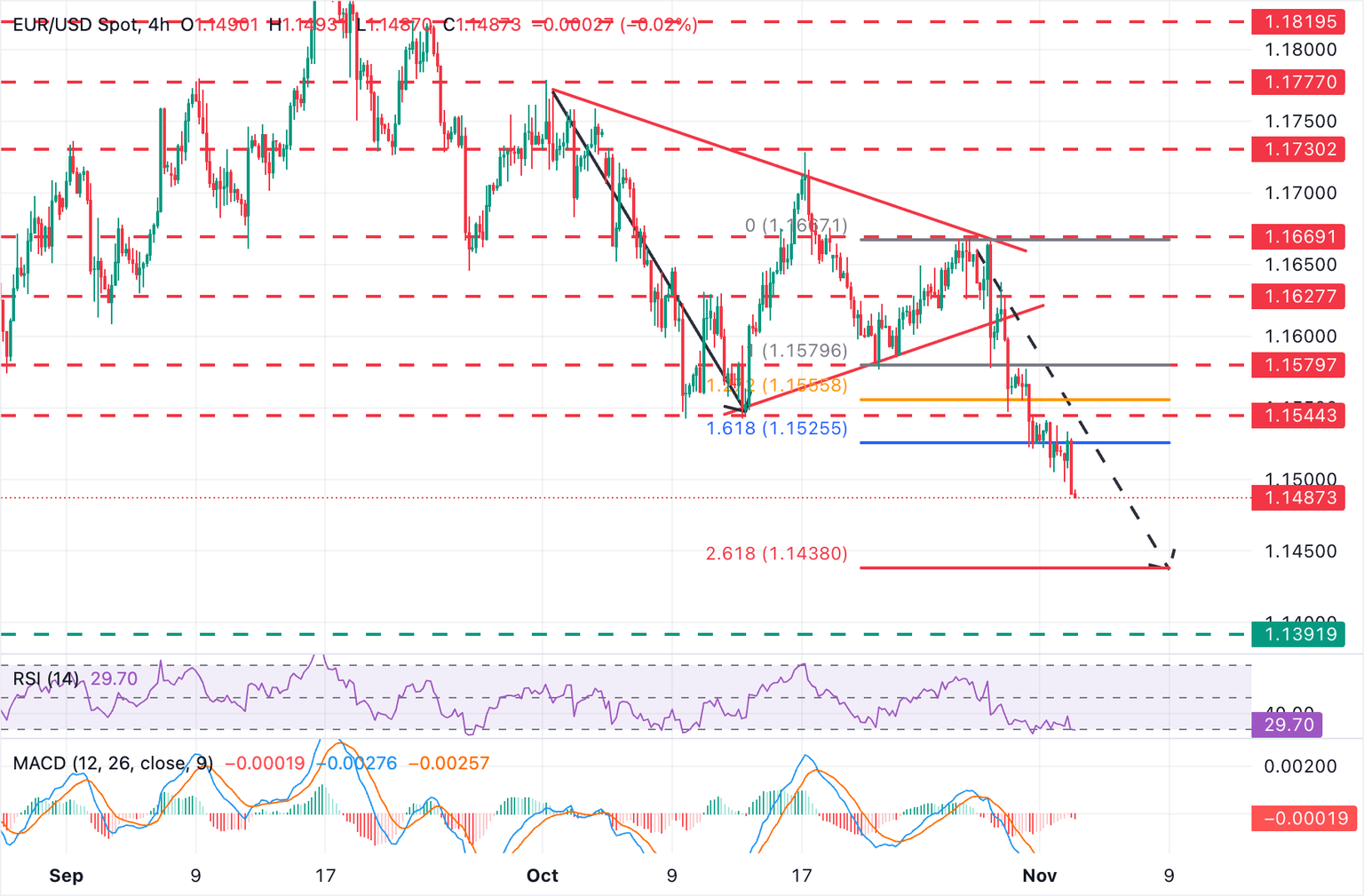

Top of the 4-month channel and VAH are the last daily supports. Acceptance back above 24,052 reopens 24,542/24,846; a daily close below 23,748 risks a slide toward 23,258 → 22,955 → POC ~22,464.

Daily structure (mid-term lens)

- Inflexion point level remains 24,052 (daily critical pivot). Two failed attempts left a supply shelf just overhead.

- Price is testing 23,748, which aligns with the upper rail of the 4-month rising channel and the VAH cluster—this is the market’s “do-or-continue” spot into the weekly close.

- Momentum: daily oscillator has rolled off overbought and is crossing lower, while the histogram is positive but narrowing—momentum needs a close back above 24,052 to re-accelerate.

Scenarios

- Bullish continuation:

- Reclaim 24,052 and hold (daily close).

- Targets: 24,542 first, then 24,846 (next profile shelf).

- Validation: expanding volume on the break and a higher daily low above 23,748.

- Bearish pullback:

- Lose 23,748 on a daily close → opens a rotation to 23,258 and 22,955.

- A deeper magnet sits near the POC around 22,464 at the lower channel boundary.

Nasdaq September Futures August 15 daily price chart

Key levels (mid-term map)

- Break/Go: 24,052

- Upside refs: 24,542 → 24,846

- Decision support: 23,748 (channel/VAH confluence)

- Supports below: 23,258 → 22,955 → POC ~22,464

How to use it

- Treat 24,052 as the confirmation gate for trend extension; fade attempts below it only if daily momentum stays soft.

- If 23,748 breaks on a close, step down the ladder (23,258/22,955/22,464) for rotations until a new higher-low forms.

- Use your MacroStructure playbook to time entries on the intraday pullbacks that align with these daily triggers—no chase.

The views expressed are for informational and educational purposes only and do not constitute financial advice, a recommendation, or a solicitation to buy or sell any instrument. Trading futures, options, FX, and crypto is highly speculative and involves significant risk of loss. You are solely responsible for your decisions. Past performance is not indicative of future results.

Post Comment