Polygon and Ethereum Lock Down 29% TVL Each – Is POL at $0.22 the Hidden Goldmine Investors Can’t Afford to Miss?

Ever wonder what happens when a rising star starts matching the league leader? Well, Polygon just did exactly that—locking arms with Ethereum by capturing a hefty 29% share of U.S. Treasury Bill TVL. That’s no small feat when you think about the institutional weight behind these numbers. It’s like the underdog suddenly stepping into the big arena and holding their ground with the champs. But here’s the twist: while institutional confidence in Polygon is soaring, POL’s price action is dancing on a razor’s edge between crucial support at $0.22 and resistance near $0.29. So, is this a moment of solid foundation or just a prelude to volatility? If accumulation keeps its grip, those higher targets at $0.34 and $0.42 aren’t just pipe dreams—they’re very much on the table. Yet, as always, the market loves to keep us guessing, with outflows hinting at caution and open interest whispering tales of uncertainty. Buckle up, because in the world of Polygon, it’s anyone’s game right now. LEARN MORE

Key Takeaways

Why does Polygon matter now?

Polygon matched Ethereum with 29% USTBL TVL, cementing its institutional role.

What’s next for POL’s price?

Traders watched $0.22 support and $0.2899 resistance. A rebound could extend toward $0.3426 and $0.4209 if accumulation holds.

Polygon’s native token, POL (ex-MATIC) [POL], drew investor attention as it matched Ethereum [ETH] in U.S. Treasury Bill TVL, with both holding 29%.

This milestone highlighted the rising demand for institutional-grade exposure through Polygon’s network, which has steadily attracted inflows due to its lower fees compared to Ethereum.

As capital rotates toward efficient blockchains, the surge in TVL has become a key driver for POL’s relevance.

Still, price action showed weakness, leaving short-term sentiment hinged on key support and resistance levels.

Can POL hold $0.22 support?

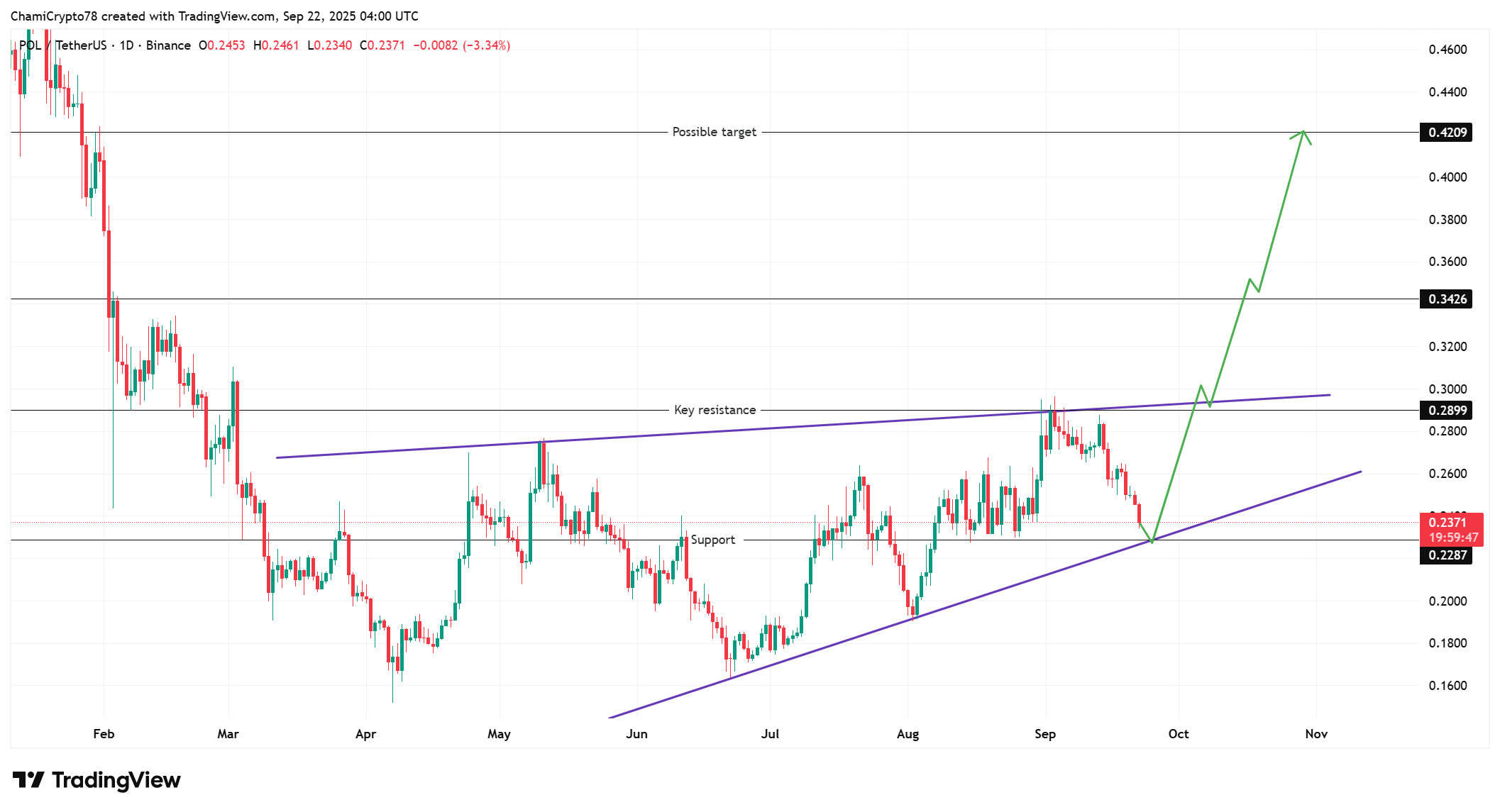

Price action showed that POL slipped toward $0.237 at press time and has been hovering close to its ascending trendline. The charts suggested a possible retest of $0.22 support before momentum builds again.

If buyers defend this zone, a breakout above $0.2899 resistance could unfold, unlocking targets at $0.3426 and possibly $0.4209. Failure to hold $0.22, however, risked a deeper downside.

That left POL’s immediate outlook balanced between resilience and vulnerability.

Persistent outflows show bearish undertones

Exchange data indicated that POL saw consistent negative flows at press time. The latest being outflows of around $608.78K.

This trend reflects declining supply on exchanges, often a sign of accumulation by long-term holders.

While this could reduce immediate sell pressure, it also means reduced liquidity, which may amplify volatility during sharp price swings.

Even so, sustained accumulation of exchanges supported a more stable mid-term base.

Source: CoinGlass

POL’s Open Interest signals caution

Derivatives market data revealed that POL’s Open Interest fell 8.10% to $142.54 million at press time.

Traders scaled back leveraged exposure after heightened volatility phases.

Lower Open Interest limited immediate swings but reflected weak conviction among short-term speculators.

By contrast, if Spot accumulation and TVL strength aligned, derivatives markets could provide the launchpad for stronger moves.

Source: CoinGlass

Can TVL strength offset short-term market caution?

Polygon’s fundamentals stayed firm, supported by its 29% share of U.S. Treasury Bill TVL. Yet near-term performance depended on holding $0.22 and clearing $0.2899.

With persistent outflows and weaker Open Interest, traders leaned cautious. Still, if accumulation persisted, POL could rebound and test higher resistance levels.

Post Comment