Pump.fun Rakes in $1.3M Daily—Is This the Ticking Time Bomb Ready to Explode into a Massive Rally?

What happens when the crypto market takes a nosedive but one player just keeps cashing checks? That’s exactly the curious case we’re witnessing with Pump.fun — a Solana-based memecoin launchpad that not only weathered the recent storm but actually raked in impressive revenues amid widespread market gloom. Now, isn’t it a bit of a head-scratcher how Pump.fun manages to thrive while major sectors, especially decentralized exchanges, slow down drastically? You’d think a surge in platform revenue would spell good news for the PUMP token itself, right? Well, not so fast. Despite the flood of cash flowing through Pump.fun’s ecosystem, PUMP’s price action stubbornly clings to a bearish script, challenging traders and investors to question whether the fundamentals truly support a rally or if the charts are simply playing hard to get. So, if you’re scratching your head and pondering whether to jump in or sit tight, stick around — because unpacking this paradox uncovers a lot more than just numbers on a screen. LEARN MORE

Key Takeaways

Why does Pump.fun stand out in the crypto market?

The Solana memecoin launchpad posted healthy revenues despite the market downturn over the past ten days.

Does this bode well for PUMP?

It should, but evidence of that wasn’t yet visible on the price charts. The PUMP token trend remains bearish.

On Friday, the 10th of October, crypto markets went careening downward. The altcoin market cap was slashed by 12.68% on the day, and the sentiment remained fearful.

Even though the storm, one protocol has been minting money.

Source: The Block

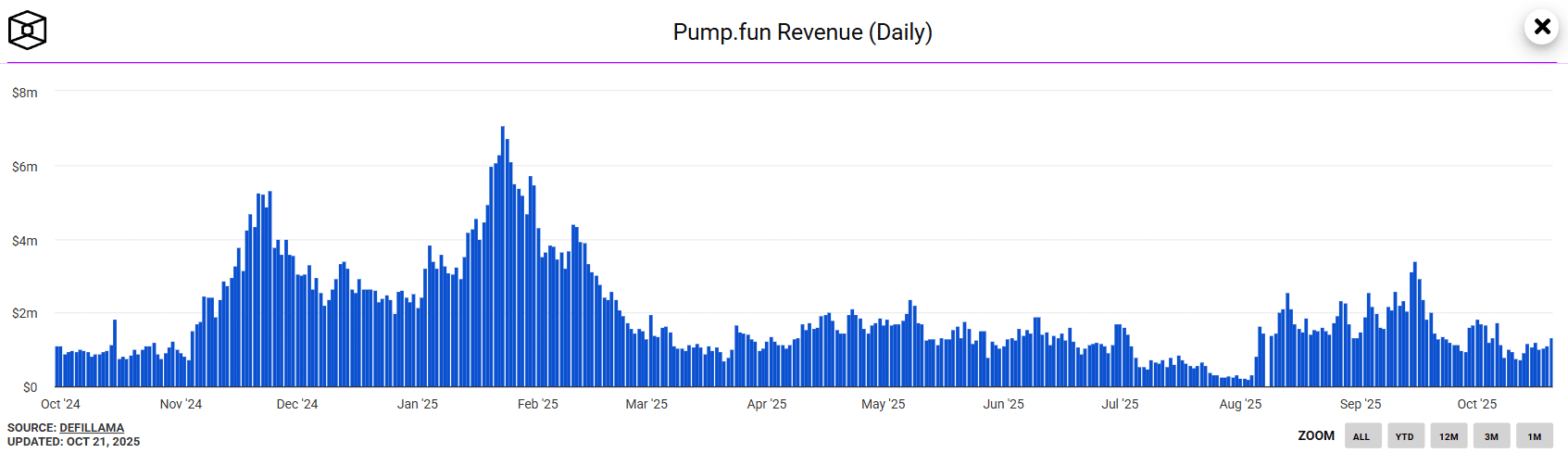

Pump.fun [PUMP] posted an impressive $1.31 million in daily revenue on the 20th of October. By comparison, one of its competitors, Moonshot, only had $17.45k in revenue on the same day.

Source: Token Terminal

Revenue and activity have indeed slowed down across the market in October. Pump.fun, which has its own decentralized exchange, PumpSwap, saw a slight increase in revenue over the past week.

It rose from $5.787 million to $6.073 million, while DEX exchange revenue dropped from $39.875 million to $30.477 million in the past week. This revealed a dramatic slowdown for the DEX sector in terms of revenue.

Source: The Block

Pump.fun dominated the token graduations on Solana launchpads. It commanded a 95.45% market share of token graduations at the time of writing.

Once a memecoin reaches the end of its bonding curve, it graduates to an external or internal DEX.

Before March 2025, the graduated tokens were automatically routed to the Raydium DEX. This changed after the launch of PumpSwap.

Should you buy PUMP?

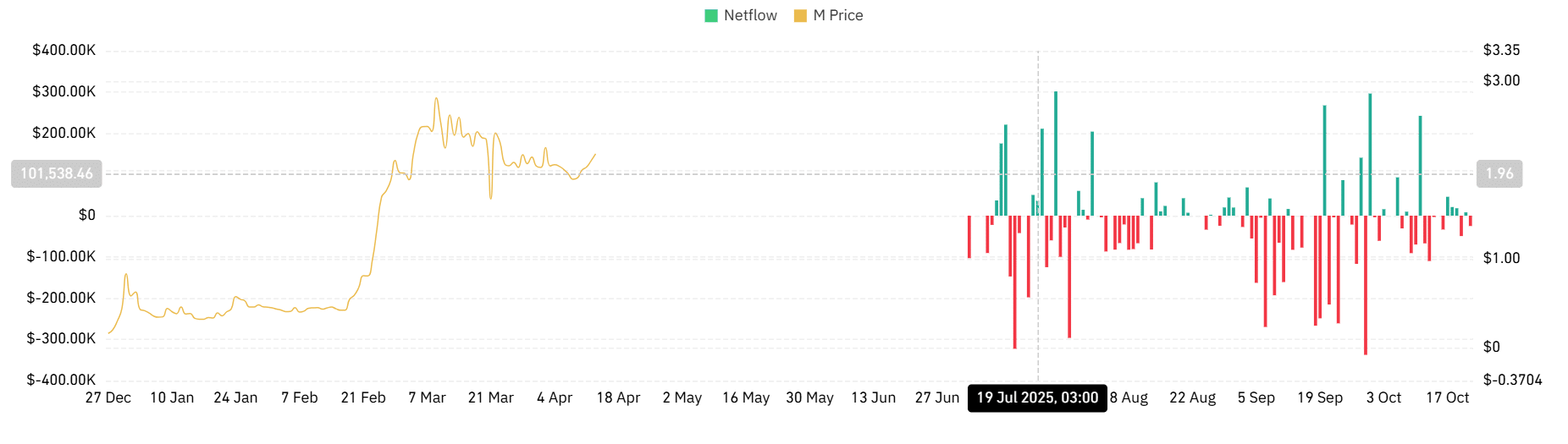

Despite the platform’s overall success, PUMP retained its bearish outlook. On the daily chart, its structure was firmly bearish. There was an imbalance overhead that coincided with the former swing lows.

This confluence made the $0.0048-$0.005 a strong resistance zone to PUMP bulls. The OBV also slipped below the late September lows, showing bearish pressure was dominant.

The RSI also signaled momentum remained in favor of the sellers.

A rally beyond $0.0045 would be the first step toward PUMP recovery. The PUMP buybacks could help reverse the downtrend in the coming weeks.

Post Comment