Q3 2025 Passive Portfolio Shake-Up: What the Market Isn’t Telling You (But I’m About to Reveal)

Well, here we are, still riding the waves since Trump’s tariffs sent shockwaves through the market back in April — remember that chaotic scramble? It’s almost poetic how Monevator’s Slow & Steady passive portfolio has clawed back nearly 13% since that “Liberation Day” fiasco. Feels almost like gardening, doesn’t it? Planting seeds patiently, then watching them grow despite the stormy weather outside your window. And guess what? Despite the relentless drumbeat of doom scrolling through my feeds, this steady approach has yielded a solid 6% growth in 2025 alone. Funny how reality can sneak in and surprise us when we least expect it. So, if you’ve been doubting the slow grind or tempted by flashing, risky grabs — maybe it’s time to take a deep breath, look away from the noise, and check out where steady really gets you.

Well now, we’ve had quite a run since the shock of Trump’s tariffs scattered our forces back in April.

Monevator’s Slow & Steady passive portfolio has rebounded almost 13% since the aftermath of Liberal With The Truth Liberation Day. I hope yours has done at least as well.

Overall, the portfolio has grown 6% so far in 2025. Which feels odd given the 24/7 bombardment of pessimism that’s churning up my online world. It’s getting to the point where I’m turning to real life for an escape.

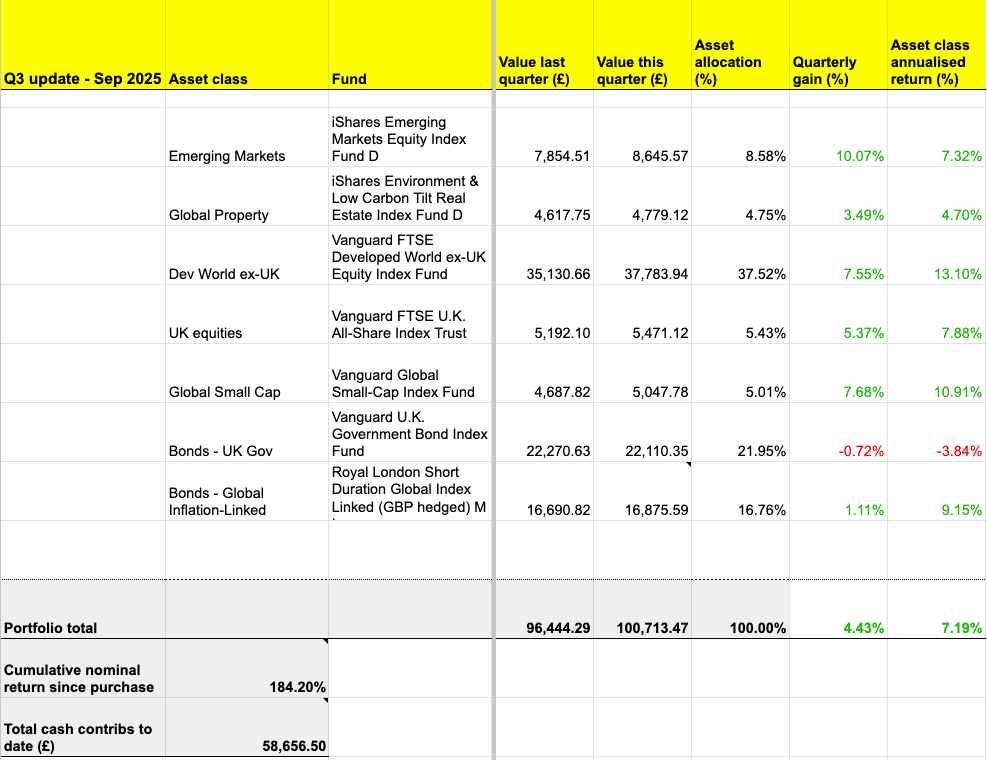

Anyway, here are the latest numbers fresh from the manna-sphere:

The Slow & Steady is Monevator’s model passive investing portfolio. It was set up at the start of 2011 with £3,000. An extra £1,310 is invested every quarter into a diversified set of index funds, tilted towards equities. You can read the origin story and find all the previous passive portfolio posts in the Monevator vaults. Last quarter’s instalment can be found here. Subtract about 3% from the portfolio’s annualised performance figure to estimate the real return after inflation.

Ignoring the third-quarter’s thrivers and divers for a moment, the thing that catches my eye is the portfolio has broken through six figures in total value. We’re clocking in at £100,713 on the table above.

That’s quite something for a portfolio launched in 2011 with £3,000. It’s been run passively ever since on an inflation-adjusted £250 per month in cash contributions.

(Just to stress again, this is a model portfolio. The attached monetary values are entirely notional. But I used the same kind of passive investing strategy to grow my own wealth if you’re concerned about skin in the game.)

Growing modest savings into such a sum seemed unimaginable to a younger me. I had zero interest in the stock market and couldn’t stop splurging away everything I earned.

I thought investing was the preserve of the rich and highly informed financial experts. Ha!

Think again

But as millions of investors have already discovered – and our model portfolio is just the latest to demonstrate – it’s entirely possible to achieve good results by sticking to a passive plan:

The dark green line shows the portfolio’s return in nominal terms. The more important lower (lighter) inflation-adjusted line represents the Monevator model portfolio’s real annualised return of 4%.

We’re bang on the historical average for a 60/40 portfolio. Granted, that’s not spectacular – but this portfolio isn’t called Slow and Steady for nothing.

Of course, my inner critic is scornful. He casts brickbats like:

“You fool! What if you’d invested less in bonds?”

And:

“Why didn’t you foresee the AI revolution and invest 100% in Nvidia in 1999?”

But I look again at the chart above and I’m reminded of Charley Ellis’ brilliant description of investing as a loser’s game. By which he meant you win primarily by avoiding egregious mistakes.

In other words, you come through by playing the percentages and limiting your unforced errors. As opposed to trying to smash it with spectacular winners.

Ellis’ metaphorical inspiration was amateur tennis. If you’d seen me play tennis you’d understand why I’m happy with average.

New transactions

Every quarter we lob £1,310 over the investing net, hoping the rally keeps going. The cash is split between our seven funds, according to our predetermined asset allocation.

We rebalance using Larry Swedroe’s 5/25 rule. That hasn’t been activated this quarter, so the trades play out as follows:

Emerging market equities

iShares Emerging Markets Equity Index Fund D – OCF 0.2%

Fund identifier: GB00B84DY642

New purchase: £104.80

Buy 44.19 units @ £2.37

Target allocation: 8%

Global property

iShares Environment & Low Carbon Tilt Real Estate Index Fund – OCF 0.17%

Fund identifier: GB00B5BFJG71

New purchase: £65.50

Buy 27.68 units @ £2.37

Target allocation: 5%

Developed world ex-UK equities

Vanguard FTSE Developed World ex-UK Equity Index Fund – OCF 0.14%

Fund identifier: GB00B59G4Q73

New purchase: £484.70

Buy 0.625 units @ £775.82

Target allocation: 37%

UK equity

Vanguard FTSE UK All-Share Index Trust – OCF 0.06%

Fund identifier: GB00B3X7QG63

New purchase: £65.50

Buy 0.204 units @ £320.79

Target allocation: 5%

Global small cap equities

Vanguard Global Small-Cap Index Fund – OCF 0.29%

Fund identifier: IE00B3X1NT05

New purchase: £65.50

Buy 0.135 units @ £484.60

Target allocation: 5%

UK gilts

Vanguard UK Government Bond Index – OCF 0.12%

Fund identifier: IE00B1S75374

New purchase: £301.30

Buy 2.275 units @ £132.43

Target allocation: 23%

Royal London Short Duration Global Index-Linked Fund – OCF 0.27%

Fund identifier: GB00BD050F05

New purchase: £222.70

Buy 203.193 units @ £1.096

Target allocation: 17%

New investment contribution = £1,310

Trading cost = £0

Average portfolio OCF = 0.17%

User manual

Disclosure: Links to platforms may be affiliate links, where we may earn a commission. This article is not personal financial advice. When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Take a look at our broker comparison table for your best investment account options.

InvestEngine is currently cheapest if you’re happy to invest only in ETFs. Or learn more about choosing the cheapest stocks and shares ISA for your situation.

If this seems too complicated, check out our best multi-asset fund picks. These include all-in-one diversified portfolios such as the Vanguard LifeStrategy funds.

Interested in monitoring your own portfolio or using the Slow & Steady spreadsheet for yourself? Our piece on portfolio tracking shows you how.

You might also enjoy a refresher on why we think most people are best choosing passive vs active investing.

Take it steady,

The Accumulator

Post Comment