Rhode Island’s “Taylor Swift Tax” on Vacation Homes is Spreading — Are Short-Term Rental Owners Facing a Silent Financial Storm?

So, here’s a curveball for short-term rental owners: what happens when your vacation haven suddenly comes with a Taylor Swift soundtrack — featuring a hefty new tax? That’s right, Rhode Island’s soon-to-be-implemented “Taylor Swift tax” is shaking up the property world, targeting those non-owner-occupied homes valued over $1 million. Imagine facing an extra surcharge that could feel like a chart-topping hit to your wallet, all while trying to keep your rental business afloat. With other states jumping on this tax train, there’s a swirling storm of debate brewing—between local governments eager to fund housing, realtors worried about losing clients, and landlords caught in the middle wondering how much more this will cost them. Curious about what this means for your investment strategy, and how to navigate these murky waters without missing a beat? Dive in as we break down who’s backing this controversial levy, who’s pushing back, and what savvy landlords can do to stay ahead of the game. LEARN MORE

Short-term landlords might not be able to sh-sh-shake it off when it comes to the additional taxes they may be liable for. This follows the introduction of Rhode Island’s “Taylor Swift tax,” the nickname given to part-time residents who own vacation rentals.

With other states following suit, tensions are escalating between local municipalities, brokers, agents, and the wealthy property owners they represent.

What is the Taylor Swift Tax?

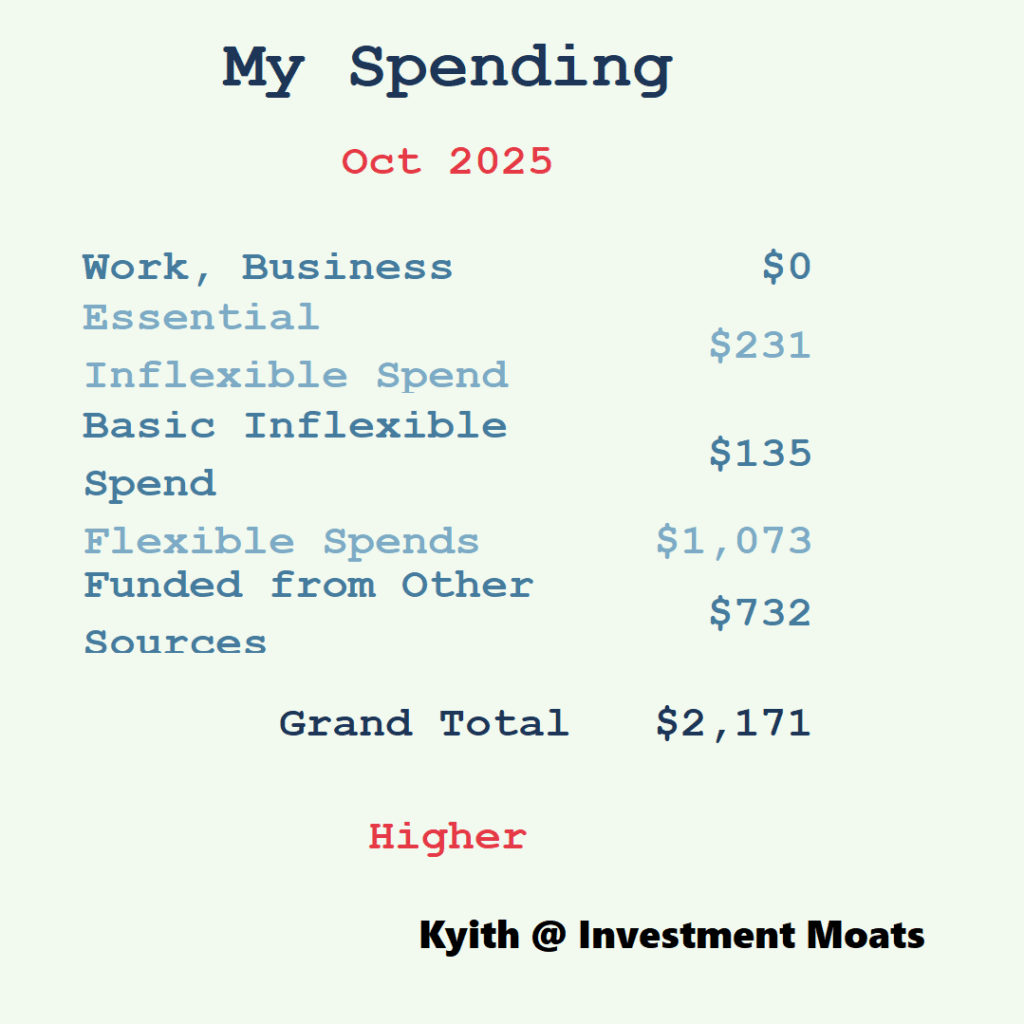

The so-called Taylor Swift tax—officially known as the Non-Owner-Occupied Property Tax Act—will take effect on July 1, 2026. It imposes an annual surcharge on non-primary residences (i.e., homes not occupied by their owners or tenants for at least 183 days a year) that are valued at more than $1 million.

The surcharge is set at $2.50 for every $500 of assessed value above that threshold. Using these metrics, Kiplinger calculated that a $3 million property would face a surcharge of approximately $10,000 annually, in addition to regular property taxes.

The tax was named after the pop superstar because Swift purchased a mansion in the upscale Watch Hill section of Rhode Island in 2013, where she is a part-time resident. It’s estimated that she will be liable for an extra $136,000 annually when the new tax takes effect.

Proponents and Opponents

The goal of the additional levy, according to the state, is to raise revenue that supports housing initiatives while reducing the number of residences that remain vacant for much of the year. In the case of short-term landlords, this could be devastating to their bottom line, as they would not only be taxed on the revenue they make as a landlord, but also from the Taylor Swift tax too, if they rent the home for more than 183 days a year but not as a long-term rental.

The new tax has not been well received by many within the real estate industry. “These are people who just come here for the summer, spend their money, and pay their fair share of taxes,” Donna Krueger-Simmons, sales agent with Mott & Chace Sotheby’s International in Watch Hill, Rhode Island, told CNBC. “They’re getting penalized just because they also live somewhere else.”

“You’re just hurting the people who support small business,” Lori Joyal of the Lila Delman Compass office in Watch Hill, told CNBC. “You’re chasing away the people who spend most of the money in these towns.”

Brokers fear that the tax could backfire on vacation homeowners, who might choose to spend their money on nearby vacation towns with less stringent tax laws.

Other States Are Implementing Similar Taxes

Montana

Montana recently passed reforms set to take effect in 2026, which similarly distinguish between primary residences and long-term rentals versus secondary/vacation homes and short-term rentals. The state experienced an influx of new residents from New York and other major cities during the COVID-19 pandemic.

Montana’s new system will require non-primary residents and short-term rental owners to pay a flat rate of 1.90% beginning in 2026, regardless of the property value. However, homes used as primary residences or for long-term rentals can qualify for lower, tiered rates, depending on market values, according to the Montana Department of Revenue.

There are caveats to Montana’s program. Homeowners who live in their residences for at least seven months of the year, or have long-term rentals, may qualify for reduced rates and a one-time rebate for 2025, according to tax compliance site Avalara. The site also estimates that second homes and higher-value properties will bear a greater percentage of the tax burden due to their higher tax rates.

Cape Cod, Massachusetts

Cape Cod is considering joining nearby Rhode Island in taxing affluent part-time residents. However, rather than an annual tax, Cape Cod will apply a “mansion tax” in the form of a 2% real estate transfer tax on sales of over $2 million. Proponents argue that it could generate around $56 million annually for affordable and year-round housing.

Rob Brennan, chief legal officer at the nonprofit organization Housing Assistance, told Cape Cod’s local government website:

“This is no longer a cyclical shortage—it’s an existential crisis. Without a permanent, predictable source of funding, we cannot support housing that working Cape Codders can actually afford. There’s no way out of this crisis without bold, systemic solutions. The $2,000,000 home becoming $2,040,000 doesn’t stop second-home buyers.”

Conversely, full-time residents in Chatham, Cape Cod, will receive a 35% property tax exemption as of July 1, 2026.

“The vast amount of wealth in this town in residential property is held by a disproportionate number of people who aren’t residents of this town,” Chatham community board member Seth Taylor told the Cape Cod Chronicle. “I don’t think it’s too much to ask to look at this as a realistic way to help the middle-income folks that we say we want to have in our community.”

Chatham and 10 other communities on the Cape and islands, as well as six other cities and towns across the state, including Boston, have adopted a residential tax exemption.

California

Los Angeles’ “mansion tax,” known as Measure ULA, imposes a 4% transfer tax on property sales between $5 million and $10 million, and a 5.5% tax on sales above $10 million to support affordable housing and homeless prevention programs. However, the tax has recently been under scrutiny and could be eliminated to encourage development.

“It was sold as a mansion tax, which means big houses for rich people, but it actually had a chilling effect on housing construction, particularly apartments,” former Assembly Speaker Bob Hertzberg, who was tapped by Mayor Karen Bass to work out the details of the legislative proposal, told the Los Angeles Times.

Things Short-Term Rental Owners Should Keep In Mind

If you own a short-term rental in states like Rhode Island or Montana, you will need to pay particular attention to:

- The number of days you live in the property personally as a primary residence versus the days you rent it.

- Keep records of residency use dates versus short-term and mid-term rental occupancy.

- Weigh the income generated from the rental versus the tax payable by not occupying it to qualify for residency restrictions to calculate the best use of your property.

Final Thoughts: Gray Areas

I would never advocate finding ways to circumvent the new rules, but there are some gray areas that astute investors could take advantage of.

If you live in a section of your home while also using it as a short-term rental, your tax liability will be determined based on the percentage of the house you occupy. In reality, it’s unlikely that an IRS representative will visit to verify the apportioned use of your rental.

If certain areas, such as the kitchen and TV areas, are jointly used, their delineation becomes even more opaque. Throw ADUs, finished basements, and attics into the mix, and who lives in what parts of the property presents an interesting proposition for an accountant who knows how far to bend the rules.

Conversely, and less likely to draw attention, is to simply ramp up your short-term income as much as possible while taking advantage of renovation and depreciation tax deductions. Pay the new taxes as required, and enjoy a good night’s sleep.

Post Comment