SEC’s Project Crypto is about to shake up XRP and SOL prices—here’s what nobody’s telling you that could make or break your portfolio.

You ever notice how just when you think a crypto asset like Ripple’s XRP is gearing up for a breakout, the market throws a curveball? That’s exactly what went down after the SEC dropped its ‘Project Crypto’ bombshell. Instead of riding a wave of optimism thanks to clearer regulations, XRP took a nosedive below the $3 mark, sliding to $2.89 with a velocity that screamed more strategic unloading than just plain panic. What’s going on here? Are traders suddenly jittery, or is this a classic case of locking in gains while the market figures out the new rules of the game? The technical signals don’t lie—the RSI plunged deep into oversold territory and the MACD’s red bars widened dramatically, hinting there’s no quick rebound in sight. It’s a stark reminder that even the promise of clarity can stir up a cocktail of uncertainty and profit-taking. Curious how this ripple effect is shaking other big players like Solana? Hang tight—the market’s mood is about to get even more interesting. LEARN MORE

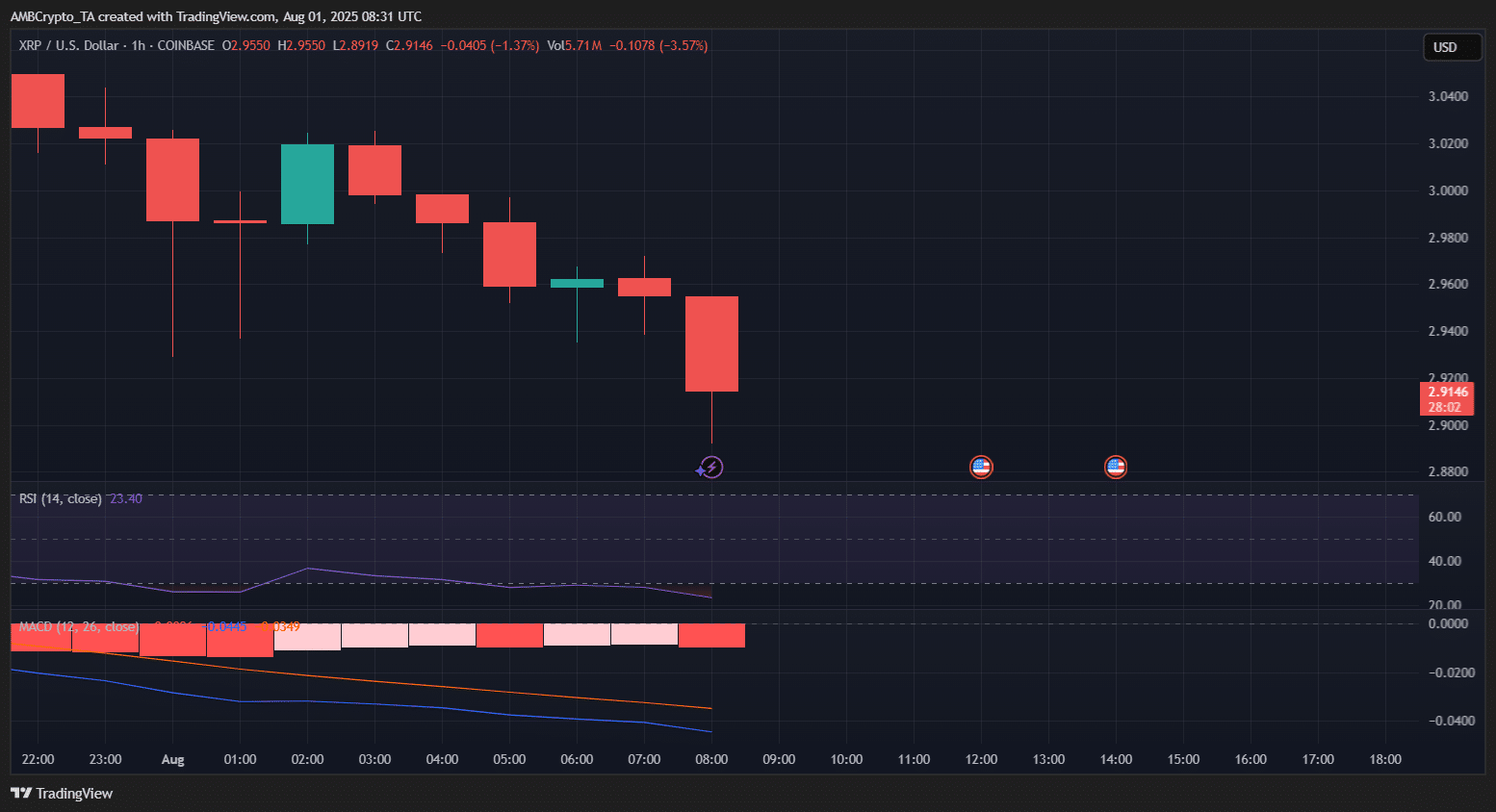

Ripple’s [XRP] price action turned sharply bearish in the hours following the SEC’s ‘Project Crypto’ announcement, with the token falling below the $3 mark and extending losses to a low of $2.89 on the hourly chart, as of writing.

The sell-off intensified following the announcement, marked by a sharp red candle and rising trading volume, suggesting deliberate distribution rather than panic selling.

Technical indicators reinforced the bearish sentiment: the RSI plunged deep into oversold territory, and the MACD continued to show widening red bars, with no signs of a reversal.

Despite expectations that XRP might benefit from improved regulatory clarity, short-term traders seemed to be locking in profits amid broader market uncertainty.

As a result, the token dropped 3.57% in the latest trading session.

SOL drops below $170

Solana[SOL] saw a sharp decline following the SEC’s announcement, falling from $169.34 to a session low of $166.13 before stabilizing around $167.29, at press time.

The hourly RSI slipped to 26.89 – indicating oversold conditions – while the OBV continued to trend lower, showing consistent selling pressure.

The large red candle at 08:00 UTC suggests a strong bearish reaction in the immediate aftermath of the news, as traders appeared to sell into the announcement rather than buy the optimism.

The broader market followed a similar trajectory. While Project Crypto aims to deliver long-term clarity and legitimize blockchain-based markets, the short-term reaction has been risk-off.

Traders seem to be bracing for implementation delays, enforcement complexities, or simply locking in gains after recent run-ups.

In the near future, continued volatility is likely as the market digests the scope and the limits.

Post Comment