Senator Lummis Exposes the U.S. Bitcoin Sell-Off: Why This ‘Strategic Blunder’ Could Cost You Big—And How Savvy Investors Can Win

So, here’s a curveball for the Bitcoin enthusiasts and policy watchers alike: The U.S. Marshals Service just dropped some surprising news—turns out, the government’s stash of Bitcoin is not 189,000 BTC as many had assumed, but a mere 28,988 BTC. Yep, you read that right—about 85% less than the expected hoard. Imagine prepping for a treasure hunt only to find out the trove is just a fraction of what was promised. Pro-Bitcoin Senator Cynthia Lummis didn’t mince words, calling this revelation a ‘strategic blunder’ if it holds water. What does this mean for America’s position in the global Bitcoin race, especially with whispers of silent sell-offs and shadowy swaps swirling around? And how might this shake up the ambitious goals for a strategic BTC reserve championed by some of the country’s sharpest Bitcoin advocates? If you’re wondering whether the government’s Bitcoin coffers are as deep as previously thought—or if we’re simply witnessing a high-stakes game of digital hide-and-seek—stick around, because this story is just heating up. LEARN MORE

Key Takeaways

U.S. Marshals revealed that the government holds 28,988 BTC instead of the expected 189K BTC. Pro-BTC Senator Lummis called the update a ‘strategic blunder’ if true.

The U.S. government has hit the headlines amid speculation that it might have sold a big chunk of its Bitcoin [BTC] holdings.

The U.S. Marshals Service (USMS), the entity that custodies forfeited crypto assets, holds only 28,988 BTC ($3.4B).

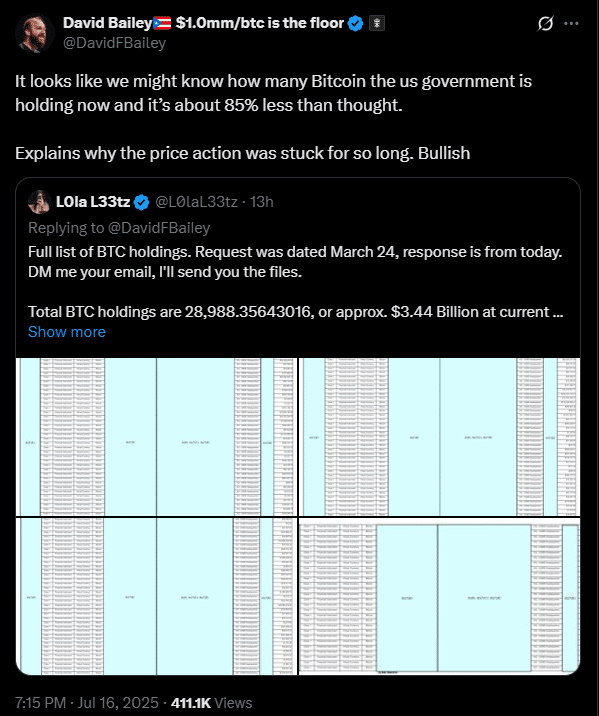

This was according to a Freedom of Information Act (FOIA) request filed by an independent crypto reporter and X user, L0la L33tz.

Speaking on the same, David Bailey, chairman of the Bitcoin Conference, termed it ‘bullish’ and added,

“It looks like we might know how many Bitcoin the U.S. government is holding now, and it’s about 85% less than thought.”

The revelations elicited divergent views, but the consensus leaned toward a potential sell-off by the government.

Senator Lummis reacts: A ‘strategic blunder’ for the U.S.

Worth pointing out that Arkham data estimates that the U.S.government holds about 198K BTC (worth $23 billion) as of July 2025.

This is according to the government’s custody wallets it tracks. In other words, the USMS should have the 198K BTC.

But others were quick to point out that none of the BTC has moved on-chain.

In fact, security researcher, Tay Vano, stated that about 69.37K BTC confiscated from Silk Road was yet to be forfeited (made state property).

Hence, it hasn’t appeared in USMS custody, and the government could still be holding more than 28.9K BTC.

However, Bailey doubted this and said that the U.S. probably sold part of the holdings via swaps, leaving no on-chain trace.

“I think it is conclusive they’ve been selling without creating onchain footprint”

One of the on-chain analysts, Sani, agreed that the only large custody firm that could handle such swaps was Coinbase. Interestingly, the firm doubles as the USMS custody provider.

Most of the U.S. government’s BTC holdings were from forfeitures and seizures by the FBI and other investigative services.

Besides, the 198K BTC reportedly held by the U.S. included the Bitfinex hack, which the court ordered to be returned to the exchange in early 2025. Put differently, it was not surprising that the government held fewer BTC.

So, what’s next for the strategic BTC reserve (SBR) championed by President Donald Trump?

Pro-BTC reserve champion Senator Cynthia Lummis said she was ‘alarmed’ by the update and called it a ‘strategic blunder’ for the U.S.

“If true, this is a total strategic blunder and sets the United States back years in the Bitcoin race.”

Since early 2025, the odds of a U.S. SBR being created by 2025 have dropped from nearly 80% to 30% as of July, per prediction site Polymarket.

Post Comment