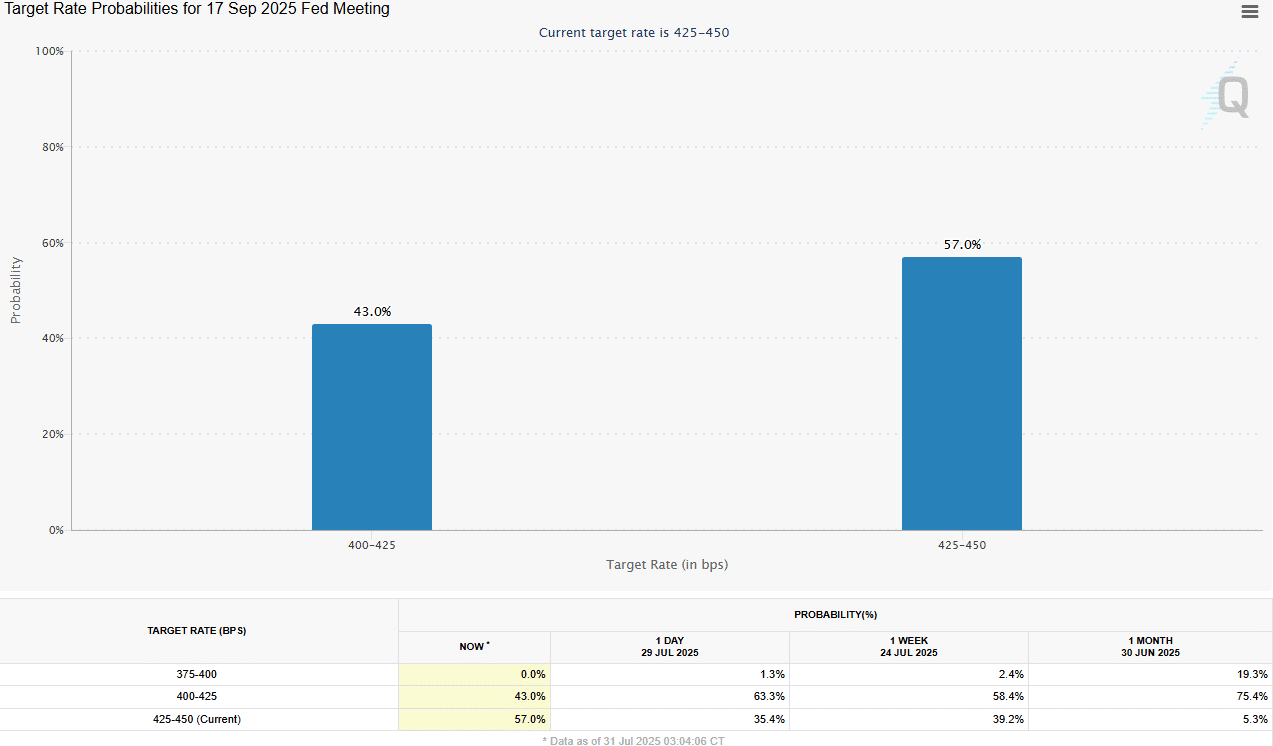

September Fed Rate Cut Odds Plunge to 43% — Is Bitcoin’s Next Bull Run on Shaky Ground or Ready to Explode?

Another risk factor for the market rally was rising BTC profitability.

Glassnode highlighted that BTC’s unrealized profit hit a record high of $1.4 trillion, and the relative unrealized profit hit levels that triggered past ATH conditions and sell pressure.

But crypto analytics firm Swissblock held that the BTC rally could go higher if QE (quantitative easing) or a surge in dollar liquidity begins.

In the short term, the macro pressure could cap BTC below $120K and elevate profit-taking. However, any potential Fed pivot in the mid-term could spark a rebound.

Post Comment